U.S. Dental Services Market: Growth in Dental Clinics vs. Hospitals

The U.S. dental services market was valued at USD 192.22 billion in 2023 and is projected to reach USD 242.88 billion by 2030.

The U.S. dental services market was valued at USD 192.22 billion in 2023 and is projected to reach USD 242.88 billion by 2030, growing at a CAGR of 3.3% from 2024 to 2030. Dental services include the diagnosis, prevention, and treatment of oral health conditions, provided by qualified dentists and other dental professionals.

Market growth is being driven by a combination of factors, including rising awareness of dental hygiene, an increasing prevalence of dental caries and gum diseases, technological advancements in dental procedures, and growing demand for cosmetic and laser dentistry. These trends reflect a growing emphasis on both functional and aesthetic aspects of oral care.

Impact of COVID-19

The COVID-19 pandemic significantly disrupted the dental services industry. Strict social distancing regulations led to the temporary closure of dental practices, limiting operations to emergency procedures only. According to data from the American Dental Association’s Health Policy Institute (HPI), the industry experienced a substantial slowdown in early 2020.

In March 2020, the American Dental Association (ADA) issued public guidelines advising the postponement of non-urgent procedures, including routine check-ups, X-rays, cleanings, and cosmetic treatments. However, critical services such as treatment for oral bleeding, dental trauma, severe decay, tooth fractures, and urgent biopsies continued.

Order a free sample PDF of the U.S. Dental Services Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By End-Use: The dental clinics segment held the largest revenue share of over 68.1% in 2023 and is also projected to grow at the fastest rate during the forecast period. Patients often prefer private dental clinics due to the presence of specialists and the use of advanced equipment. Notably, over 80% of dental clinics are owner-operated, and this independent practice model is likely to remain dominant due to cost-efficiency, accessibility, and high-quality care.

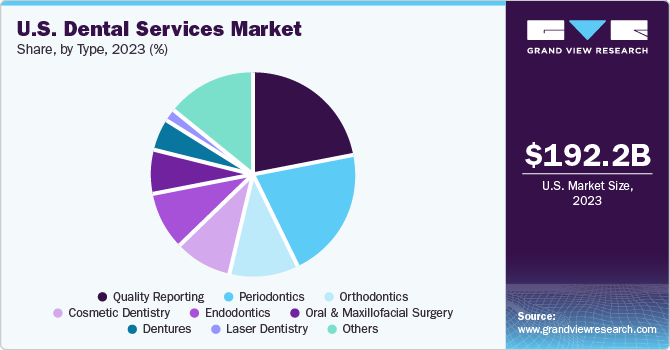

- By Type: Dental implants led the market with a revenue share of over 21.2% in 2023. These implants offer long-lasting and visually appealing solutions for tooth replacement. According to the American Association of Oral and Maxillofacial Surgeons (AAOMS), around 70% of adults aged 35–44 have lost at least one permanent tooth due to decay, gum disease, or trauma. This high incidence has significantly increased the demand for implant-based treatments.

Market Size & Forecast

- 2023 Market Size: USD 192.22 Billion

- 2030 Projected Market Size: USD 242.88 Billion

- CAGR (2024-2030): 3.3%

Key Companies & Market Share Insights

Key players in the U.S. dental services market are adopting a variety of strategies—including mergers, partnerships, service innovation, and geographic expansion—to maintain competitive advantage and improve service delivery.

The early pandemic-induced closures had a widespread impact on dental practices, but providers have since pivoted toward patient-centric innovations aimed at enhancing safety, convenience, and overall experience. These changes are shaping the competitive dynamics of the market and driving long-term improvements in dental care delivery.

Key Players

- Aspen Dental Management Inc.

- Heartland Dental

- Pacific Dental Services

- Align Technology

- DentaQuest

- InterDent, Inc.

- National Health Service England

- The British United Provident Association Limited

- Coast Dental

- Dental Service Group

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. dental services market is on a steady growth trajectory, with projections reaching USD 242.88 billion by 2030. Rising awareness of oral health, advances in dental technologies, and growing demand for aesthetic procedures are key contributors to this expansion.

Despite temporary setbacks due to the COVID-19 pandemic, the industry has demonstrated strong recovery and adaptability. The shift toward private dental clinics, increasing adoption of dental implants, and ongoing innovations in care delivery are likely to sustain growth in the years ahead. With an emphasis on both function and aesthetics, the dental services sector will continue playing a vital role in promoting public health and well-being across the U.S.