UK Food Preservatives Market 2030: Strategies for Effective Market Penetration

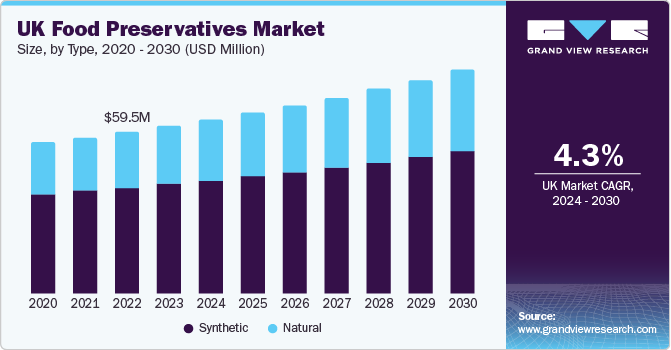

Imagine a silent guardian watching over the UK's edible treasures. This UK Food Preservatives Market, a realm valued at USD 61.7 million in 2023, now stirring with an energy that projects a 4.3% annual growth spurt until 2030.

Imagine a silent guardian watching over the UK's edible treasures. This UK Food Preservatives Market, a realm valued at USD 61.7 million in 2023, now stirring with an energy that projects a 4.3% annual growth spurt until 2030. The wind beneath its wings? A growing chorus of consumers calling for nature's own protectors in their dairy delights, snack-time savories, and everyday processed meats – a clear sign that natural food preservatives are stepping into the limelight.

The UK's preservation prowess accounts for a modest yet significant 2.1% slice of the global pie in 2023. Its food and beverage sector, a fertile ground nurtured by appealing corporate tax rates and accessible labor, is steadily blossoming compared to its European counterparts. This upward trajectory is set to further cultivate the demand for wholesome, naturally shielded food choices.

Rewind to 2018, and synthetic sentinels held the dominant position in the UK's preservative landscape. However, the narrative is shifting. The coming years are predicted to witness a significant surge in the popularity of natural alternatives, fueled by this ever-increasing appetite for clean and nutritious sustenance.

Get a preview of the latest developments in the UK Food Preservatives Market; Download your FREE sample PDF copy today and explore key data and trends

Consider the butcher's block and the poultry counter. The need to safeguard these staples is anticipated to amplify the call for botanical guardians like rosemary extract, alongside the microbial shields of natamycin and the timeless vinegar. Interestingly, the traditional source of vinegar, the grape, has seen a dip in production, paving the way for balsamic vinegar to step in and fulfill this age-old preserving role.

The UK's culinary currents also involve a flow of imported processed meats from neighboring shores. This necessitates a heightened demand for antimicrobial allies to stand guard against unwanted microbial activity on these incoming provisions. Simultaneously, a health-conscious wave is steering consumers towards seafood and poultry, potentially creating a counterbalance to a slight ebb in pork consumption. Notably, the enduring love affair with dairy products is expected to generate a parallel surge in the need for antimicrobial preservation within that creamy domain.

Several powerful forces are orchestrating this market's evolution: the rising demand for "clean label" clarity, the undeniable allure of packaged and processed convenience, and the intricate choreography of the global food supply chain. The expansion of organized retail, particularly in emerging economies, is also poised to further propel the need for these preserving partners.

However, the path isn't entirely smooth. The generally higher price tag of these increasingly coveted natural preservatives, coupled with a growing public awareness of the potential downsides of their synthetic counterparts, present notable headwinds. Yet, the industry is showing its resilience. Take Corbion NV, for instance, who strategically doubled their production of lactic acid and its derivatives in March 2021, actively cultivating their capabilities across Europe and beyond – a clear indication of a market attuned to the changing tastes and demands of its consumers.

Detailed Segmentation

Type Insights

The synthetic food preservatives market accounted for a revenue share of 65.4% in 2023. Because it is affordable and simple to make, the synthetic variety is utilized extensively. They can be created according on the needs of the application.

Label Insights

The conventional food preservatives market accounted for a revenue share of 58.7% in 2023. Either by alone or in combination with other preservation methods, conventional food preservatives are utilized. The majority of conventional preservatives are either antimicrobial preservatives, which stop bacteria or fungus from growing, or antioxidants, which act as oxygen absorbers.

Function Insights

The anti-microbial food preservatives category held a revenue share of nearly 65% in 2023. Natural antimicrobial agents are becoming increasingly popular owing to the rising concerns among consumers regarding chemical preservatives. Antimicrobial properties against pathogens and microbes can be found in herbal plants, medicinal plants, and edible oils. These natural sources of antimicrobial properties are expected to increase the shelf life of packaged foods.

Application Insights

The food preservative demand in the meat & poultry segment held a revenue share of 32.4% in 2023. Factors such as increasing demand for processed food and availability of technology that can extend the shelf life of processed meat are attributing to the expansion of the food processing industry, thereby driving the demand for food preservatives. Moreover, use of food preservatives that can retain the natural flavor and aroma of the meat is the current trend in the meat & poultry industry.

Key UK Food Preservatives Company Insights

The UK industry is characterized by the presence of a large number of synthetic preservative manufacturers. However, because organic preservatives are becoming more and more popular, new players have entered the market. Due to growing consumer health consciousness and willingness to pay more for high-quality goods, there is a progressive growth in demand for natural food products. The rivalry has been even more intense because of the enormous number of natural food manufacturers who have entered the market.

Key UK Food Preservatives Companies:

- Cargill, Inc.

- Kemin Industries, Inc.

- Archer Daniels Midland Company

- Tate & Lyle

- Koninklijke DSM N.V.

- BASF SE

- Celanese Corporation

- Corbion N.V.

- Galactic S.A.

- Kerry Group plc

UK Food Preservatives Market Segmentation

Grand View Research has segmented the UK food preservatives market report on the basis of label, type, function, and application:

- Label Outlook (Revenue, USD Million, 2018 - 2030)

- Clean Label

- Conventional

- Type Outlook (Revenue, USD Million, 2018 - 2030)

- Natural

- Synthetic

- Function Outlook (Revenue, USD Million, 2018 - 2030)

- Anti-microbial

- Anti-oxidant

- Others

- Application Outlook (Revenue, USD Million, 2018 - 2030)

- Meat & Poultry Products

- Bakery Products

- Dairy Products

- Beverages

- Snacks

- Others

Curious about the UK Food Preservatives Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- July 2022: Kemin Industries Inc. unveiled a new food preservative, RUBINITE GC Dry, as a alternative for sodium nitrite. According to the company, RUBINITE is a natural substitute, which can be utilized as a curing agent in foods, providing utmost microbiological safety and preserving product steadiness. Moreover, Kemin Industries aims to use it in processed meat products such as hot dogs and sausages.

- March 2022: DSM introduced DelvoGuardcultures, directing producers towards pursuing for clean-label solutions while also offering them with a solution to increase the shelf life of their dairy products such as fresh cheese, yogurt, and sour cream.