U.S. Oral Care Products Market 2030: Toothpaste Innovations to Watch

The U.S. oral care products market was valued at USD 11.41 billion in 2024 and is anticipated to reach USD 15.71 billion by 2030.

The U.S. oral care products market was valued at USD 11.41 billion in 2024 and is anticipated to reach USD 15.71 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030. This growth is primarily attributed to the increasing incidence of dental diseases, the aging population prone to dental caries, poor dietary habits, and continuous product innovation.

According to the National Institute of Dental and Craniofacial Research, nearly 90% of adults aged 20 to 64 have experienced tooth decay, with the highest prevalence—96%—observed among adults aged 50 to 64. Smoking is also linked to higher rates of dental conditions, further contributing to the rising demand for oral care products.

The widespread occurrence of oral health issues, including dental caries, enamel erosion, periodontal disease, and decay, underscores the importance of advanced dental hygiene solutions. The rise of precision cleaning and minimally invasive dentistry is reshaping oral care practices. Technologies like ultrasonic cleaners, high-performance electric toothbrushes, and water flossers enhance plaque and bacteria removal, helping to reduce gum disease and cavities. Additionally, diagnostic tools such as digital X-rays and intraoral cameras enable early detection, while gentler, drill-free techniques like air abrasion significantly improve patient experience and comfort.

These innovations reflect a shift toward preventive, long-term oral health strategies. For example, Water Pik, Inc. introduced the Sensonic electric toothbrush in August 2023, featuring specially designed bristles and a long-lasting rechargeable battery. Similarly, in October 2023, BURST Oral Care launched the Pro Sonic Toothbrush and Curve Sonic Toothbrush, which incorporate LED screens, smart software, and rechargeable batteries.

The growing awareness of oral hygiene and increased per capita disposable income are also fueling the demand for advanced oral care solutions integrated with smart technology and teledentistry. In February 2023, Colgate introduced a whitening pen and kit focused on enamel-safe whitening, catering to consumers' desire for convenient, effective, and tech-enabled solutions.

Order a free sample PDF of the U.S. Oral Care Products Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By product, generalized oral care items held a 71.28% share of the U.S. market in 2024. This includes toothpaste, toothbrushes, mouthwash, and dental floss, with toothpaste emerging as the most widely used due to its role in daily oral hygiene routines.

- By gender, women accounted for 63.80% of product usage in 2024. This reflects differences in health behaviors, as women generally demonstrate a stronger focus on oral hygiene, influenced by biological, psychological, and social factors.

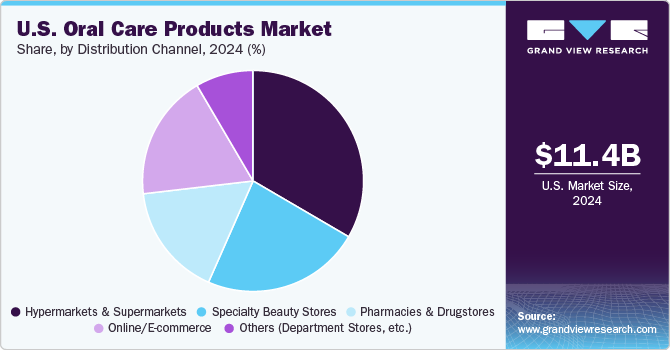

- By distribution channel, hypermarkets and supermarkets captured 33.41% of the market share in 2024. These retail formats benefit from their wide accessibility and the ability to offer bulk discounts, making oral care products more affordable and widely available to consumers.

Market Size & Forecast

- 2024 Market Size: USD 11.41 Billion

- 2030 Projected Market Size: USD 15.71 Billion

- CAGR (2025-2030): 5.6%

Key Companies & Market Share Insights

The U.S. oral care market is shaped by leading players like Procter & Gamble Company, Colgate-Palmolive Company, and Church & Dwight Co., Inc., who continue to invest in R&D and innovation to maintain a competitive edge.

- Colgate-Palmolive Company offers a broad range of oral, personal, and home care products under brands such as Colgate, Softsoap, Tom’s of Maine, and Elmex. With operations in over 75 countries and product reach across 200+ markets, the company remains a dominant force in the oral care sector.

- GSK plc, formerly a major player in oral care through brands like Sensodyne, underwent structural changes in July 2022 by spinning off its consumer healthcare division to form Haleon plc, which now manages its oral care product lines across 115 countries.

Key Players

- Procter and Gamble Company (P&G)

- Colgate-Palmolive Company

- Church & Dwight Co., Inc.

- Unilever PLC

- Johnson & Johnson Services, Inc.

- SmileDirectClub, Inc.

- GlaxoSmithKline plc (GSK Consumer Healthcare)

- Philips Oral Healthcare, Inc.

- Perrigo Company

- Dr. Brite, LLC

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. oral care products market is poised for steady growth, supported by rising dental disease prevalence, an aging population, lifestyle-related risk factors, and ongoing innovation in product technology. As consumers become more informed and proactive about oral hygiene, the demand for advanced, user-friendly, and tech-integrated solutions continues to rise. Companies that embrace these innovations and cater to the growing focus on preventive care and personalized dental solutions are likely to drive future market expansion.