White Cement Market 2030: Repair and Restoration Applications

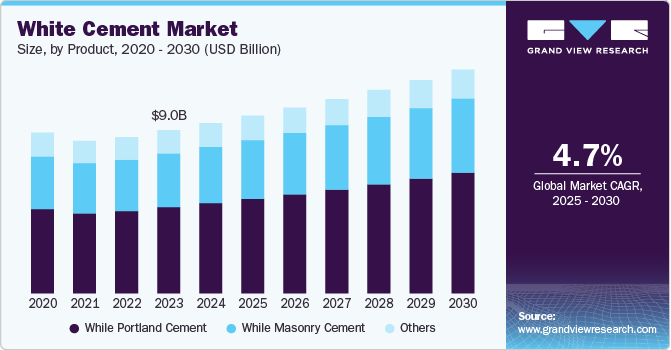

The global white cement market was valued at USD 9.43 billion in 2024 and is projected to reach USD 12.39 billion by 2030, expanding at a CAGR of 4.7% from 2025 to 2030.

White Cement Market Overview

The global white cement market was valued at USD 9.43 billion in 2024 and is projected to reach USD 12.39 billion by 2030, expanding at a CAGR of 4.7% from 2025 to 2030. This growth is primarily driven by rising construction expenditures across both developed and developing economies worldwide.

A major contributing factor to the market’s expansion is the rapid growth of the industrial sector in emerging economies such as India, Mexico, and Brazil, particularly following their recovery from the COVID-19 pandemic. White cement is increasingly preferred over grey cement due to its added benefits, including enhanced heat reflection and aesthetic appeal, especially in warmer climates where these features are in high demand. As a result, white cement is widely used in a range of applications such as pavements, buildings, and decorative structures, enhancing both functionality and visual quality.

In the United States, the market has experienced robust growth in recent years, attributed to ongoing residential and commercial construction projects. For example, in 2022, U.S. commercial construction spending reached approximately USD 97.00 billion, single-family residential construction stood at USD 404.00 billion, and multifamily residential construction amounted to USD 119.00 billion, with projections showing a 4% increase to USD 123.00 billion in 2023.

The white cement market’s value chain includes raw material suppliers, manufacturers, distributors, and end users. Raw material suppliers provide essential resources such as limestone, additives, machinery, and tools. Manufacturers process these materials through grinding and finishing to produce white cement suitable for diverse applications.

Order a free sample PDF of the White Cement Market Intelligence Study, published by Grand View Research.

Key Market Trends and Insights

- Product Segment: White Portland cement held the largest revenue share of 52.9% in 2024. It is chemically similar to traditional grey Portland cement but differs in color and fineness, making it ideal for architectural and aesthetic applications.

- Application Segment: The residential sector accounted for the largest market share at 48.52% in 2024, driven by high demand in residential construction projects including houses, apartments, and complexes. White cement is favored for its compressive strength, low alkali content, and visual appeal.

Market Size and Forecast Summary

- 2024 Market Size: USD 9.43 Billion

- 2030 Forecasted Market Size: USD 12.39 Billion

- CAGR (2025–2030): 4.7%

- Leading Region in 2024: Asia Pacific

Key Players in the White Cement Market

- Cementir Holding NV: An Italian multinational and global leader in white cement production with operations in over 18 countries. It offers a wide portfolio of construction materials including cement, concrete, and aggregates.

- UltraTech Cement: A major Indian manufacturer under the Aditya Birla Group, expanding into the white cement segment to meet increasing demand for aesthetic and premium construction materials.

- J.K. Cement: One of India's leading white cement producers, known for its flagship brand J.K. White Cement. The company has expanded its global footprint through substantial investment in production capacity since its inception in 1975.

Other Prominent Companies Include:

- Çimsa Çimento Sanayi ve Ticaret A.Ş

- Royal White Cement

- LafargeHolcim

- Grasim Industries Ltd (Aditya Birla)

- Dyckerhoff GmbH

- Federal White Cement

- India Cements Ltd

- Saudi White Cement Company

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global white cement market is set for consistent growth through 2030, driven by increasing construction activities, particularly in developing regions. Its superior qualities—such as aesthetic value and heat reflection—make it a preferred alternative to grey cement in architectural applications. The rising demand in residential and commercial construction, along with a strong presence of key industry players, will continue to support market expansion. The Asia Pacific region is expected to remain the largest consumer, while emerging players like UltraTech and J.K. Cement are likely to shape the competitive landscape over the forecast period.