U.S. Roadside Drug Testing Market 2030: AI and Chromatography Transform Road Safety

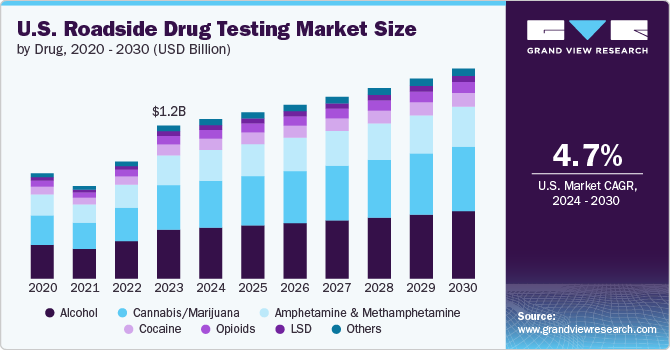

The U.S. roadside drug testing market size was valued at USD 1.17 billion in 2023 and is projected to grow at a CAGR of 4.71% from 2024 to 2030.

The U.S. roadside drug testing market size was valued at USD 1.17 billion in 2023 and is projected to grow at a CAGR of 4.71% from 2024 to 2030. The market is likely to show promising growth due to increasing awareness of the danger of drug-impaired driving and rising drug use, especially with the legalization of marijuana in many states. Law enforcement agencies are investing in new technologies for accurate and efficient testing to ensure public safety. Moreover, government regulations and campaigns against impaired driving are boosting the demand for reliable roadside testing solutions. The market expansion is also fueled by rapid technological advancements, enabling quicker and more effective detection of various substances.

The rise in fatalities and accidents related to alcohol & substance abuse among drivers has become a significant public safety concern in the U.S. This trend is driving the demand for roadside drug testing as law enforcement and public health officials seek to combat impaired driving & enhance road safety. The growing prevalence of substance abuse in the U.S. has contributed to the marked increase in drug-impaired driving incidents. According to the National Highway Traffic Safety Administration (NHTSA), the number of traffic fatalities involving alcohol-impaired drivers has remained persistently high, accounting for nearly 30% of all traffic-related deaths. Moreover, the rise in use of prescription medications, recreational marijuana, and illicit drugs has exacerbated the problem, leading to a concerning surge in drug-related accidents & fatalities. This uptick underscores the urgent need for effective measures to detect and deter impaired driving.

Get a preview of the latest developments in the U.S. Roadside Drug Testing Market; Download your FREE sample PDF copy today and explore key data and trends

Routine checking by police forces is significantly contributing to the growth of the market. As law enforcement agencies intensify efforts to combat impaired driving, the need for effective roadside drug testing solutions has become increasingly critical. Routine checks enable police officers to identify drivers under the influence of drugs more efficiently, ensuring safer roadways & deterring substance abuse. This heightened focus on drug detection has driven the demand for advanced roadside testing technologies that provide quick and accurate results.

The increasing prevalence of drug use and its impact on driving safety has prompted state & federal authorities to invest in more sophisticated testing tools. Public awareness campaigns and stricter regulations have further bolstered the need for these testing solutions. As a result, manufacturers and suppliers in the roadside drug testing market are experiencing significant growth, fueled by continuous advancements in testing technology and the expansion of law enforcement programs. Overall, routine checking by police forces can enhance road safety and propel the roadside drug testing market.

In 2023, 5.8% of individuals aged 12 years or older, or 16.4 million people, were classified as heavy alcohol users. This rate was notably higher among young adults aged 18 years to 25 years, where 6.9%, or 2.4 million people, reported heavy alcohol use. For adults aged 26 years and older, the percentage was 6.2%, corresponding to 13.9 million individuals. Approximately 0.5% of adolescents aged 12 years to 17 years, or about 141,000 people, were identified as heavy alcohol users.

