U.S. Genome Editing Market 2030: Innovations in Gene-Editing Technologies

The U.S. genome editing market was valued at USD 3.49 billion in 2023 and is projected to reach USD 10.69 billion by 2030.

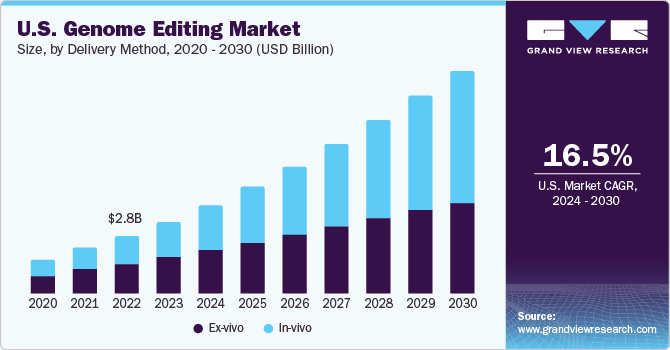

The U.S. genome editing market was valued at USD 3.49 billion in 2023 and is projected to reach USD 10.69 billion by 2030, growing at a CAGR of 16.5% from 2024 to 2030. This robust growth is primarily driven by increasing demand for synthetic genes, the widespread application of CRISPR technology, and significant government funding. Additional growth factors include advancements in R&D, the production of genetically modified crops, and the expansion of genomics projects. Innovations in gene editing tools have greatly enhanced molecular biology and gene therapy, with user-friendly gene therapy platforms and the ability to conduct large-scale genome-wide analyses further contributing to market expansion.

In 2023, the U.S. represented more than 43.9% of the global genome editing market, marking its strong position in the industry. The emergence of advanced technologies that facilitate straightforward editing of genomic DNA has opened a new chapter in therapeutic development. Genome editing holds the potential to elevate precision medicine, and upcoming regulatory approvals for clinical trials and research involving gene editing therapies are expected to accelerate their adoption. Promising results from preclinical and early-stage trials are likely to encourage product launches and generate new opportunities within the market.

The demand for synthetic genes and the increasing use of CRISPR genome editing across various biotech sectors have significantly contributed to recent market expansion. Continued growth is expected due to rising public and private investment, government-backed genomics initiatives, and the growing use of genetically modified crops. CRISPR-based diagnostics also support this trend—highlighted by innovations like the VaNGuard (Variant Nucleotide Guard) test, developed in March 2021 at Nanyang Technological University, which can detect mutated strains of SARS-CoV-2. This reinforces the role of CRISPR technology in diagnostics and pandemic preparedness.

Order a free sample PDF of the U.S. Genome Editing Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- End-Use: In 2023, biotechnology and pharmaceutical companies led the market with a 50.8% revenue share, owing to the increasing volume of research aimed at developing novel therapies. Collaborations between established pharmaceutical firms and emerging biotech companies to develop innovative technologies are also fueling this growth.

- Delivery Method: The ex-vivo segment dominated in 2023 with a 50.8% revenue share, driven by its controlled DNA editing process. The rise of genome editing-based clinical trials and the legacy of the Human Genome Project, which identified nearly 7,000 new human genetic diseases, are supporting this segment's expansion.

- Technology: CRISPR/Cas9 was the leading technology in 2023, capturing 41.8% of the market, and is forecasted to grow at the fastest rate. Known for its precision, efficiency, and simplicity, CRISPR/Cas9 is widely used in gene therapy, research, and drug development.

- Mode: The contract-based segment accounted for the largest share of 65.5% in 2023 and is expected to grow at the highest CAGR. This is attributed to the benefits of outsourcing, including reduced operational costs and increased flexibility, especially as leading players expand their service capabilities.

- Application: Genetic engineering was the top application in 2023, with a 68.4% revenue share, and is projected to grow rapidly. The segment benefits from ongoing developments in gene and stem cell therapies, with CRISPR gene editing playing a pivotal role, particularly in human induced pluripotent stem cells (hiPSCs) research.

Market Size & Forecast

- 2023 Market Size: USD 3.49 Billion

- 2030 Projected Market Size: USD 10.69 Billion

- CAGR (2024-2030): 16.5%

Key Companies & Market Share Insights

U.S.-based genome editing companies are actively forming licensing agreements with technology providers to reinforce their market position. Many are pursuing acquisitions, partnerships, and strategic collaborations to expand their market share.

For instance, in April 2022, Thermo Fisher Scientific launched the Gibco CTS TrueCut Cas9 Protein, a high-performance tool designed to assist researchers transitioning from laboratory studies to therapeutic applications using genome editing. The product has shown strong performance in CRISPR-Cas9 research, particularly for CAR T-cell therapy, consistently achieving over 90% efficiency in human primary T-cells and high editing success across various cell types.

Key Players

- Merck KGaA

- Cibus

- Recombinetics, Inc.

- Sangamo

- Editas Medicine

- Precision Biosciences

- CRISPR Therapeutics

- Intellia Therapeutics, Inc.

- Caribou Biosciences, Inc.

- Cellectis S.A.

- GenScript

- AstraZeneca

- Integrated DNA Technologies, Inc.

- Egenesis Inc.

- New England Biolabs

- OriGene Technologies, Inc.

- Lonza

- Thermo Fisher Scientific, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. genome editing market is on a trajectory of rapid growth, fueled by innovation in CRISPR technologies, government funding, and increasing demand from biotech and pharmaceutical sectors. With a projected CAGR of 16.5%, the industry is expected to more than triple in size by 2030. CRISPR/Cas9 technology, in particular, continues to drive advancements in gene therapy and diagnostics. Additionally, contract-based services and genetic engineering applications are seeing strong uptake. As clinical research progresses and regulatory pathways become clearer, genome editing is poised to become a cornerstone of precision medicine and therapeutic innovation in the coming years.