U.S. Agricultural Tractor Market: The 2WD vs. 4WD Debate

The U.S. agricultural tractor market reached 367.04 thousand units in 2023 and is expected to grow at a CAGR of 7.4% from 2024 to 2030.

The U.S. agricultural tractor market reached 367.04 thousand units in 2023 and is expected to grow at a CAGR of 7.4% from 2024 to 2030, with the market projected to reach 591.62 thousand units by 2030. In 2023, the U.S. accounted for 11.8% of the global agricultural tractor market, highlighting its significant role in the global agricultural machinery landscape.

The continued mechanization of agriculture is a major driver of market growth, especially in the compact tractor segment, which offers flexibility and customization for diverse farming applications. In addition, technological advancements such as telematics, automation, and the integration of AI, big data, and machine learning (ML) are transforming the operational capabilities of modern tractors, contributing significantly to increased farm productivity.

The market is also influenced by the shortage of skilled agricultural labor, leading farmers to increasingly adopt mechanized solutions to maintain efficiency and output. As a result, tractors have become vital to modern farming practices, playing a central role in improving productivity and minimizing labor dependency.

While the high cost of advanced machinery—including tractors, harvesters, and combiners—can be a financial burden for many farmers, government support programs are helping to mitigate these challenges. Initiatives from agencies such as the U.S. Farm Service Agency (FSA) offer both direct and guaranteed loans to family-size farmers who are unable to secure commercial credit. These funds can be used to purchase land, equipment, livestock, feed, and supplies, thus enabling broader access to mechanization.

However, the increasing cost of farm machinery, driven by rising prices for components, energy, and maintenance, presents a potential restraint to market expansion. Tractors require regular maintenance and repairs due to routine wear and tear, and accidents can add to ownership costs. Despite this, the long-term productivity gains and technological benefits continue to encourage adoption.

Order a free sample PDF of the U.S. Agricultural Tractor Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Engine Power: The less than 40 HP segment held the largest market share in terms of volume in 2023, accounting for over 64%. These compact tractors are popular due to their low cost, smaller size, and suitability for basic farming tasks. The trend toward electrification is gaining momentum in this segment, which is also projected to grow at the fastest CAGR of 7.5% through 2030.

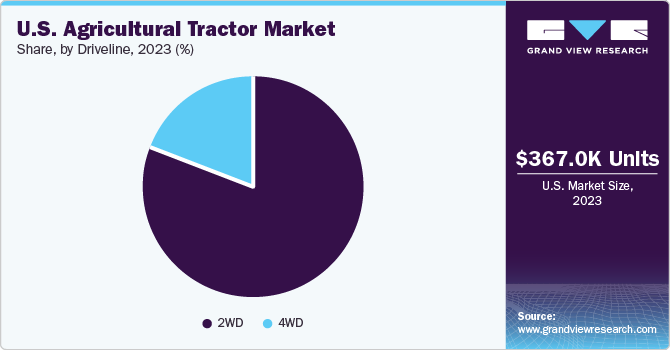

- Driveline: The 2WD (two-wheel drive) segment dominated the market in 2023 with over 80% share by volume and is expected to grow at the fastest rate during the forecast period. These tractors are favored for their lower upfront costs, ease of maneuverability, and effectiveness in light-duty operations such as sowing and planting. They are widely used in orchards, livestock farms, and crop fields where agility and turning capability are prioritized over traction.

- Propulsion: Traditional tractors rely on engines to power various auxiliaries such as hydraulic pumps, coolant pumps, air compressors, and radiator fans. In contrast, fully electric tractors eliminate the need for a constantly running engine, allowing auxiliary functions to be operated more efficiently and independently. This shift is expected to play a growing role in the modernization of the tractor market.

Market Size & Forecast

- 2023 Market Size: 367.04 Thousand Units

- 2030 Projected Market Size: 591.62 Thousand Units

- CAGR (2024-2030): 7.4%

Key Companies & Market Share Insights

The U.S. agricultural tractor market features strong competition among established and emerging players, with significant investments in electric, autonomous, and smart tractor technologies.

- Deere & Company continues to lead innovation with strategic acquisitions. For example, in July 2023, the company acquired Smart Apply, Inc., which offers the Intelligent Spray Control System, enhancing precision in orchard and vineyard spraying by reducing chemical use and drift, and increasing yield optimization.

- AGCO Corporation, a major global player, launched the Massey Ferguson 3 Series Specialty tractor in February 2024. This lineup addresses the specific needs of vineyard and orchard farming, offering a range of seven models (75–115 HP) with a focus on reliability and simplicity.

Emerging market participants include:

- Iron Ox is advancing automated robotics for farming, offering solutions like robotic arms for planting, harvesting, and packaging, contributing to precision agriculture practices.

- Monarch Tractor is disrupting the market with its MK-V model, a fully electric, driver-optional smart tractor. In May 2023, the company entered into a financial services agreement with CNH Industrial Capital America, aiming to expand access to its technology across wider U.S. markets through improved equipment financing options.

Key Players

- AGCO Corp.

- CNH Industrial N.V.

- Deere & Company

- International Tractors Ltd.

- YanmarCo., Ltd.

- KubotaCorp.

- Mahindra & Mahindra Ltd.

- Tractors and Farm Equipment Ltd.

- CLAAS KGaA mbH

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. agricultural tractor market is on a steady growth trajectory, projected to increase from 367.04 thousand units in 2023 to 591.62 thousand units by 2030, at a CAGR of 7.4%. This growth is primarily driven by the rapid mechanization of agriculture, the integration of advanced technologies, and government support programs that make farm machinery more accessible.

The less than 40 HP and 2WD segments continue to dominate the market due to their affordability and versatility. Meanwhile, the transition toward electrification, autonomy, and smart farming solutions is reshaping the competitive landscape.

Although high equipment costs and maintenance expenses remain challenges, they are being offset by the long-term benefits of increased productivity, precision, and operational efficiency. With continued investments from key players and support from government initiatives, the U.S. agricultural tractor market is set to play a pivotal role in the future of sustainable and efficient farming.