U.S. Pharmacy Market 2030: Bridging Gaps in Rural Healthcare

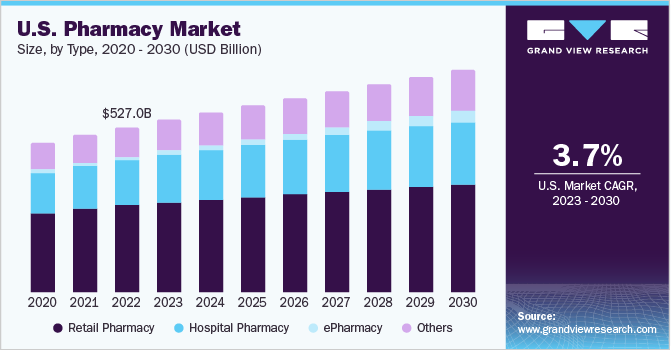

The U.S. pharmacy market is poised for significant expansion, with projections indicating it will hit USD 708.9 billion by 2030. This impressive growth trajectory, detailed in a recent report by Grand View Research, Inc., suggests a CAGR of 3.67% from 2023 to 2030.

The U.S. pharmacy market is poised for significant expansion, with projections indicating it will hit USD 708.9 billion by 2030. This impressive growth trajectory, detailed in a recent report by Grand View Research, Inc., suggests a CAGR of 3.67% from 2023 to 2030.

What's fueling this boom? A confluence of critical factors: the rising tide of chronic diseases, an ever-increasing aging population, and the widening net of healthcare coverage. These elements are collectively driving up the demand for both healthcare services and the medications that support them, making essential medicines more accessible to a broader demographic.

Beyond these foundational drivers, the market is also being reshaped by innovation. Key players are rolling out improved services and embracing the shift towards e-pharmacy, further accelerating market growth. A prime example is Medicure Inc.'s February 2022 launch of Marley Drug Pharmacy. This direct-to-consumer e-commerce platform offers over 100 chronic care medications and provides free delivery across the entire U.S. and some territories. Such advancements are set to significantly bolster the market's upward trajectory.

Get a preview of the latest developments in the U.S. Pharmacy Market; Download your FREE sample PDF copy today and explore key data and trends

Furthermore, the number of pharmacies in the country for drug distribution is increasing due to the rapid growth in the number of prescriptions, which is expected to have a positive impact on market growth. The National Council for Prescription Drug Programs (NCPDP) reported that the number of independent pharmacies in the U.S. increased by 12.9% from 2010 to 2019. In 2010, there were 20,427 independent pharmacies in the U.S., while in 2019, there were 23,061. This increase in the number of independent pharmacies is expected to contribute to the growth of the U.S. pharmacy industry.

U.S. Pharmacy Market Report Highlights

- Based on type, the retail pharmacy segment held the largest market share in 2022 owing to easy accessibility and the presence of multiple retail pharmacy chains across the country

- Based on product type, the prescription segment held the largest revenue share in 2022, owing to the increasing burden of chronic diseases and the growing aging population

- Based on the ownership, the pharmacy chains segment held the largest market share in 2022 owing to the emergence of large hospital and corporation chains that offer convenient and cost-effective services, including specialty drugs, mail-order prescriptions, and other services

- The market has witnessed significant vertical and horizontal consolidations in recent years, which is expected to improve services

- The market potential is driving a number of service providers to strengthen their market presence by opening new centers and entering into partnerships. For instance, in October 2021, Walgreens Boots Alliance (WBA) announced an investment of USD 5.2 billion in VillageMD, a primary care provider. The investment allow VillageMD to open 600 new primary care practices in over 30 US markets by 2025, more than half of which will be located in underserved communities

U.S. Pharmacy Market Segmentation

Grand View Research has segmented the U.S. pharmacy market based on pharmacy type, product type, and ownership:

U.S. Pharmacy Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- ePharmacy

- Others

U.S. Pharmacy Ownership Outlook (Revenue, USD Billion, 2018 - 2030)

- Independent

- Chain

U.S. Pharmacy Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Prescription

- OTC

Curious about the U.S. Pharmacy Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.