Vietnam Dietary Supplements Market: The Surge in Prenatal Health Products

The Vietnam dietary supplements market was valued at USD 889.4 million in 2024 and is expected to grow to USD 1,665.2 million by 2030.

The Vietnam dietary supplements market was valued at USD 889.4 million in 2024 and is expected to grow to USD 1,665.2 million by 2030, expanding at a CAGR of 11.1% from 2025 to 2030. The market's expansion is primarily driven by increasing health awareness, a growing population of young adults and working professionals seeking nutritional support, and a notable rise in spending on preventive healthcare.

In recent years, health and wellness have gained considerable attention among Vietnamese consumers. This shift is reflected in changing dietary habits, with more individuals opting for nutrient-rich foods. However, to bridge nutritional deficiencies, dietary supplements have become a preferred choice. There is increasing adoption of specialized supplements such as prenatal and infant supplements, along with those used in managing chronic conditions like cardiovascular diseases.

According to data from the World Health Organization’s Global Health Expenditure Database, Vietnam's per capita health expenditure rose from USD 121.00 in 2015 to USD 189.00 in 2022. Urban areas, particularly Hanoi and Ho Chi Minh City, play a key role in driving demand for dietary supplements.

The market is also witnessing the entry of global companies, contributing to its growth momentum. For example, Otsuka Pharmaceutical Co., Ltd. of Japan completed construction of its Pocari Sweat manufacturing plant in Vietnam in April 2025. This facility will produce 350 ml and 500 ml PET bottle formats of the product, which is expected to further stimulate market opportunities during the forecast period.

Order a free sample PDF of the Vietnam Dietary Supplements Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Ingredient: The vitamins segment held the largest revenue share of 31.3% between 2025 and 2030. This is driven by increasing consumer awareness about the benefits of vitamins and the growing availability of vitamin-enriched products such as drinks, tablets, and gummies. Entry of international brands is further supporting this segment.

- By Form: The tablets segment led the market in 2024, owing to benefits such as ease of use, effective delivery, dosage accuracy, and storage convenience. These features make tablets the preferred form for both consumers and manufacturers.

- By Type: In 2024, the prescribed supplements segment dominated. A rising prevalence of chronic diseases, including cancer and cardiovascular conditions, has led to a growing number of healthcare providers recommending supplements like immunity boosters and anti-cancer formulations to support treatment outcomes.

- By Application: The immunity segment recorded the highest revenue share in 2024. Increased public awareness post-COVID-19, urban lifestyle changes, and growing medical endorsements have boosted demand. New product launches in this category also contribute to its growth.

- By End Use: The adults segment accounted for the highest market share in 2024. Young adults, students, and professionals are key consumers, with a preference for innovative formats like gummies and nutrient-enriched drinks. Many working individuals also use tablets or capsules as part of their daily routine.

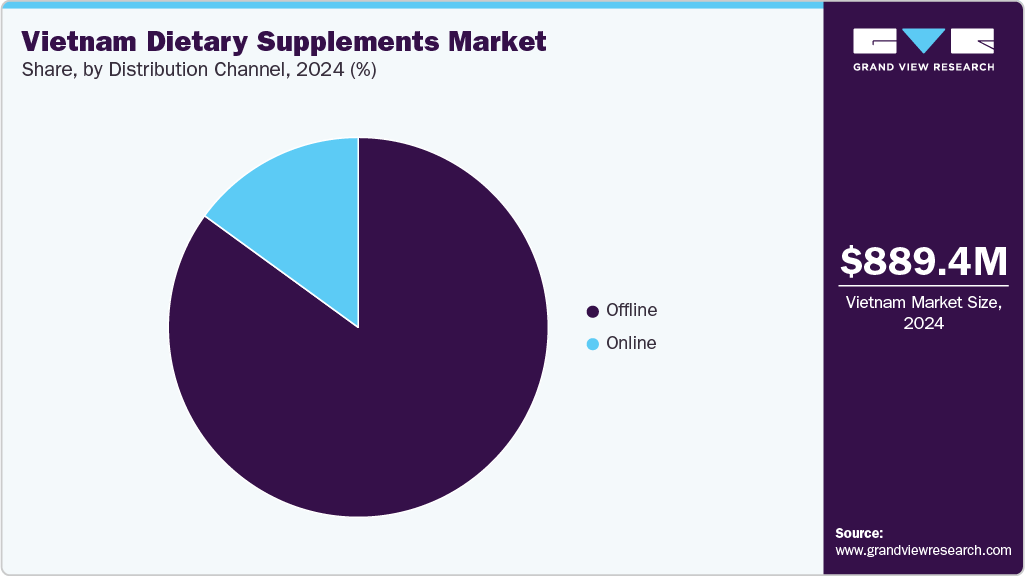

- By Distribution Channel: The offline channel held the largest share in 2024. Consumers favor offline purchases due to easy access to pharmacies and hypermarkets. Retail pharmacy chains are expanding their presence, further strengthening this segment.

Market Size & Forecast

- 2024 Market Size: USD 889.4 Million

- 2030 Projected Market Size: USD 1,665.2 Million

- CAGR (2025-2030): 11.1%

Key Companies & Market Share Insights

Several companies are actively competing in Vietnam’s dietary supplements market, including Tigerwhey, Amway, Abbott, and others. To remain competitive, these firms are focusing on product innovation, multi-channel distribution strategies, and strategic collaborations.

- Amway is a global company offering a wide range of products across nutrition, beauty, and personal care categories. Its nutrition line includes dietary and sports supplements, along with infant health products.

- Tigerwhey is a local, innovation-driven brand specializing in protein-based nutrition. Its offerings include quick oats, unflavored and flavored whey proteins, and casein products.

Key Players

- Amway

- Herbalife

- Abbott

- Nestlé

- Tigerwhey

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

Vietnam dietary supplements market is poised for significant growth through 2030, driven by increasing health awareness, rising healthcare spending, and growing urban demand for convenient nutritional solutions. The market is further strengthened by the entry of global players, product innovation, and expanding distribution networks. With a CAGR of 11.1%, the industry presents strong growth opportunities for both domestic and international stakeholders aiming to tap into Vietnam’s evolving wellness and healthcare landscape.