U.S. Healthcare Staffing Market 2030: Insights from Industry Leaders

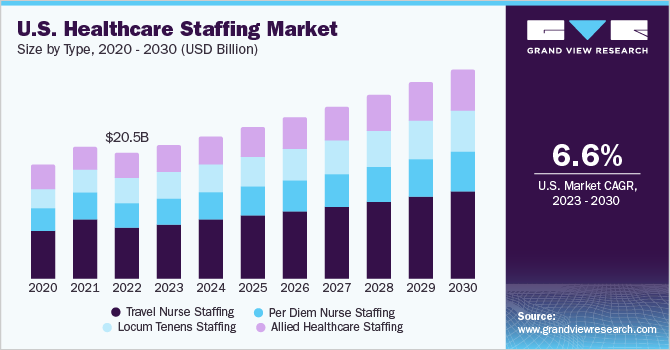

The U.S. healthcare staffing market was valued at USD 20.5 billion in 2022 and is projected to reach USD 34.7 billion by 2030. This growth reflects a compound annual growth rate (CAGR) of 6.69% from 2023 to 2030.

U.S. Healthcare Staffing Market Overview

The U.S. healthcare staffing market was valued at USD 20.5 billion in 2022 and is projected to reach USD 34.7 billion by 2030. This growth reflects a compound annual growth rate (CAGR) of 6.69% from 2023 to 2030. The primary drivers of this growth include the increasing reliance on temporary healthcare staffing due to the expanding geriatric population and a widespread shortage of skilled nursing professionals across the country.

A growing life expectancy has contributed to the expansion of the elderly demographic. According to the U.S. Census Bureau, the number of individuals aged 65 and older is expected to increase by approximately 80% between 2020 and 2030. Compared to the general population, this group is three times more likely to require hospitalization and twice as likely to visit a physician, making them a significant factor in the demand for healthcare services. Their vulnerability to chronic illnesses and lifestyle-related diseases continues to place added pressure on the healthcare infrastructure.

The existing healthcare system is already strained by the rising elderly population. Data from the Association of American Medical Colleges indicates that the U.S. may face a physician shortage ranging between 46,900 and 121,900 by 2032. Additionally, the American Nurses Association estimated a demand for 3.44 million nurses by 2022. To meet staffing needs, hospitals and medical institutions are increasingly working with recruitment firms to fill both temporary and permanent roles—further propelling market expansion.

Order a free sample PDF of the U.S. Healthcare Staffing Market Intelligence Study, published by Grand View Research.

Key Market Trends and Insights

- Travel Nurse Staffing led the market in 2022 with a 39.55% share and is anticipated to be the fastest-growing segment, with a projected CAGR of 6.37%. This growth is attributed to competitive pay, flexibility, and the appeal of short-term assignments with travel opportunities.

- Locum Tenens Staffing is expected to record the highest growth during the forecast period. Factors such as shortages in primary care providers and seasonal demand surges have led healthcare facilities to adopt locum tenens staffing as a cost-effective solution.

Market Size and Forecast

- Market Value in 2022: USD 20.5 Billion

- Forecast for 2030: USD 34.7 Billion

- CAGR (2023–2030): 6.69%

Competitive Landscape

The U.S. healthcare staffing market is moderately fragmented. Leading firms such as AMN Healthcare, Envision Healthcare Corporation, and CHG Management, Inc. hold significant market shares due to their extensive networks, robust recruitment services, and investment in technology.

To enhance their market presence, key players are employing strategies such as partnerships, mergers and acquisitions, tech integration, and geographic expansion. For example, in June 2021, Cross Country Healthcare, Inc. acquired Workforce Solutions Group, Inc., further expanding its talent management capabilities.

Prominent Companies in the Market Include:

- Envision Healthcare Corporation

- AMN Healthcare

- CHG Management, Inc.

- Maxim Healthcare Group

- Cross Country Healthcare, Inc.

- Aya Healthcare

- Trustaff

- TeamHealth

- Adecco Group

- LocumTenens.com

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. healthcare staffing market is poised for steady growth, driven by demographic shifts, rising healthcare demands, and persistent shortages in medical personnel. As healthcare providers seek flexible, scalable staffing solutions to meet patient needs, the demand for staffing services—particularly in travel nursing and locum tenens—is expected to remain strong. Market players who invest in technology, expand service offerings, and form strategic partnerships will be best positioned to capitalize on the ongoing evolution of the healthcare workforce landscape.