Tag Management System Market 2033: Revolutionizing Retail Strategies

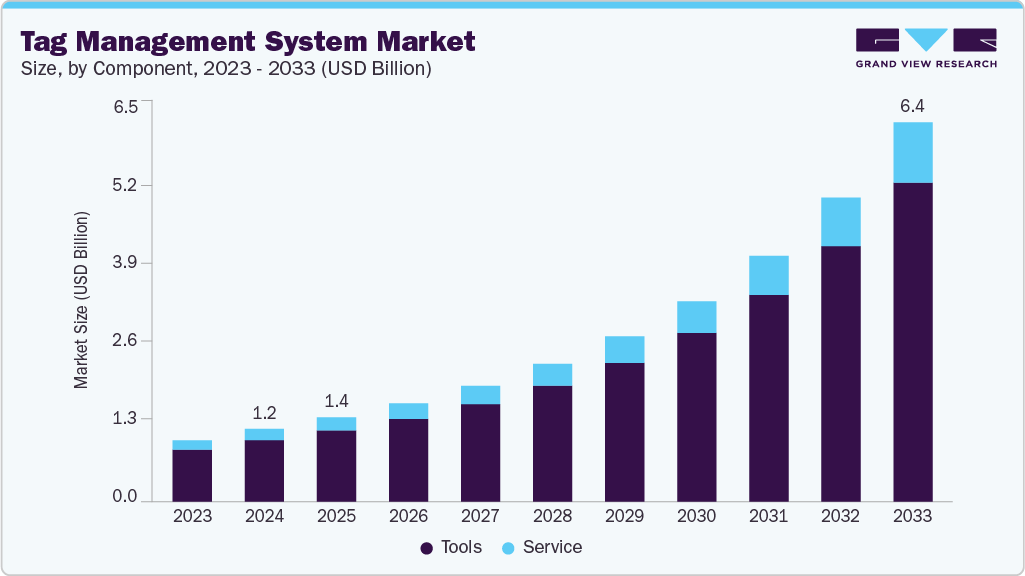

The global tag management system (TMS) market was valued at USD 1.24 billion in 2024 and is expected to reach USD 6.45 billion by 2033.

The global tag management system (TMS) market was valued at USD 1.24 billion in 2024 and is expected to reach USD 6.45 billion by 2033, growing at a CAGR of 11.5% from 2025 to 2033. This growth is driven by the increasing need for streamlined digital marketing operations, enhanced website performance, and the growing emphasis on data-driven strategies and customer personalization. Efficient management and deployment of marketing tags across digital assets have become essential as businesses seek to optimize their marketing efforts.

Tag management systems allow organizations to implement tracking codes without manual coding, reducing the reliance on IT teams and enabling greater agility in marketing operations. Furthermore, the adoption of cloud-based TMS solutions is accelerating market growth by offering real-time tag deployment and enhancing flexibility in managing user consent and ensuring privacy compliance.

As data privacy regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) gain prominence, businesses are increasingly turning to TMS solutions to manage user consent, data collection, and tracking mechanisms. These systems facilitate compliance by providing tools for consent management and data governance, ensuring that businesses meet legal requirements.

Order a free sample PDF of the Tag Management System Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America held a 40.6% revenue share of the global TMS market in 2024, thanks to its well-established digital marketing ecosystem, high adoption of data-driven technologies, and presence of large enterprise users. The rising incidence of cyberattacks and stringent data protection regulations have driven organizations in the region to adopt TMS platforms for managing consent, regulating data flow, enforcing security policies, and preventing breaches to ensure compliance with cybersecurity standards.

- By component, the tools segment led the market with a share of over 84.7% in 2024. Tag management system tools are the core enabler for the deployment, tracking, and management of tags. They allow businesses to add or modify tags without coding, trigger tags based on user actions, and integrate with analytics, advertising platforms, and customer data platforms (CDPs).

- By deployment, the cloud segment dominated the market in 2024, as it eliminates the need for costly on-premises infrastructure and maintenance. Cloud-based TMS solutions offer businesses robust functionalities at a lower cost compared to traditional on-premises solutions, as well as remote access for teams to manage tags and collaborate in real time.

- By enterprise size, large enterprises dominated the market in 2024. These organizations typically manage a complex digital ecosystem that includes multiple websites, mobile apps, and e-commerce platforms across various regions and languages. Without an efficient system like TMS, managing marketing and analytics tags manually would be inefficient and error-prone.

- By end-use, the retail and e-commerce segments led the market, accounting for over 27.0% of the revenue share in 2024. Retailers and e-commerce businesses use tag management systems to track user behavior across different touchpoints, such as product views, add-to-cart actions, and checkout completions, to gain deeper insights into customer behavior.

Market Size & Forecast

- 2024 Market Size: USD 1.24 Billion

- 2033 Projected Market Size: USD 6.45 Billion

- CAGR (2025-2033): 11.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Notable players in the tag management system industry include Google LLC, Adobe Inc., Tealium Inc., Ensighten Inc., and others. These companies are focused on strategic initiatives such as new product development, partnerships, and collaborations to strengthen their market position. Some examples of these initiatives include:

- Google Tag Manager (GTM) introduced an update in April 2025, where GTM containers will automatically load Google Tag before firing Google Ads or Floodlight event tags. This update aims to improve tracking accuracy, streamline data collection, and provide easier access to features like Enhanced Conversions and Cross-domain tracking.

- Atlan launched Tag Management in September 2023, becoming one of the first Snowflake data governance partners to enable bi-directional tag synchronization between Atlan and Snowflake. This integration allows data teams to manage and protect data assets across the entire ecosystem using Atlan as a central control plane for tag-based access control.

- Tealium launched Consent Integrations for its Tealium iQ (TiQ) tag management solution in April 2023, allowing seamless plug-and-play connectivity with consent management platforms (CMPs) such as OneTrust, Didomi, and Usercentrics. This feature ensures that consumer privacy preferences are respected and enforced throughout the customer journey, supporting both opt-in and opt-out regulatory frameworks.

Key Players

- Adobe Inc.

- BlueConic Inc.

- Cloudsaver, Inc.

- Commanders Act SAS

- Coveo Solutions Inc.

- Ensighten Inc.

- Google LLC

- Heap Inc.

- InnoCraft Ltd. (Matomo)

- Oracle Corporation

- Piwik PRO Sp. z o.o.

- Signal Digital, Inc.

- Tealium Inc.

- Twilio Inc.

- Yottaa, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The tag management system market is poised for significant growth, driven by the increasing demand for efficient digital marketing operations, data privacy compliance, and improved website performance. The adoption of cloud-based TMS solutions and the need for more agile and scalable systems to handle user consent are key factors contributing to the market's expansion. As businesses continue to prioritize data-driven marketing strategies, tag management systems will play an increasingly vital role in ensuring efficient tag deployment and compliance with global privacy regulations. North America remains the largest market, while Asia Pacific is set to be the fastest-growing region in the coming years.