U.S. External Analgesics Market 2030: Expanding Opportunities in Retail Channels

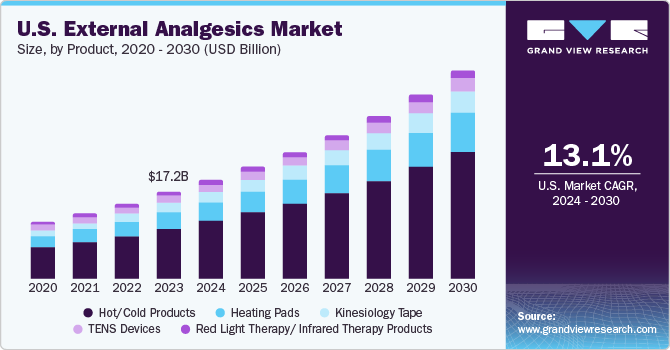

U.S. external analgesics market, a sphere valued at USD 2.78 billion in 2023 and now pulsing with a projected annual expansion of a significant 13.1% from 2024 to 2030 – a clear indicator of our shared pursuit of ease.

Picture a landscape where everyday discomfort finds its antidote not within a swallowed capsule, but through a direct, soothing touch. This is the narrative unfolding within the U.S. external analgesics market, a sphere valued at USD 2.78 billion in 2023 and now pulsing with a projected annual expansion of a significant 13.1% from 2024 to 2030 – a clear indicator of our shared pursuit of ease.

Several powerful currents are fueling this surge in demand. The rising tide of chronic and lifestyle diseases is creating a greater need for accessible pain relief. Simultaneously, our active lifestyles, filled with sports and recreational pursuits, often lead to muscle strains and aches, further driving the demand for these topical solutions. Adding to this momentum are the growing investments from both private and government sectors in pharmaceutical innovation, specifically targeting the development of effective analgesic products.

At the heart of this growth story lies the increasing prevalence of chronic disorders. The modern challenges of obesity and diabetes are, unfortunately, leading to a greater incidence of nerve and muscle issues. Consider this: a significant portion of the U.S. population, a staggering 37.3 million individuals (11.3%), lives with diabetes, according to the Diabetes Research Institute Foundation. A common companion to this condition is diabetic neuropathy, making electrical stimulation devices like TENS units a vital tool for pain management. Furthermore, our pursuit of fitness isn't without its risks. In 2022 alone, the National Safety Council (NSC) highlighted a staggering 445,642 injuries related to exercise equipment in the U.S., topping the charts for sports and recreation-related incidents.

Get a preview of the latest developments in the U.S. External Analgesics Market; Download your FREE sample PDF copy today and explore key data and trends

The demographic landscape is also shifting, with a growing geriatric population increasingly seeking solace from the persistent discomfort of joint pain, muscle aches, migraines, and strains. In 2022, migraine epidemiology revealed a significant gender disparity, with 17.0% of women experiencing a migraine attack annually compared to just 6.0% of men. This widespread need for pain relief therapies is naturally driving the utilization of various pain-relieving agents, consequently expanding the market across different regions.

Adding to this narrative is the significant rise in musculoskeletal disorders like arthritis, osteoarthritis, degenerative orthopedic conditions, and rheumatoid arthritis. In June 2023, CDC data revealed that approximately 1 in 5 U.S. adults, a substantial 53.2 million individuals, grapple with some form of arthritis. Osteoarthritis (OA) stands out as the most common culprit, affecting over 32.5 million people nationwide. Looking ahead, the Population Reference Bureau (PRB) projected in January 2024 that the U.S. population aged 65 and above is set to balloon to 82 million by 2050 (a 47% increase from 2022's nearly 58 million), representing almost 23% of the country's total population. This increasing susceptibility to arthritis is a major driver for the demand for external analgesics in managing the chronic pain it often brings. Experts anticipate that around 78 million adults in the U.S. will be diagnosed with arthritis by 2040, according to Arthritis & Rheumatology, further fueling the need for pain management solutions. This demand for effective pain management is also intertwined with a growing desire for shorter hospital stays, leading to a greater emphasis on shifting certain treatments from inpatient to outpatient settings.

Even the unprecedented events of the COVID-19 pandemic have left their mark on the landscape of chronic pain management and the U.S. market. The postponement of non-essential procedures and the temporary closure of specialized pain management centers disrupted traditional patient care pathways, leading to an increased reliance on home-based device usage, which had its own impact on market dynamics. The accelerated adoption of telehealth and a greater inclination towards self-medication have also influenced the preferred methods of pain management, with medications gaining prominence in some cases over devices. Furthermore, the ripples of supply chain disruptions, the surge in e-commerce, and evolving regulatory frameworks have all contributed to shaping the current market landscape.

