U.S. Biodefense Market Trends: Investing in a Safer Future

The U.S. biodefense market was valued at USD 13.4 billion in 2023 and is projected to grow at a CAGR of 4.1% from 2024 to 2030.

U.S. Biodefense Market Overview

The U.S. biodefense market was valued at USD 13.4 billion in 2023 and is projected to grow at a CAGR of 4.1% from 2024 to 2030. This growth is largely driven by rising concerns over bioterrorism, the emergence of new infectious diseases, and the increasing need for robust public health protection systems.

In response to these threats, governments and organizations have ramped up investments in biodefense initiatives. Significant funding is being directed toward the research, development, and production of countermeasures to address both intentional biological attacks and naturally occurring outbreaks. For example, in October 2022, the U.S. Department of State released the National Biodefense Strategy, laying out a comprehensive roadmap for addressing biological threats. This strategy aims to transform national capabilities in prevention, detection, and outbreak preparedness.

The public-private collaboration model has also been instrumental in advancing biodefense. Strategic partnerships are fueling the development and deployment of cutting-edge biodefense solutions, bolstered by regulatory policies that support innovation and investment. Agencies such as the Department of Health and Human Services provide essential guidance and support to unify biodefense strategies across sectors.

Looking ahead, further initiatives are being launched to optimize preparedness. In April 2024, the Bipartisan Commission on Biodefense is expected to introduce the ‘2024 National Blueprint on Biodefense’, a national-level initiative to enhance response efforts to biological threats—both natural and deliberate.

A pivotal goal of the new 2022 biodefense strategy is to enable the development of vaccines within 100 days of a potential outbreak. The strategy also prioritizes strengthening the healthcare workforce, global vaccine partnerships, and biosafety in laboratories.

Order a free sample PDF of the U.S. Biodefense Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

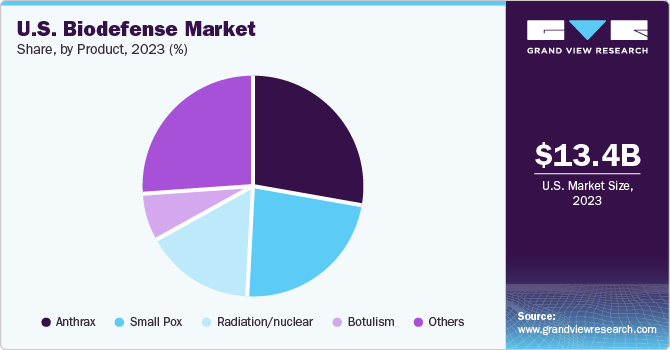

- By Product – Anthrax: The anthrax segment led the market with a 28.1% share in 2023. Caused by the bacterium Bacillus anthracis, anthrax is recognized as one of the most dangerous bioterrorism agents due to its high lethality rate (80–90%) if untreated. Its potential for widespread harm has made it a central focus of biodefense programs.

- By Product – Radiation/Nuclear: The radiation/nuclear segment is expected to witness the highest CAGR of 4.7% during the forecast period. Concerns around nuclear terrorism and radiological hazards have become increasingly pressing. Biodefense efforts in this area include the development of early detection systems, response protocols, and long-term health risk mitigation measures related to radiological contamination.

Market Size & Forecast

- 2023 Market Size: USD 13.4 Billion

- 2030 Projected Market Size: USD 17.90 Billion

- CAGR (2024-2030): 4.1%

Key Companies & Market Share Insights

Several major players are active in the U.S. biodefense market, focusing on biological countermeasures, vaccine development, and biothreat detection technologies. These include:

- XOMA Corporation: Specializes in the discovery and development of antibody therapeutics for a range of diseases, including infectious threats. Its portfolio includes XOMA 052, targeting IL-1 beta, and XOMA 3AB, an anti-botulism antibody developed specifically for biodefense applications.

- Altimmune Inc., Emergent BioSolutions, Inc., and Dynavax Technologies Corporation are also key players contributing to the biodefense ecosystem through vaccine technologies, immune system modulators, and biologic countermeasures.

Key Players

- XOMA Corporation

- Altimmune, Inc.

- EMERGENT

- Dynavax Technologies

- SIGA Technologies.

- Elusys Therapeutics Inc.

- Ichor Medical Systems

- Dynport Vaccine Company (General Dynamics Information Technology, Inc.)

- Cleveland Biolabs

- Bavarian Nordic

- Ology Bioservices, Inc.

- Alnylam Pharmaceuticals, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. biodefense market is poised for steady growth, expected to reach USD 17.90 billion by 2030 with a CAGR of 4.1%. The increasing threats from bioterrorism and emerging infectious diseases continue to push the need for proactive biodefense strategies. Government-backed initiatives, such as the National Biodefense Strategy and the 2024 National Blueprint, reflect a strong policy focus on improving preparedness, response time, and coordination across sectors.

With continued public-private collaboration, regulatory support, and technological innovation, the U.S. biodefense sector is well-positioned to respond rapidly to future biological threats—ensuring public health resilience and national security.