U.S. Digital Health Market: The Shift Towards Patient-Centric Services

The U.S. digital health market was valued at USD 81.17 billion in 2023 and is projected to reach USD 276.62 billion by 2030.

The U.S. digital health market was valued at USD 81.17 billion in 2023 and is projected to reach USD 276.62 billion by 2030, growing at a CAGR of 19.5% between 2024 and 2030. Market expansion is driven by favorable conditions for digital healthcare services and improved internet connectivity, enabling remote healthcare delivery through digital channels. Additionally, the growing adoption of smartphones has motivated manufacturers to invest in and leverage opportunities within the U.S. digital health sector. For example, in May 2023, UC San Diego Health introduced a SMART health insurance card that displays real-time insurance information upon scanning.

The increasing number of mobile and smartphone subscriptions is anticipated to support market growth. According to Oberlo, smartphone penetration in the U.S. rose from 83% in 2018 to 91% in 2023. The Mobile Economy North America 2023 report notes that 53% of 5G internet usage in North America is dedicated to services such as healthcare. Several network providers are partnering with hospitals to enhance connectivity. For instance, in July 2023, Verizon deployed a private full-spectrum 5G network at the VA Palo Alto Health Care System, a veterans’ hospital in California.

In August 2023, the Advanced Research Projects Agency for Health (ARPA-H), part of the U.S. Department of Health and Human Services (HHS), launched the Digital Health Security (DIGIHEALS) initiative to protect the nation’s healthcare electronic infrastructure. The program seeks proposals for technologies initially developed for national security and plans to implement them in clinical care facilities, civilian health systems, and personal health devices. DIGIHEALS aims to ensure uninterrupted patient care even during large-scale cyberattacks, which have previously forced hospitals to close permanently.

The integration of artificial intelligence (AI) and machine learning (ML) in healthcare is also driving market growth. The U.S. government is promoting AI/ML applications in healthcare. For instance, in October 2023, the U.S. FDA established a Digital Health Advisory Committee to address issues related to digital health technologies (DHTs), including augmented reality (AR), virtual reality (VR), AI/ML, digital therapeutics, remote patient monitoring, wearables, and healthcare software.

Order a free sample PDF of the U.S. Digital Health Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By technology: The tele-healthcare segment accounted for the largest revenue share of 43.2% in 2023, driven by rising investments in tele-healthcare platforms post-COVID-19. Companies increasingly adopt digital healthcare solutions to provide remote care for patients, particularly those with chronic conditions such as diabetes.

- By component: The services segment led with a revenue share of more than 37.8% in 2023, supported by continuous software upgrades and advancements in hardware and software. The development of digital platforms for monitoring, diagnosis, prevention, and wellness is expected to further bolster this segment.

- By application: The diabetes segment recorded the largest revenue share of over 24.3% in 2023 and is projected to register the highest CAGR from 2024 to 2030. Rising diabetes prevalence is a key growth factor; according to the CDC, 38.4 million people in the U.S. had diabetes in 2021, with 38.1 million aged 18 and above.

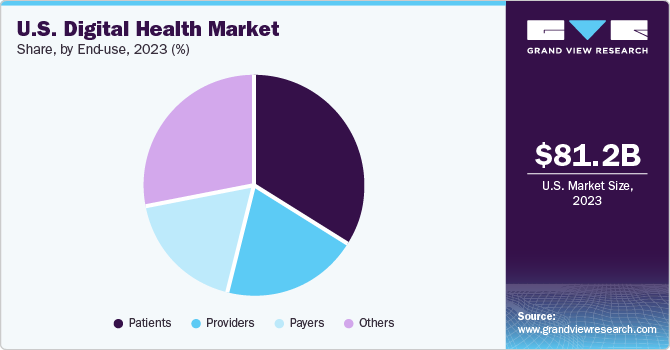

- By end-use: The patient segment accounted for the largest share of 34.1% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030. This growth is driven by increasing awareness of health management and patient-centered care, as digital health technologies empower patients with remote monitoring tools, self-management options, and easy access to health information.

Market Size & Forecast

- 2023 Market Size: USD 81.17 Billion

- 2030 Projected Market Size: USD 276.62 Billion

- CAGR (2024-2030): 19.5%

Key Companies & Market Share Insights

Major players such as Apple, Inc., Google, Inc., and Qualcomm Technologies, Inc. focus on mergers, acquisitions, technological partnerships, and product innovations to meet the growing demand for digital healthcare solutions. Intense competition drives these companies to expand their product portfolios through strategic collaborations, partnerships, and new product launches.

Key Players

- Apple, Inc.

- AT&T

- Airstrip Technologies

- Allscripts

- Google, Inc.

- Orange

- Qualcomm Technologies, Inc.

- Softserve

- Samsung Electronics Co. Ltd.

- Telefonica S.A.

- Vodafone Group

- Cerner Corp.

- McKesson Corp.

- Epic Systems Corp.

- NextGen Healthcare, Inc

- Greenway Health LLC

- CureMD Healthcare

- HIMS

- Computer Programs and Systems, Inc.

- Vocera Communications

- IBM Corp.

- Siemens Healthcare GmbH

- Cisco Systems, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. digital health market is poised for robust growth, fueled by expanding smartphone and internet penetration, technological advancements in AI and tele-healthcare, and increasing patient demand for remote and personalized care. With continued government initiatives and active participation from major industry players, the market is expected to reach USD 276.62 billion by 2030, reflecting significant opportunities for innovation and investment.