U.S. Irrigation Insurance Market Segments: From Center Pivots to Drip Systems

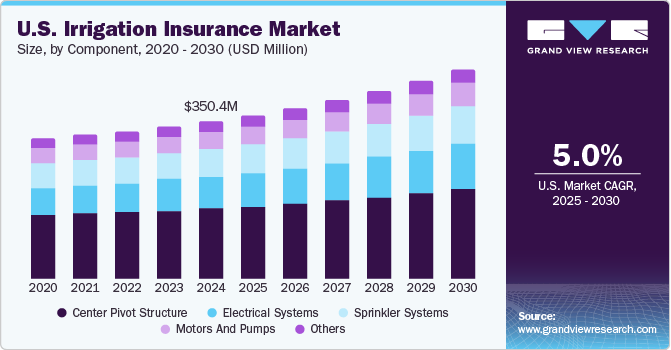

The U.S. irrigation insurance market was valued at USD 350.4 million in 2024 and is anticipated to reach USD 465.8 million by 2030.

U.S. Irrigation Insurance Market Overview

The U.S. irrigation insurance market was valued at USD 350.4 million in 2024 and is anticipated to reach USD 465.8 million by 2030, expanding at a CAGR of 5.0% from 2025 to 2030. As modern agriculture increasingly depends on advanced irrigation systems, farmers are turning to insurance to safeguard against mechanical breakdowns, environmental hazards, and operational disruptions.

The growth of this market is being driven by several key factors: the rising adoption of advanced irrigation technologies, increasing climate variability, and heightened awareness among farmers about the financial importance of protecting their irrigation infrastructure.

Farmers across the U.S. are adopting technologies such as sprinkler and drip irrigation systems to enhance water efficiency, maximize crop yields, and reduce operational costs. The growing concerns around water scarcity and climate change are accelerating this trend. Government programs and subsidies are also promoting investments in modern irrigation systems. As reliance on these systems grows, so does the demand for insurance coverage that protects against malfunctions, mechanical damage, and climate-related impacts. In this context, irrigation insurance plays a vital role in promoting the long-term sustainability and resilience of U.S. agriculture.

Climate variability is further amplifying risks for farmers. Events such as droughts, floods, and intense precipitation are increasingly affecting crop performance and soil health. In 2024 alone, weather-related disasters in the U.S. led to over USD 20.3 billion in agricultural losses, much of which was either uninsured or fell outside coverage limits. This reinforces the need for comprehensive irrigation insurance, as farmers seek to minimize financial exposure from unpredictable climate conditions.

Order a free sample PDF of the U.S. Irrigation Insurance Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Component: The center pivot structure segment led the U.S. irrigation insurance market in 2024, accounting for a 44.5% revenue share. Center pivot systems are favored for their efficiency in covering large areas and optimizing water usage. However, due to their vulnerability to mechanical issues and weather-related damage, they require dedicated insurance protection.

- By Type of Coverage: Comprehensive coverage was the most preferred in 2024, securing the largest market share. Farmers value inclusive policies that cover multiple risk types, including equipment failures and climate events. Such coverage ensures continuous operation and financial stability.

- By Distribution Channel: Insurance brokers and agents held the largest revenue share in 2024. Their role in helping farmers understand policy options, assess risk, and select the most suitable coverage has been critical. Personalized advice and tailored services continue to drive this segment.

Market Size & Forecast

- 2024 Market Size: USD 350.4 Million

- 2030 Projected Market Size: USD 465.8 Million

- CAGR (2025-2030): 5.0%

Key Companies & Market Share Insights

The U.S. irrigation insurance market includes several key players focused on offering tailored insurance solutions:

- Chubb Agribusiness: Established in 1919 and headquartered in Nebraska, Chubb Agribusiness is a leading provider of insurance solutions for farms and agribusinesses. It offers a wide range of coverage options for risks related to agricultural operations, manufacturing, and distribution.

- UNICO Group, Inc.: Founded in 1988, also in Nebraska, UNICO Group is a full-service insurance brokerage firm offering irrigation insurance as part of its specialized programs. It provides comprehensive policies for irrigation systems, including those under pivots.

Other notable market players include Central Valley Irrigation, Agri Industries, Inc., and Plummer Insurance. Competitive strategies across the sector involve service differentiation, policy customization, and enhanced customer support.

Key Players

- UNICO Group, Inc.

- Agri Industries

- Chubb Agribusiness

- Plummer Insurance

- Scribner Insurance Agency

- Gerald Ross Agency

- Central Valley Irrigation

- DFS Insurance

- Western Shelter Insurance, Inc.

- Minnesota Valley Irrigation

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. irrigation insurance market is poised for steady growth, supported by the increasing use of modern irrigation systems, rising climate-related risks, and growing farmer awareness around financial protection. As weather-related uncertainties continue to challenge agricultural productivity, the demand for robust and comprehensive irrigation insurance will likely intensify. With a projected market size of USD 465.8 million by 2030, the industry presents significant opportunities for insurers and brokers focused on agriculture-specific solutions. The role of personalized insurance services, policy flexibility, and government support will remain crucial in shaping the future landscape of this market.