U.S. Car Rental Market 2030: Airport Transfers Reimagined

The U.S. car rental market size is anticipated to reach USD 56.27 billion by 2030 and is expected to expand at a CAGR of 7.5% during the forecast period.

The U.S. car rental market size is anticipated to reach USD 56.27 billion by 2030 and is expected to expand at a CAGR of 7.5% during the forecast period, according to a new report by Grand View Research, Inc. Evolving consumer preferences, technological advancements, and a resurgence in travel activity are expected to drive market growth.

The increasing demand for flexible transportation solutions is particularly pronounced in urban centers, where the cost and inconvenience of vehicle ownership have become more pronounced. Consumers, especially younger demographics and business travelers, gravitate toward rental services that offer convenience without long-term commitment. This shift is further reinforced by the popularity of subscription-based models and short-duration rentals, which cater to changing mobility needs and hybrid work arrangements.

The rebound in domestic and international tourism has also played a pivotal role in revitalizing the car rental industry. As travel restrictions ease and leisure travel resumes, rental companies are experiencing heightened demand in key destinations such as Orlando, Las Vegas, and Los Angeles. Airport-based rentals and regional travel have seen notable upticks, driven by travelers seeking private, safe, customizable transport options. Additionally, business travel—though selectively returning—continues to support market growth, with corporate clients utilizing rental fleets for inter-city movement and employee mobility.

Technological innovation has transformed the car rental experience, making it more accessible and efficient. Integrating mobile applications and online booking platforms has streamlined the reservation process, while contactless services and predictive analytics have enhanced customer satisfaction. Rental companies also invest in fleet electrification and data-driven pricing strategies to meet sustainability goals and optimize operations.

Order a free sample PDF of the U.S. Car Rental Market Intelligence Study, published by Grand View Research.

Further key findings from the report suggest:- By vehicle type, the economy cars segment accounted for a revenue of 29.6% in 2024.

- By application, the local usage segment accounted for a revenue share of 46.7% in 2024, driven by the rise in urban populations and the growing need for convenient, short-term mobility solutions.

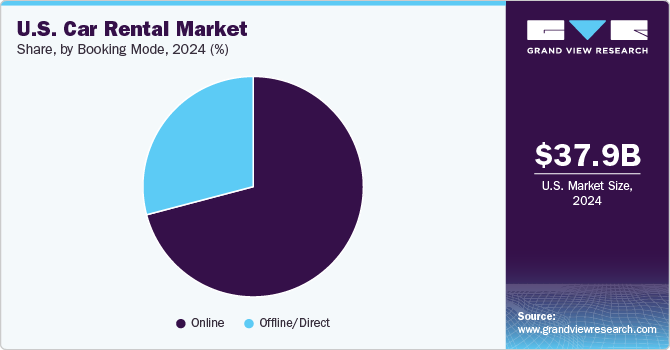

- Booking through online channels accounted for a revenue share of 70.1% in the overall U.S. car rental industry in 2024.

- In March 2025, SIXT inaugurated its newest U.S. branch at the Seminole Hard Rock Hotel & Casino in Hollywood, Florida, marking its 24th Florida location. This launch began with a partnership with Hard Rock International and Seminole Gaming, offering exclusive discounts for Unity by Hard Rock members at SIXT branches nationwide. The Unity loyalty program provides redeemable points for perks across Hard Rock venues and reciprocal benefits from Royal Caribbean and Celebrity Cruises. Leaders from SIXT and Hard Rock have expressed enthusiasm for this collaboration.

List of Key Players in the U.S. Car Rental Market

- Enterprise Holdings, Inc.

- The Hertz Corporation

- Avis Budget Group

- Sixt

- Fox Rent A Car

- Turo

- Getaround

- Midway Car Rental

- Dollar

- Europcar

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.