U.S. Metagenomics Market 2030: Harnessing the Power of Environmental Analysis

The U.S. metagenomics market was valued at USD 776.5 million in 2023 and is projected to reach USD 1.79 billion by 2030.

U.S. Metagenomics Market Overview

The U.S. metagenomics market was valued at USD 776.5 million in 2023 and is projected to reach USD 1.79 billion by 2030, growing at a CAGR of 12.99% between 2024 and 2030. This growth is largely driven by extensive research in genomics, oncology, and whole-genome sequencing. Additional factors contributing to the increasing adoption of metagenomics technology in the U.S. include superior medical and research infrastructure, substantial funding, the presence of companies focused on innovative diagnostic and therapeutic technologies, and a skilled workforce.

In 2023, the U.S. accounted for 38.3% of the global metagenomics market. The market growth has been bolstered by prominent players such as Life Technologies, Roche, and Illumina, which have significantly advanced rapid and high-throughput sequencing technologies. These companies are actively engaging in strategic initiatives, including research and development. For example, in November 2023, researchers at the University of Cambridge’s Milner Therapeutics Institute (MTI) announced functional genomics studies aimed at understanding genetic alterations that contribute to disease progression, with the goal of improving diagnostics and therapies.

Technological progress has played a vital role in reducing the cost of genome sequencing, leading to increased use of metagenomic studies, particularly in clinical sequence analysis. Further advancements in DNA technologies and bioinformatics—especially in streamlining RNA-Seq workflows—are expected to further decrease costs while enhancing analytical accuracy. As sequencing expenses decline, the adoption of metagenomics research is expected to rise accordingly.

Order a free sample PDF of the U.S. Metagenomics Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Product: The kits & reagents segment dominated the market in 2023 with a share exceeding 61.50%. These products are specifically designed for applications such as soil, water, and biological sample analysis and are widely used for detecting bacteria, viruses, pathogens, fungi, and microeukaryotes based on study requirements.

- By Technology: The shotgun sequencing segment held the largest share of over 30.04% in 2023, owing to its broad applications in genomics research, clinical diagnostics, environmental monitoring, conservation, agriculture, and crop improvement.

- By Workflow: The sequencing segment led with over 53.35% market share in 2023. Platforms like shotgun sequencing, 16S & ITS ribosomal RNA (rRNA) sequencing kits, and Ion 16S metagenomics kits are widely adopted for metagenomic workflows. Continuous technological improvements have lowered sequencing costs by approximately 28% annually, significantly driving the growth of this segment.

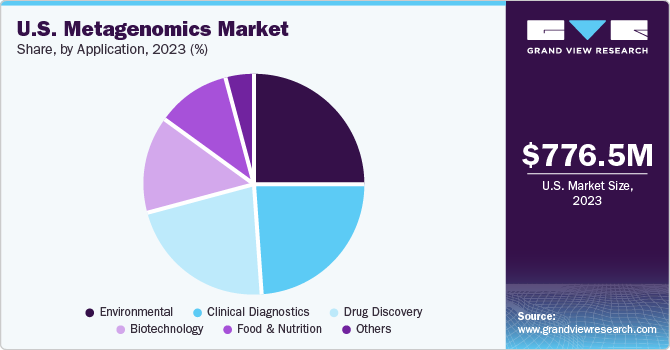

- By Application: The environmental segment accounted for the largest share of over 25.0% in 2023. The genetic analysis of microbial communities from environmental samples has created a new domain known as environmental metagenomics. This segment includes specialized kits and reagents developed for sample collection, DNA purification, sample enrichment, library preparation, and validation.

Market Size & Forecast

- 2023 Market Size: USD 776.5 Million

- 2030 Projected Market Size: USD 1.79 Billion

- CAGR (2024-2030): 12.99%

Key Companies & Market Share Insights

Leading players in the U.S. metagenomics market include Bio-Rad Laboratories, Illumina, Inc., PerkinElmer, Inc., Thermo Fisher Scientific, Inc., Novogene Co. Ltd., Promega Corporation, QIAGEN, and Takara Bio, Inc. These companies enjoy strong brand recognition, broad distribution networks, and diverse product portfolios, which intensify market competition.

Several market participants are engaging in strategic efforts such as expansions, acquisitions, and mergers to drive growth throughout the forecast period. Investments in the development of novel technologies and products are ongoing. Many firms have also extended sequencing programs focused on monitoring mutations to support vaccine development for various diseases.

Key Players

- Bio-Rad Laboratories, Inc

- Illumina, Inc.

- PerkinElmer, Inc.

- Thermo Fisher Scientific, Inc.

- Novogene Co., Ltd.

- Promega Corporation

- QIAGEN

- Takara Bio, Inc.

- Oxford Nanopore Technologies

- F. Hoffmann-La Roche Ltd.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. metagenomics market is poised for robust growth, fueled by continuous technological advancements, decreasing sequencing costs, and extensive research activities in genomics and disease diagnostics. The country’s strong infrastructure, funding availability, and presence of key industry players further support market expansion. As metagenomics becomes increasingly integral to clinical and environmental research, demand for specialized products and sequencing services will continue to rise, driving the market toward an estimated value of USD 1.79 billion by 2030. Strategic initiatives by leading companies and ongoing innovation will play a crucial role in shaping the competitive landscape and accelerating adoption across various applications.