U.S. Pharmacy Benefit Management Market Breakdown: Understanding Business Models

The U.S. pharmacy benefit management (PBM) market was valued at USD 482.4 billion in 2022 and is projected to reach USD 934.0 billion by 2030.

The U.S. pharmacy benefit management (PBM) market was valued at USD 482.4 billion in 2022 and is projected to reach USD 934.0 billion by 2030, expanding at a CAGR of 8.77% from 2023 to 2030. This growth is primarily fueled by increasing healthcare spending, the rising prevalence of chronic diseases, and a growing trend toward vertical integration within the pharmaceutical distribution system.

PBMs act as intermediaries between pharmaceutical manufacturers and insurance providers, managing prescription drug benefits on behalf of health insurers, Medicare Part D drug plans, large employers, and other payers. According to the National Association of Insurance Commissioners, approximately 66 PBM companies are currently operating in the U.S., overseeing the pharmacy benefits of more than 266 million Americans.

As the number of insurance providers with in-house PBM groups increases, so does the demand for efficient PBM services. These systems reduce overall drug costs by pooling patients from various health plans into larger networks, allowing PBMs to negotiate better pricing and secure manufacturer discounts.

Market Drivers

One of the strongest growth drivers is vertical integration, especially following major mergers such as CVS-Aetna and Cigna-Express Scripts. These alliances are reshaping the pharmaceutical supply chain by increasing PBMs’ influence over drug pricing, reimbursement structures, and the delivery of care. PBMs, in partnership with health insurers, are playing a growing role in formulary design, treatment decisions, and cost-containment strategies.

Additionally, many drugs on the market have similar mechanisms of action, resulting in heightened price sensitivity. PBMs capitalize on this by negotiating rebates and discounts in exchange for formulary placement. This process allows PBMs to exert control over prescribing decisions through mechanisms like prior authorization and can even influence whether or not a treatment is approved or delayed.

Order a free sample PDF of the U.S. Pharmacy Benefit Management Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

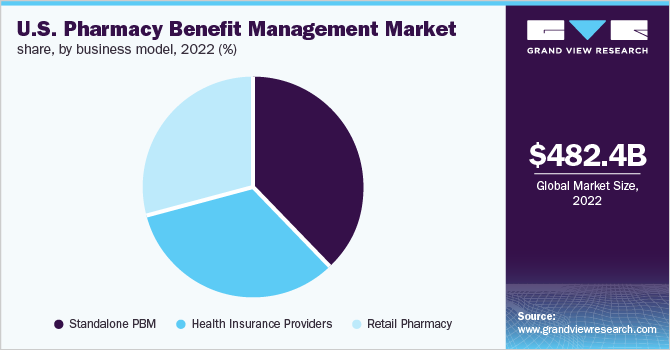

- By Business Model: The standalone PBM segment accounted for the largest market share of 37.9% in 2022. Key players in this segment, including CVS Health and Express Scripts, have been involved in major mergers and acquisitions. These consolidations allow for greater pricing transparency, improved cost control, and competitive positioning within the broader pharmaceutical supply chain.

- By End-Use: The commercial segment generated the highest revenue and is expected to maintain its dominance throughout the forecast period. A large proportion of U.S. employees are covered under commercial private insurance plans, enabling them to benefit from copay structures for expensive medications. As per the Congressional Research Service, approximately 211 million individuals were enrolled in private insurance (including group and non-group coverage) in 2020.

Market Size & Forecast

- 2022 Market Size: USD 482.4 Billion

- 2030 Projected Market Size: USD 934.0 Billion

- CAGR (2023-2030): 8.77%

Key Companies & Market Share Insights

Mergers and acquisitions remain central to the strategic direction of leading PBM providers. Market participants continue to explore ways to enhance competitiveness through strategic partnerships, integration, and service diversification.

For example, in October 2021, a nonprofit consortium of approximately 40 employers, including major retailers such as Walmart and Costco, launched a new company to provide pharmacy benefit management services. The goal of this initiative is to create a more transparent and cost-effective PBM model for employers, bypassing traditional structures and bringing additional competition into the market.

Key Players

- CVS Health

- Cigna

- Optum, Inc.

- MedImpact

- Anthem

- Change Healthcare

- Prime Therapeutics LLC

- HUB International Limited.

- Elixir Rx Solutions LLC

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. pharmacy benefit management market is poised for sustained expansion, with revenue expected to nearly double by 2030, reaching USD 934.0 billion. This growth is driven by rising healthcare expenditures, the increasing burden of chronic conditions, and a shift toward integrated delivery systems that align PBMs, insurers, and healthcare providers.

As PBMs continue to gain influence over drug pricing, treatment access, and formulary design, their role in shaping the future of U.S. healthcare will only become more prominent. Strategic mergers, policy changes, and emerging nonprofit PBM models are expected to further transform the competitive landscape, pushing the industry toward greater efficiency, cost transparency, and patient-centric outcomes.