U.S. Drone Battery Market 2033: A Deep Dive into Consumer Trends

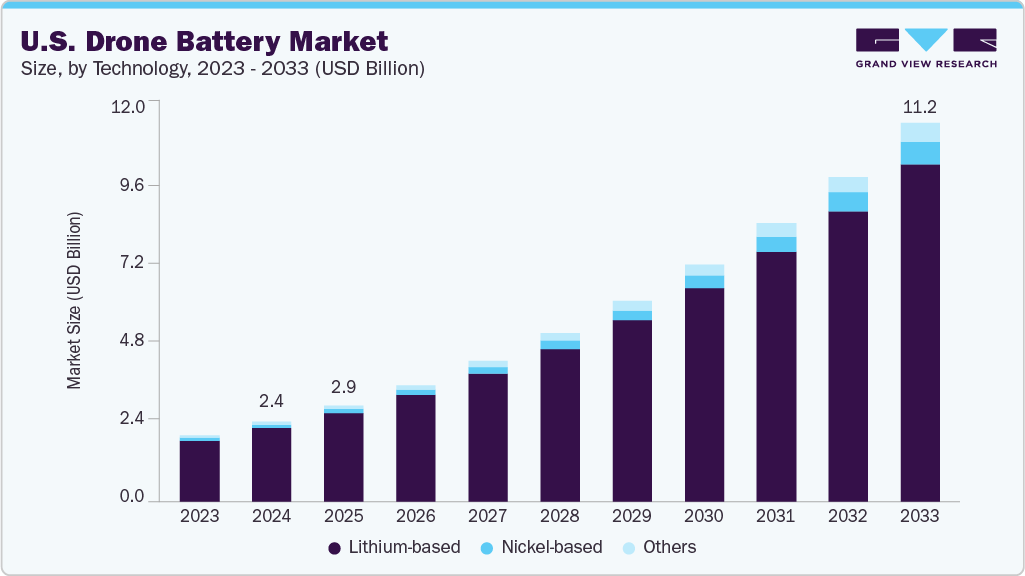

The U.S. drone battery market was valued at USD 2.36 billion in 2024 and is projected to reach USD 11.20 billion by 2033.

The U.S. drone battery market was valued at USD 2.36 billion in 2024 and is projected to reach USD 11.20 billion by 2033, growing at a CAGR of 18.7% from 2025 to 2033. This rapid market expansion is driven by the increasing integration of drones across both commercial and military sectors.

In the commercial domain, industries such as agriculture, construction, logistics, and media are widely adopting drones for a variety of applications—ranging from crop monitoring and site inspections to parcel delivery and aerial photography. These operations require longer flight durations, quicker recharging, and lightweight power solutions, fueling the demand for advanced lithium-based and hybrid battery technologies.

Simultaneously, the U.S. Department of Defense continues to scale up its drone capabilities for surveillance, reconnaissance, and tactical operations. This creates a need for rugged, high-performance battery systems capable of withstanding extended missions under demanding conditions.

Technology and Innovation Landscape

Technological innovation in battery design and performance is a major factor driving market growth. Leading companies are heavily investing in research and development to enhance energy density, charging speed, and battery lifespan. Emerging battery technologies—such as lithium-sulfur, solid-state batteries, and graphene-based cells—show great potential for enabling next-generation drone capabilities.

The growing adoption of smart battery management systems (BMS) also plays a vital role. These systems help monitor battery health, temperature, and charge cycles in real time, thereby enhancing flight safety and operational efficiency. Both OEMs and aftermarket providers are integrating such technologies into their offerings, contributing to the evolution of the U.S. drone battery ecosystem.

Order a free sample PDF of the U.S. Drone Battery Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Technology: Lithium-based batteries accounted for the largest market share of 92.12% in 2024. Variants such as lithium-ion and lithium-polymer dominate the U.S. drone landscape due to their high energy density, lightweight properties, and consistent power output. The demand for longer flight times and improved payload efficiency, especially in sectors like delivery, agriculture, mapping, and surveillance, continues to drive adoption.

- By Point of Sale: The OEM (Original Equipment Manufacturer) segment held the highest market share of 72.02% in 2024. OEMs shape battery demand by offering integrated, purpose-built battery solutions pre-installed in drones across diverse sectors. As enterprise and commercial drone applications grow, OEMs are prioritizing customized, high-performance batteries that meet the specific operational needs of end users. These factory-fitted battery systems offer enhanced safety, compatibility, and warranty assurance.

Market Size & Forecast

- 2024 Market Size: USD 2.36 Billion

- 2033 Projected Market Size: USD 11.20 Billion

- CAGR (2025-2033): 18.7%

Key Companies & Market Share Insights

Several key players are shaping the U.S. drone battery market through innovation, partnerships, and targeted offerings. Notable companies include: EaglePicher Technologies, Packet Digital LLC, AeroVironment, Inc., MaxAmps, Inc., Amprius Technologies and RRC Power Solutions.

These companies are actively developing high-capacity, rugged, and lightweight battery systems, aiming to meet both military-grade standards and commercial application requirements.

Key Players

- Eaglepicher Technologies

- Packet Digital

- AeroVironment

- MaxAmps

- Amprius

- RRC Power Solutions

- SolidEnergy Systems

- Oxis Energy

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. drone battery market is on a high-growth trajectory, with projections indicating a rise from USD 2.36 billion in 2024 to USD 11.20 billion by 2033, supported by a robust CAGR of 18.7%. This momentum is being fueled by increasing drone usage across commercial and defense sectors, alongside rapid technological innovation in battery materials and systems.

Government support through regulatory easing and domestic manufacturing incentives is further enhancing market potential. Developments such as smart battery management systems, fast-charging infrastructure, and next-gen battery chemistries are positioning the U.S. as a leader in advanced drone battery solutions.

As reliance on drones continues to grow, especially for critical applications like delivery, surveillance, and national defense, the demand for high-performance, reliable, and domestically produced battery systems is expected to remain strong, driving long-term growth and innovation in the industry.