Detailed SegmentationDrug Insights

Alcohol segment dominated the market with a share of 31.96% in 2023. Alcohol testing dominates the market because alcohol impairment is a well-established concern with established legal limits and widespread use of standardized testing devices such as breathalyzers. The effects of alcohol on driving ability are extensively studied, making it easier to enforce regulations and set impairment thresholds. In addition, alcohol is one of the most commonly consumed substances, leading to a higher frequency of testing. The established infrastructure and protocols for alcohol testing, along with public awareness of drunk driving laws, contribute to its dominance in the market.

Sample Insights

Breath segment dominated the market with a share of 44.44% in 2023. Breath samples are the most commonly used method in roadside drug testing due to their practicality, non-invasive nature, and immediate results. Law enforcement officers favor breath tests because they are quick and easy to administer during traffic stops, minimizing the disruption for both the driver and the officer. Breathalyzers, the devices used to measure alcohol levels, have been well-established and widely accepted in the legal system, offering a reliable and standardized method for detecting alcohol impairment.

Test Location Insights

Highway police segment dominated the market with a share of 90.87% in 2023. The highway police segment dominated the roadside drug testing market because they are primarily responsible for enforcing traffic laws and ensuring road safety. Their jurisdiction over highways and major roads, where a significant proportion of traffic incidents occur, gives them a crucial role in monitoring and deterring impaired driving. Equipped with specialized training and tools, highway police conduct routine checks and operate sobriety checkpoints, making them key players in testing and enforcement.

State Insights

California Roadside Drug Testing Market Trends

California roadside drug testing market dominated with largest revenue share of 14.50% in 2023. The state generated the highest revenue due to its large population, significant number of roadways, and progressive stance on drug regulations. As the most populous state, California has a high volume of traffic, increasing the demand for effective roadside drug testing to ensure road safety. The state's comprehensive approach to drug enforcement, including strict DUI laws and widespread implementation of drug testing, further drives market demand. Additionally, California's progressive policies on drug legalization, such as the legalization of recreational marijuana, have heightened the need for reliable roadside testing to address the complexities of impaired driving. The state's large budget for law enforcement and public safety also supports the adoption of advanced drug testing technologies. Consequently, California's unique combination of factors makes it a key player and major influence in the market.

Key U.S. Roadside Drug Testing Companies:

- Drägerwerk AG & Co. KGaA

- Abbott.

- Intoximeters

- Lifeloc Technologies, Inc.

- Hound Labs, Inc.

- Immunalysis Corporation

- CMI Inc.

- Alcohol Countermeasure Systems Corp.

- AK GlobalTech Corp.

- PAS Systems International, Inc

U.S. Roadside Drug Testing Market Segmentation

Grand View Research has segmented the U.S. roadside drug testing market based on sample, drug, test location, and states:

U.S. Roadside Drug Outlook (Revenue, USD Million, 2018 - 2030)

- Alcohol

- Cannabis/Marijuana

- Cocaine

- Opioids

- Amphetamine & Methamphetamine

- LSD

- Others

U.S. Roadside Sample Outlook (Revenue, USD Million, 2018 - 2030)

- Saliva

- Breath

- Urine

- Blood

U.S. Roadside Test Location Outlook (Revenue, USD Million, 2018 - 2030)

- Highway Police

- Drug Enforcement Agencies

U.S. Roadside States Outlook (Revenue, USD Million, 2018 - 2030)

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Curious about the U.S. Roadside Drug Testing Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In May 2024, Hound Labs, Inc. representatives conducted on-site demonstrations of the HOUND CANNABIS BREATHALYZER1. They engaged with clinics, employers, and professionals in legal, safety, & human resources, discussing the implementation of recent-use breath testing to enhance drug testing program outcomes.

- In January 2020, Lifeloc Technologies, Inc. received ISO 17034:2016 accreditation for its Plus 4 Certified Reference Solution from the American Association for Laboratory Accreditation (A2LA).

- In July 2020, Lifeloc Technologies, Inc. announced the results of a study evaluating the risk of virus transmission between subjects using their FC Series (EV30, Phoenix 6.0, FC20) and L Series (LT7, LX9, LT7I) breath alcohol testing devices. The analysis revealed no detectable viruses in the air samples pulled through multiple mouthpieces of both the L Series and FC Series units.