Detailed Segmentation

Product Insights

The hot/cold products segment led the market with the largest revenue share of 58.3% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Growth of the segment can be attributed to its effectiveness in providing relief for a wide range of pain conditions. Adoption of hot and cold therapies has increased in the long-term treatment of chronic pain diseases, such as arthritis, lower back pain, and others. The hot/cold product segment also has the advantage of being non-invasive and easy to use, making hot/cold products a convenient pain management solution for individuals seeking non-pharmacological approaches. With the growing demand for natural and self-directed pain management solutions, hot/cold products are expected to continue to dominate the U.S. market.

Distribution Channel Insights

Based on distribution channel, the retail/ brick & mortar segment led the market with the largest revenue share of 71.0% in 2023. This dominance is attributable to the established presence of physical stores that sell over-the-counter pain relief products for external use. In 2022, according to a report by Forbes, for the first time, traditional brick and mortar stores demonstrated a faster growth rate compared to e-commerce, with a 18.5% increase in physical store sales, while e-commerce expanded by 14.2%. Although this 14.2% growth is slightly higher than the usual annual growth rate, it is lower than in comparison to the 31.8% surge experienced by online retail in the previous year. Brick-and-mortar stores can adapt to local market trends and customer preferences more quickly than online retailers, which is one of the key factor for segment large market share.

Key U.S. External Analgesics Company Insights

Key participants in the U.S. market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key U.S. External Analgesics Companies:

- Baxter

- Boston Scientific Corporation

- Enovis

- Medtronic

- ICU Medical Inc.

- Abbott

- Stryker

- Nevro Corp.

- OMRON Healthcare, Inc.

U.S. External Analgesics Market Segmentation

Grand View Research has segmented the U.S. external analgesics market report based on the product and distribution channel:

U.S. External Analgesics Product Outlook (Revenue, USD Million, 2018 - 2030)

- Hot/Cold Products

- Kinesiology Tape

- Heating Pads

- TENS Devices

- Red Light Therapy/ Infrared Therapy Products

U.S. External Analgesics Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Retail/Brick & Mortar

- E-Commerce

- Others

Curious about the U.S. External Analgesics Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In November 2023, Nutriband Inc. introduced a new addition of Kinesiology Tape (pre-cut strips) to their Active Intelligence (AI Tape) brand portfolio. This innovative product combines the stretch, support, and advantages of traditional kinesiology tape with pain-alleviating ingredients that offer both heating and cooling sensations. These unique features are designed to provide temporary relief for minor muscle and joint aches and pains

- In October, 2023, Kinesiology Tape Brand KT partnered with Boxout, a nationwide distributor in the sports medicine sector. Through this collaboration, they are introducing an exclusive KT Tape Pro for Sports Medicine Professionals. In addition, they aim to raise awareness about the KT Tape mobile application, which serves as a valuable tool for both sports medicine professionals and their users

- In September 2023, Boston Scientific announced the acquisition of Relievant Medsystem Inc., based in U.S. for expanding its neuromodulation portfolio of Intracept Intraosseous Nerve Ablation System for providing novel treatment to treat chronic lower back pain

- In July 2023, Motive Health, launched its Motive Knee, a muscle stimulation device approved by the US Food and Drug Administration (FDA) in U.S.This provides a non-invasive, non-opioid alternative for managing arthritis-induced knee discomfort. Its primary objective is to provide effective means of alleviating pain without requiring invasive procedures or relying on opioid-based treatments

- In March 2022, Omron Healthcare started conducting research studies to evaluate the positive effectiveness of its Focus TENS (Transcutaneous Electrical Nerve Stimulation) therapy device (PM-710), used in reducing pain for individuals experiencing mild to moderate knee "wear and tear." This innovative product from OMRON aims to provide relief for those affected by this common condition

- In February 2022, STRATA Skin Sciences unveiled its latest innovation, the XTRAC Momentum 1.0 excimer laser system and announced further first installation in the U.S. This advanced device is designed to provide targeted UVB light therapy for treating various inflammatory skin conditions, such as psoriasis, vitiligo, and atopic dermatitis, in both children and adults. By employing sophisticated excimer laser technology, the system delivers accurate and efficient treatment to specific skin areas, ultimately accelerating the healing process and enhancing overall effectiveness