Tempered Glass Market 2033: Exploring Emerging Applications

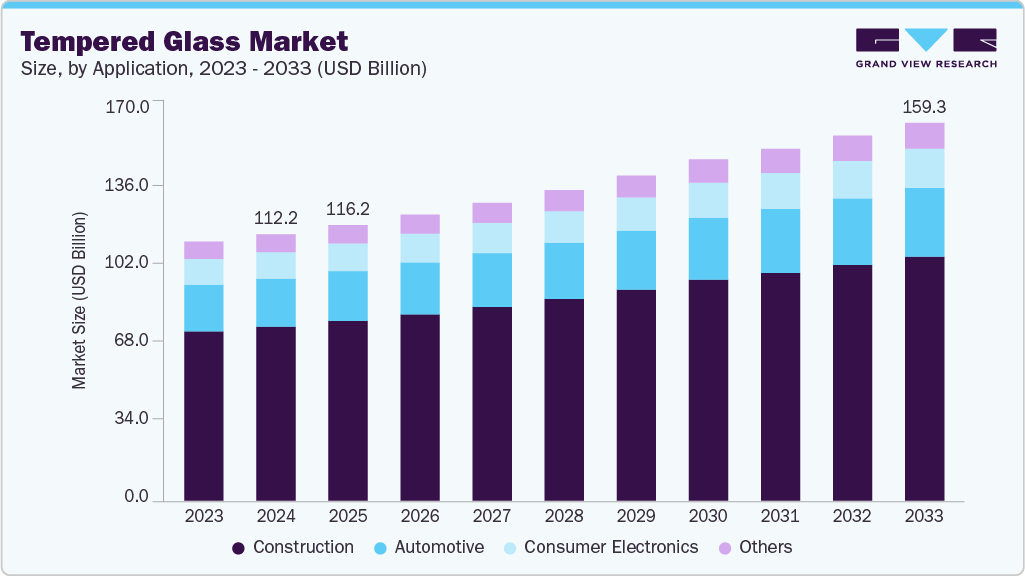

The global tempered glass market was valued at USD 112.21 billion in 2024 and is projected to reach USD 159.27 billion by 2033.

The global tempered glass market was valued at USD 112.21 billion in 2024 and is projected to reach USD 159.27 billion by 2033, growing at a CAGR of 4.0% from 2025 to 2033. This rapid growth is primarily driven by increasing demand for safety, durability, and the adoption of stronger materials in building and construction sectors. Governments and construction authorities across the world are prioritizing the use of stronger, more secure materials for public spaces and infrastructure, significantly boosting the demand for tempered glass.

Tempered glass stands out in terms of strength compared to regular glass. Unlike conventional glass, which can shatter into sharp, dangerous shards, tempered glass breaks into small, blunt pieces, significantly reducing the risk of injury. This makes it an ideal choice for applications in schools, hospitals, offices, and other crowded spaces. As more countries implement strict building safety codes, the demand for tempered glass continues to grow.

The construction and automotive industries play major roles in driving market expansion. In modern architecture, tempered glass is used in office buildings, hotels, and residential towers, providing both aesthetic appeal and safety. Iconic structures like the Burj Khalifa in Dubai and the Shanghai Tower in China incorporate tempered glass to combine strength with transparency. In the automotive industry, manufacturers such as Toyota and Tesla utilize tempered glass for side and rear windows, sunroofs, and panoramic roofs. The rise in electric vehicle production and the demand for luxury cars with larger glass surfaces further intensify the need for tempered glass.

Technological innovations in manufacturing processes and coating techniques have also contributed to the market’s growth. Advancements in furnace designs and cooling systems enable the production of high-quality tempered glass with fewer distortions. Leading companies like Saint-Gobain and Guardian Glass have introduced products with additional features like anti-reflective coatings, scratch resistance, and energy efficiency. These innovations have expanded the use of tempered glass in applications like smart buildings, consumer electronics, and solar panels. For example, smartphones such as the iPhone and Samsung Galaxy now use chemically strengthened tempered glass for screen protection, a standard feature in the electronics industry.

Order a free sample PDF of the Tempered Glass Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Asia Pacific Dominance: In 2024, Asia Pacific accounted for 59.9% of the global tempered glass market share. This region's rapid urbanization and massive infrastructure investments are driving demand. Countries like China, India, and other Southeast Asian nations are experiencing significant commercial and residential construction, where developers prefer tempered glass for facades, windows, and balustrades due to its strength and design flexibility. This surge in development is expected to continue, fueling the demand for architectural and flat glass solutions.

- Plain Tempered Glass: The plain segment led the market with a 64.5% revenue share in 2024. Its widespread use in the construction and automotive industries underscores its importance. Plain tempered glass is commonly used for doors, windows, and facades because of its safety features and thermal resistance. Furthermore, global trends in sustainable building practices, such as the growth of green buildings and smart cities, are likely to increase the demand for durable and energy-efficient materials like plain tempered glass.

- Consumer Electronics Growth: The consumer electronics sector is expected to register the fastest CAGR of 4.4% from 2025 to 2033. The rising popularity of smartphones, tablets, laptops, and wearables has significantly boosted the demand for tempered glass in electronic devices. With over 1.24 billion smartphones shipped globally in 2024, tempered glass is essential for screen protection, offering durability, scratch resistance, and impact protection. Companies like Apple, Samsung, and Xiaomi are increasingly using tempered glass to enhance product lifespan and visual clarity.

Market Size & Forecast

- 2024 Market Size: USD 112.21 Billion

- 2033 Projected Market Size: USD 159.27 Billion

- CAGR (2025-2033): 4.0%

- Asia Pacific: Largest Market Region in 2024

Key Companies & Market Share Insights

Notable players in the tempered glass market include AGC Inc. and Guardian Industries.

- AGC Inc., a global leader in glass manufacturing, was founded in Japan in 1907 and has a significant presence in the tempered glass market. AGC’s products are known for their strength, durability, and optical clarity. Their advanced tempered glass solutions cater to industries like automotive, electronics, and construction. AGC’s offerings, such as Dragontrail and DT Star2, are highly regarded in the consumer electronics sector, providing high-performance glass for smartphones and other devices.

- Guardian Industries is a major U.S.-based manufacturer of glass and building products. The company is well-known for its innovation in architectural, automotive, and specialty glass solutions. Guardian focuses on producing high-quality, durable, and energy-efficient products, emphasizing sustainability and reducing the environmental impact of their glass.

Key Players

- Asahi Glass Co., Ltd.

- Dlubak Specialty Glass Corporation

- Guardian Industries

- Nippon Sheet Glass (NSG), Co. Ltd

- Press Glass SA

- Romag

- Saint-Gobain S.A

- Taiwan Glass Ind. Corp.

- Virginia Mirror Co

- Fuso India Pvt Ltd.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global tempered glass market is set for significant growth, driven by demand across various industries, including construction, automotive, and consumer electronics. The market’s expansion is fueled by factors like increasing safety awareness, urbanization, technological advancements in glass production, and the growing popularity of electric vehicles and smart devices. Asia Pacific is poised to continue dominating the market, with plain tempered glass leading in market share due to its extensive use in construction and automotive applications. With innovations in product features and coatings, tempered glass is becoming an integral material in modern infrastructure and electronics, positioning it for a steady growth trajectory through 2033.