U.S. Alternative Legal Service Providers Market 2033: Labor and Employment Legal Solutions

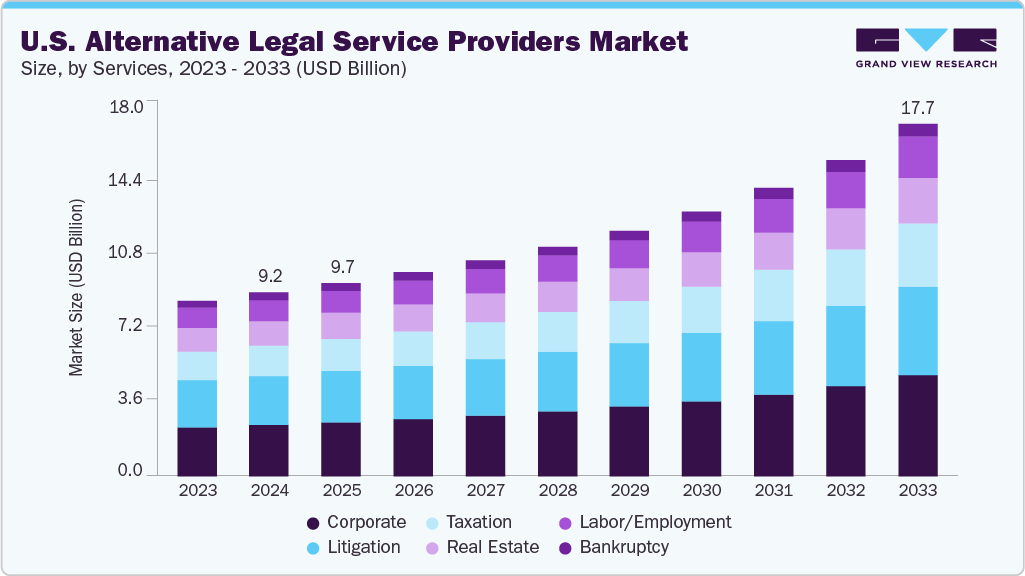

The U.S. alternative legal service providers (ALSPs) market was valued at USD 9.23 billion in 2024 and is projected to reach USD 17.68 billion by 2033.

U.S. Alternative Legal Service Providers (ALSPs) Market Overview

The U.S. alternative legal service providers (ALSPs) market was valued at USD 9.23 billion in 2024 and is projected to reach USD 17.68 billion by 2033, growing at a compound annual growth rate (CAGR) of 7.8% from 2025 to 2033. The market is witnessing robust growth due to a shift by corporate legal departments away from traditional hourly billing models toward more cost-effective, transparent pricing structures. ALSPs are addressing this need by offering fixed fees, subscription-based models, and volume discounts, enabling clients to manage legal expenses more predictably and efficiently.

ALSPs are also optimizing legal processes through operational efficiency and economies of scale, allowing them to pass cost savings on to clients without compromising service quality. This evolving demand for value-driven legal solutions is expected to be a major factor contributing to market expansion over the forecast period.

The industry is also rapidly embracing generative AI (GenAI), automation, and advanced analytics to streamline services such as contract analysis, compliance monitoring, document review, and legal research. As early adopters of these technologies, ALSPs are integrating AI tools into workflows to increase productivity and reduce turnaround time. The adoption of AI-driven solutions is reshaping the U.S. ALSP landscape, fueling smarter and more scalable service delivery across legal functions.

Additionally, U.S. corporate legal departments are increasingly outsourcing functions like contract lifecycle management, compliance, and eDiscovery to ALSPs. This trend enables in-house teams to focus on strategic legal matters while relying on ALSPs for specialized, high-volume tasks—ultimately reducing operational costs and enhancing legal performance.

Order a free sample PDF of the U.S. Alternative Legal Service Providers Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Services: The litigation segment led the market in 2024, accounting for over 26% of the total revenue share. The rise in complex and high-stakes lawsuits, including intellectual property disputes, class action suits, and product liability cases, has driven organizations to outsource tasks like document review and eDiscovery to ALSPs to better manage litigation costs and increase efficiency.

- By Billing Type: The hourly billing model remained dominant in 2024, especially in areas like litigation and intellectual property law, where case scope and timelines are often uncertain. Despite the shift toward alternative pricing models, clients and law firms continue to rely on hourly billing for its familiarity and alignment with traditional legal practices in complex matters.

Market Size & Forecast

- 2024 Market Size: USD 9.23 Billion

- 2033 Projected Market Size: USD 17.68 Billion

- CAGR (2025-2033): 7.8%

Key Companies & Market Share Insights

The U.S. ALSP market is shaped by both established players and emerging firms, offering a mix of technology-driven and customized legal solutions.

- Elevate Services, Inc.: Delivers a wide range of managed legal services, consulting, and technology-enabled solutions for legal departments and law firms. With offerings including eDiscovery, contract management, and legal operations consulting, Elevate has built a strong reputation for combining legal expertise with innovation, making it a key partner for many Fortune 500 companies.

- Epiq Systems, Inc.: Specializes in technology-enabled legal services, including managed document review, litigation support, and corporate restructuring. Its services are backed by advanced analytics, cloud-based platforms, and automation tools, positioning it as a market leader with a strong global presence and a comprehensive service portfolio.

Emerging players include:

- Morae Global Corporation: Focuses on transforming legal service delivery through expertise from former general counsels, legal operations leaders, and technology professionals. Morae offers tailored legal solutions that enhance efficiency and align legal strategies with business goals.

- Montage Legal Group: Operates a freelance legal platform connecting attorneys with law firms and corporations for contract-based work. Positioned within the growing legal gig economy, Montage enables clients to scale legal talent on demand while addressing shifting workload needs through a tech-driven staffing model.

Key Players

- DWF Group Limited

- Elevate Services, Inc.

- Epiq Systems, Inc.

- Ernst & Young Global Limited

- Integreon Managed Solutions Limited

- KPMG

- LegalEase Solutions, LLC

- Montage Legal Group

- Morae Global Corporation

- QuisLex

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. alternative legal service providers market is undergoing a rapid transformation, fueled by the demand for cost-effective, technology-enabled, and flexible legal solutions. As corporate legal departments strive to manage costs, improve efficiency, and adopt advanced technologies like AI and automation, ALSPs are uniquely positioned to meet these evolving needs.

With a strong outlook through 2033, the market is expected to continue expanding—driven by outsourcing trends, pricing innovation, and the growing role of digital tools in legal operations. Both established leaders and agile newcomers are contributing to a competitive, innovative landscape that is redefining how legal services are delivered in the U.S.