U.S. Pharmaceutical Filtration Market: Key Players Driving Competitive Dynamics

The U.S. pharmaceutical filtration market was valued at USD 4.72 billion in 2023 and is projected to reach USD 7.12 billion by 2030.

The U.S. pharmaceutical filtration market was valued at USD 4.72 billion in 2023 and is projected to reach USD 7.12 billion by 2030, expanding at a CAGR of 5.62% from 2024 to 2030. The market’s growth is driven by technological advancements in pharmaceutical filtration systems within the biopharmaceutical and pharmaceutical sectors, as well as increasing government support for healthcare research and development. The presence of leading pharmaceutical and biopharmaceutical companies in the U.S. continues to be a major contributor to market expansion.

In 2023, the U.S. represented 39% of the global pharmaceutical filtration market, supported by its well-established healthcare infrastructure and access to advanced filtration products. Favorable healthcare coverage policies ensure timely treatments, encouraging pharmaceutical manufacturers and research institutions to pursue innovation in drug development. Additionally, stringent regulatory standards by the U.S. Food and Drug Administration (FDA) for biologics and vaccine production demand high-quality, pure, and safe outputs—compelling manufacturers to adopt robust filtration solutions. Non-compliance with these regulations may lead to approval delays or the loss of facility credibility.

Consumer awareness about the safety and purity of pharmaceutical products is also rising, prompting drug manufacturers to invest in advanced filtration technologies. As drug formulations become more complex, pharmaceutical companies increasingly rely on filtration systems capable of removing even microscopic contaminants and microorganisms, particularly in biological formulations.

Order a free sample PDF of the U.S. Pharmaceutical Filtration Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By product, the membrane filters segment held a 25.2% market share in 2023, and is projected to witness the highest growth rate during the forecast period. This is attributed to its uniform pore size distribution, which ensures high precision and consistent filtration quality, making it essential in various pharmaceutical applications.

- By technique, microfiltration accounted for 33.4% of the market in 2023, due to its versatility in removing a wide range of impurities without altering the biological activity or stability of the substances being filtered.

- By type, the sterile filtration segment dominated with a 57.0% share in 2023. This filtration method is critical in the production of injectable drugs and vaccines, ensuring the removal of contaminants that could compromise the safety and effectiveness of these products.

- By application, final product processing held the leading share of 40.6% in 2023, and is expected to grow at the fastest rate. This stage is vital in ensuring the pharmaceutical product's quality, efficacy, and regulatory compliance.

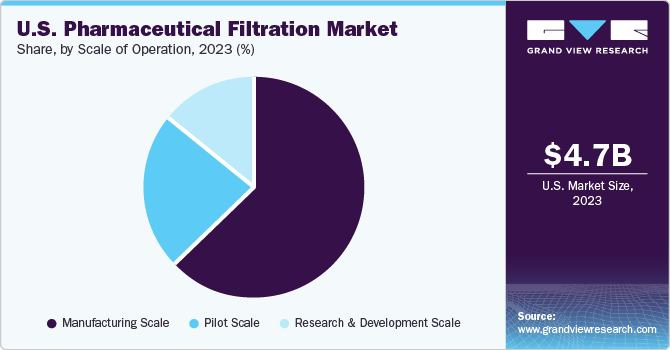

- By scale of operation, manufacturing-scale operations captured 63.4% of the market in 2023. In manufacturing, filtration processes are central to achieving safety, purity, and compliance. Strict regulatory guidelines make adherence to filtration standards crucial for maintaining product integrity.

Market Size & Forecast

- 2023 Market Size: USD 4.72 Billion

- 2030 Projected Market Size: USD 7.12 Billion

- CAGR (2024-2030): 5.62%

Key Companies & Market Share Insights

Major players in the U.S. pharmaceutical filtration market include Eaton, Merck KGaA, Amazon Filters Ltd., Thermo Fisher Scientific Inc., and Parker Hannifin Corp. These companies are capitalizing on growing demand across various pharmaceutical applications.

Competitive dynamics remain strong as companies continue to pursue mergers and acquisitions, R&D investments, strategic collaborations, and geographical expansion to solidify their market presence. Several firms have developed and commercialized advanced filtration technologies that have helped them secure a competitive edge within the industry.

Key Players

- Eaton.

- Merck KGaA

- Amazon Filters Ltd.

- Thermo Fisher Scientific Inc.

- Parker Hannifin Corp.

- 3M

- Sartorius AG.

- Graver Technologies

- Danaher.

- Meissner Filtration Products, Inc

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. pharmaceutical filtration market is poised for steady growth, supported by technological progress, strict regulatory standards, and the rising complexity of modern drug formulations. As demand for pure, safe, and effective pharmaceuticals increases, filtration technologies will remain critical in ensuring drug quality and compliance. Market leaders that continue to innovate and align with evolving regulatory and industry needs will be best positioned to capitalize on the expanding opportunities within this vital sector.