U.S. Confectionery Market 2030: Innovations in Sugar Confectionery

The U.S. confectionery market was valued at USD 38.17 billion in 2022 and is expected to grow to USD 55.35 billion by 2030.

The U.S. confectionery market was valued at USD 38.17 billion in 2022 and is expected to grow to USD 55.35 billion by 2030, registering a CAGR of 4.8% from 2023 to 2030. In recent years, confectioneries—particularly chocolates, candies, gummies, and jellies—have gained significant popularity among U.S. consumers. The increasing demand for high-quality and flavorful confectionery varieties is anticipated to be a key growth driver for the industry throughout the forecast period.

Despite challenges posed by the COVID-19 pandemic and the subsequent global economic downturn, the U.S. confectionery market showed resilience. In 2020, sales exceeded USD 36.70 billion, largely fueled by consumers reengaging with seasonal confectionery occasions after pandemic-related lockdowns. According to the National Confectioners Association’s (NCA) third annual State of Treating report (2022), chocolate and candy sales increased by 11% in 2021 compared to 2020, supported by consumers’ focus on celebrations, sharing, gifting, and emotional well-being.

Sugar-based confectioneries like candies are becoming increasingly popular as affordable, mood-enhancing treats. The NCA notes that 40% of consumers engage with confectionery brands or stores on social media, while nearly 90% seek information about brands’ environmental and social responsibility efforts via packaging or digital platforms. Additionally, 91% of consumers report taking road trips, with 83% carrying chocolates and candies during their travels.

Social media also plays a role in inspiring confectionery usage, with 66% of Americans researching candy gifting, baking, or creative uses of candy online. About 47% of consumers occasionally purchase confectionery products they perceive as “better-for-you,” though interpretations vary across demographics. Nearly 75% of consumers agree on the importance of chocolate and candy brands offering multiple portion sizes, fueling market growth.

Order a free sample PDF of the U.S. Confectionery Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Contribution: The Northeast U.S. was the largest contributor to the market in 2022. The region, including states like Massachusetts, New Jersey, New York, and Pennsylvania, has seen rapid industrial development, structural shifts, and upgrading within the confectionery sector. Rising consumer interest in sweet treats and gourmet confectioneries has boosted demand.

- By Product: Chocolate confectioneries accounted for 56.7% of the global revenue share in 2022. This segment’s growth is driven largely by millennials and younger consumers who show strong interest in premium flavors and gourmet chocolate products.

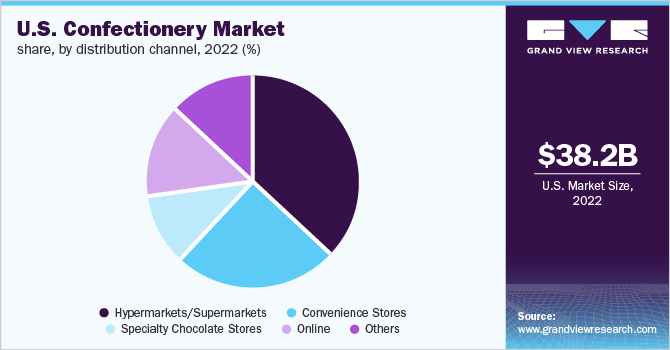

- By Distribution Channel: Hypermarkets and supermarkets represented a significant 36.5% share in 2022. Major offline retailers such as Walmart, Kroger, Target, Tesco, and Walgreens have expanded their confectionery offerings to include various flavors and product formats like dark chocolate and hazelnut, contributing to segment growth.

Market Size & Forecast

- 2022 Market Size: USD 38.17 Billion

- 2030 Projected Market Size: USD 55.35 Billion

- CAGR (2023-2030): 4.8%

Key Companies & Market Share Insights

The U.S. confectionery market is dominated by several multinational companies with a strong domestic presence, including Mars, Incorporated, Mondelez International, The Hershey Company, Ferrero, General Mills Inc., Lindt & Sprungli, Kellogg Co., Clif Bar & Co., Simply Good Foods Co., and Nestlé. These players pursue competitive advantages through mergers and acquisitions, capacity expansions, enhancing online presence, and launching new products.

Notable industry moves include:

- In June 2022, Mars, Incorporated partnered with Perfect Day, Inc. to launch its first line of animal-free, eco-friendly chocolate under the brand CO2COA. Perfect Day specializes in producing animal-free milk proteins.

- In November 2022, Ferrero unveiled its holiday lineup, adding seasonal confectionery products ranging from cookies to mints, expanding its portfolio with offerings from brands like Keebler and Royal Dansk.

- In November 2021, Nestlé launched its Christmas range featuring festive favorites and new additions from iconic brands like KitKat, Aero, and Milkybar. Notably, Aero introduced ‘Dreamy White Snowbubbles’, maintaining its signature bubbly texture with a white chocolate center.

Key Players

- Mars, Incorporated and its Affiliates

- Mondelēz International, Inc.

- The Hershey Company

- Ferrero

- General Mills Inc.

- Lindt & Sprungli

- Kellogg Co.

- Clif Bar & Co.

- Simply Good Foods Co.

- Nestlé

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. confectionery market demonstrates strong resilience and steady growth, driven by evolving consumer preferences for premium, flavorful, and socially responsible products. Increased consumer engagement through social media, the rising popularity of confectionery gifting, and demand for variety in portion sizes all contribute to sustained market expansion. With a projected CAGR of 4.8% and an expected market size of USD 55.35 billion by 2030, the industry is well positioned for continued growth. Key players are actively investing in innovation, sustainability, and strategic partnerships to capture evolving consumer demands, ensuring a competitive and dynamic market landscape ahead.