U.S. Aerospace Fasteners Market: Navigating Growth by Aircraft Type

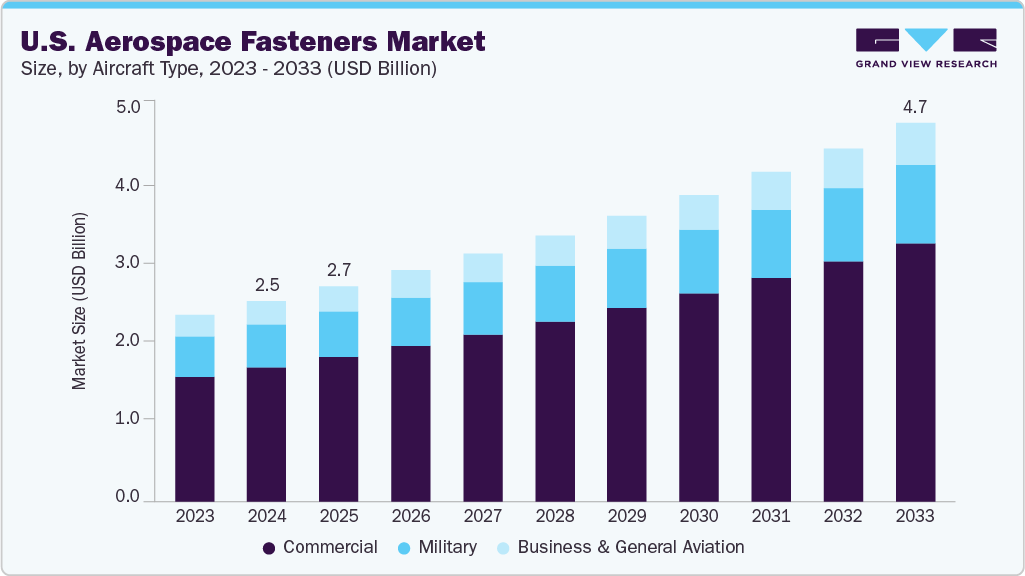

The U.S. aerospace fasteners market was valued at USD 2.49 billion in 2024 and is projected to reach USD 4.70 billion by 2033.

The U.S. aerospace fasteners market was valued at USD 2.49 billion in 2024 and is projected to reach USD 4.70 billion by 2033, growing at a CAGR of 7.3% from 2025 to 2033. The market's growth is driven by the resurgence of the aviation industry and an increase in aircraft production. As commercial airlines modernize and expand their fleets, there is a growing demand for high-performance, lightweight, and durable fastening components. The defense sector continues to play a major role, with ongoing procurement and maintenance of military aircraft ensuring a steady demand for aerospace-grade fasteners. Additionally, the expanding space industry and the emergence of new aerial platforms, including unmanned aerial vehicles (UAVs) and electric vertical takeoff and landing (eVTOL) aircraft, are further increasing the need for specialized fastener solutions.

Several factors contribute to this surge in demand. A primary driver is the aviation industry’s focus on fuel efficiency and weight reduction, which has led to a shift towards advanced materials like titanium and high-strength aluminum alloys. Moreover, the need for precision-engineered fastening systems is heightened by the emphasis on safety, performance, and regulatory compliance. The integration of advanced electronics and sensors into aircraft also requires miniaturized and custom fasteners that can endure extreme operating conditions. Furthermore, increased government investment in defense and aerospace programs is sustaining the demand for new aircraft, which benefits both original equipment manufacturers (OEMs) and the maintenance, repair, and overhaul (MRO) segment.

Order a free sample PDF of the U.S. Aerospace Fasteners Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Commercial Aircraft Segment: In 2024, the commercial aircraft segment accounted for the largest market share, holding 67.0% of the total revenue. This growth is driven by the surge in aircraft production and fleet modernization efforts as airlines ramp up orders to meet the growing travel demand. Commercial OEMs heavily rely on high-quality aluminum and titanium fasteners to ensure the structural integrity and fuel efficiency of the aircraft. Aluminum fasteners, in particular, are favored for their lightweight and corrosion-resistant properties, making them a popular choice for commercial airframes.

- Bolts Segment: The bolts segment dominated the U.S. aerospace fasteners market in 2024, accounting for 29.9% of the market share. Bolts are crucial for securing strong, reliable, and removable joints in aircraft assemblies. These fasteners are particularly important in areas requiring regular inspection, maintenance, or part replacement, such as engines, landing gear, and structural components. Their superior tensile strength and reliability make them ideal for high-stress and load-bearing applications.

Market Size & Forecast

- 2024 Market Size: USD 2.49 Billion

- 2033 Projected Market Size: USD 4.70 Billion

- CAGR (2025-2033): 7.3%

Key Companies & Market Share Insights

Prominent players in the U.S. aerospace fasteners market include Howmet Aerospace and Precision Castparts Corp. (PCC):

- Howmet Aerospace is a leading manufacturer of high-performance aerospace fasteners and engineered metal products. Specializing in titanium, aluminum, and superalloy components, Howmet produces a wide range of aerospace fasteners, including bolts, screws, and specialty components used in critical structural and engine applications for both commercial and military aircraft.

- Precision Castparts Corp. (PCC) is a major supplier of complex metal components and fasteners for the aerospace industry. Known for its expertise in forging, casting, and machining high-strength materials, PCC manufactures aerospace-grade fasteners through its SPS Technologies division. The company produces high-strength bolts, nuts, and rivets for airframe and engine assemblies.

Additionally, Boeing Distribution Services and M.S. Aerospace are emerging participants in the market:

- Boeing Distribution Services, previously known as Aviall, supplies a broad range of aerospace parts and fasteners. As a key logistics and supply chain partner for OEMs and MRO operations, it distributes thousands of fastener types, including threaded, non-threaded, and specialty fasteners, supporting Boeing's internal needs and those of third-party clients.

- M.S. Aerospace specializes in manufacturing high-strength, close-tolerance aerospace fasteners. The company focuses on critical applications in jet engines, airframes, and defense systems. Fully certified under AS9100, M.S. Aerospace produces bolts and screws engineered for extreme environments and demanding performance standards.

Key Players

- Howmet Aerospace

- Precision Castparts Corp.

- 3V Fasteners

- LISI Aerospace

- Boeing Distribution Services

- TriMas Aerospace

- M.S. Aerospace

- Fastenal Aerospace

- National Aerospace Fasteners Corp.

- B&B Specialties

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. aerospace fasteners market is poised for significant growth, driven by the revitalization of the aviation industry, ongoing military aircraft procurement, and the emergence of new aerospace technologies. As the demand for fuel-efficient, lightweight, and durable materials rises, so does the need for specialized fasteners that meet the rigorous demands of both commercial and military applications. With a strong focus on advanced materials like titanium and aluminum alloys, as well as the growing space industry, the market is expected to continue expanding at a robust pace. The projected growth from USD 2.49 billion in 2024 to USD 4.70 billion by 2033, at a CAGR of 7.3%, indicates a promising future for key market players and stakeholders across both OEMs and MRO sectors.