UK Dietary Supplements Market: Immune Boosting Trends Post-Pandemic

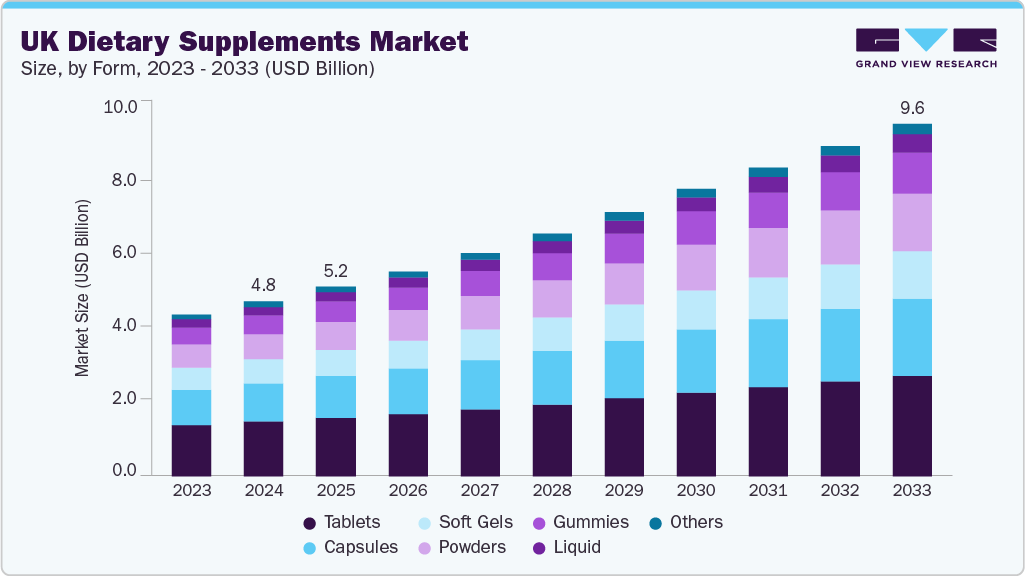

The UK dietary supplements market was valued at USD 4.79 billion in 2024 and is projected to reach USD 9.65 billion by 2033.

The UK dietary supplements market was valued at USD 4.79 billion in 2024 and is projected to reach USD 9.65 billion by 2033, growing at a CAGR of 8.1% from 2025 to 2033. This growth is driven by rising health awareness, an aging population, and the increasing prevalence of chronic conditions such as obesity, diabetes, and cardiovascular diseases.

As UK consumers become more proactive about their health, there has been a notable shift toward preventive wellness and nutritional support. Public health campaigns by the NHS and government recommendations—such as promoting vitamin D supplementation during the winter months—have played a pivotal role in shaping consumer habits. Additionally, growing interest in fitness, plant-based lifestyles, and clean-label products has further boosted the demand for supplements that promote long-term, holistic health.

Consumers in the UK are becoming more knowledgeable about healthy lifestyles and taking greater responsibility for their mental and physical well-being. The concept of health has evolved from merely treating illness to preventing it, which has driven a significant demand for dietary supplements across Europe. Factors such as increasing stress levels and the aging population have also contributed to the growing demand for these products in the UK.

Order a free sample PDF of the UK Dietary Supplements Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Ingredient: Vitamin supplements accounted for 37.4% of UK market revenue in 2024, making them the leading product category. Their popularity is driven by their vital role in maintaining overall health, preventing deficiencies, and supporting immunity. Vitamin D, C, and B-complex are among the most commonly used, particularly due to the UK's climate and limited year-round sun exposure. Government-backed health recommendations have also contributed to the dominance of this segment.

- By Type: Over-the-counter (OTC) dietary supplements dominated the market, accounting for 73.3% of the revenue in 2024. Their easy availability in pharmacies, supermarkets, and online stores makes them convenient for consumers to purchase without the need for a prescription or healthcare provider visit.

- By Form: Tablets continued to be the most common form, accounting for 31.3% of the revenue in 2024. They are widely available in major retailers, including Boots, Holland & Barrett, and Tesco, and are favored for their affordability, long shelf life, and precise dosing. Tablets remain a trusted option for consumers, especially for daily multivitamins and mineral-based supplements.

- By Application: Immunity supplements represented 12.6% of the UK market revenue in 2024, reflecting continued interest following the COVID-19 pandemic. Immune health products, such as those containing elderberry, zinc, echinacea, and vitamins C and D, have become staples for many British households. Additionally, growing awareness of the connection between gut health and immunity has driven demand for probiotic supplements.

- By End User: Adults accounted for 63.1% of the UK dietary supplements market in 2024, making them the largest consumer group. This segment includes both younger adults focused on energy, mental clarity, and fitness, as well as older adults seeking supplements for joint, heart, and cognitive health. The wide range of products available for adult health, including multivitamins and specialized supplements, continues to fuel demand across all age groups.

- By Distribution Channel: Offline channels dominated the market, representing 82.8% of total revenue in 2024. Pharmacies, supermarkets, and health food stores such as Holland & Barrett, Boots, and Tesco played a significant role in driving sales. In-person shopping remains popular due to consumer trust in physical stores, the availability of immediate advice from pharmacists, and the convenience of making on-the-spot purchases.

Market Size & Forecast

- 2024 Market Size: USD 4.79 Billion

- 2033 Projected Market Size: USD 9.65 Billion

- CAGR (2025-2033): 8.1%

Key Companies & Market Share Insights

The UK dietary supplements market is highly competitive, with both established brands and emerging players focusing on product innovation, quality, and strategic pricing to capture market share. Companies are investing in advanced manufacturing processes, automation, and skilled talent to meet regulatory standards and improve efficiency. This has led to increased innovation across the market while also raising entry barriers for new entrants.

The growing awareness of chronic health issues like obesity, diabetes, and nutrient deficiencies has shifted consumer demand toward preventive and personalized nutrition. There is also a rising interest in plant-based, allergen-free, and clean-label supplements, particularly among younger consumers seeking more targeted health solutions.

The UK has become a hub for nutraceutical innovation, with over 198 active startups, including Allplants, OptiBiotix Health, Nourished, bioniq, and Second Nature. Many of these startups focus on microbiome science, clean supplements, and personalized nutrition. Several have received funding and reached Series A or beyond, with founders often coming from prestigious institutions like Cambridge, King’s College London, and UCL, helping to shape the future of the UK's supplement industry.

Key Players

- Vitabiotics

- Haleon

- THG plc

- Healthspan

- Holland & Barrett

- Nestle

- Bayer AG

- Glanbia plc

- Pfizer Inc.

- Archer Daniels Midland Company

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The UK dietary supplements market is experiencing strong and steady growth, driven by increased consumer awareness of health, an aging population, and the rise of chronic health conditions. The shift toward preventive health and personalized nutrition, coupled with evolving consumer preferences for plant-based and clean-label products, is shaping the market's future. As consumer interest continues to grow in supplements for immunity, mental health, and overall well-being, the market presents significant opportunities for both established brands and emerging players. With ongoing innovation and rising demand, the UK's dietary supplements sector is poised for continued expansion through 2033.