Sugar Market Top Players’ Investments in Bioethanol Sector

The global sugar market is undergoing steady growth, driven by rising population, evolving consumer preferences, and expanding food and beverage industries. Increasing demand for processed and sweetened products continues to support market expansion.

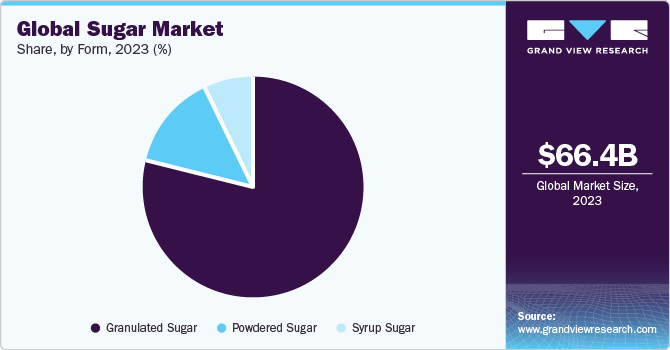

The global sugar market demonstrated substantial growth, with its valuation at USD 66.39 billion in 2023. Projections indicate a significant expansion to USD 102.32 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 6.5% between 2024 and 2030.

Several factors are propelling this market expansion. A key driver is the continuous rise in the global population, which directly translates to increased consumption of sugar, an essential component in a vast array of food and beverage items. Furthermore, evolving consumer preferences, with a notable shift towards sweetened products and drinks, are contributing significantly to market demand.

The food processing industry also plays a crucial role, with its heavy reliance on sugar for manufacturing diverse products like confectionery, baked goods, and various processed foods. Economic advancement in developing nations is leading to higher disposable incomes, subsequently boosting the intake of sugar-based commodities.

Beyond direct consumption, the sugar market is influenced by its utilization in biofuel production, particularly from crops such as sugarcane and sugar beets. Government policies, including subsidies and biofuel mandates, further impact demand for these sugar crops. Conversely, health and wellness trends advocating for reduced sugar intake present a counteracting force, shaping the overall market trajectory.

Key Market Highlights:

- Asia Pacific held the dominant position in the market in 2023, accounting for approximately 42.1% of the revenue share.

- China's sugar market is anticipated to experience the most rapid growth, with a projected CAGR of 7.2% from 2024 to 2030.

- By source, sugarcane was the leading segment in 2023, representing the largest revenue share at 77.9%.

- In terms of end-use, the food & beverages sector commanded the largest market share in 2023, contributing 45.6% of the revenue.

Order a free sample PDF of the Sugar Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2023 Market Size: USD 66.39 billion

- 2030 Projected Market Size: USD 102.32 billion

- CAGR (2024-2030): 6.5%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

Key Companies & Market Share Insights

The sugar market landscape is characterized by the presence of both international and domestic players. Leading companies in this sector are actively employing various strategic initiatives to strengthen their market position. These strategies include introducing new products, forging partnerships, engaging in mergers and acquisitions, and expanding their global reach.

Illustrative of these efforts are several recent developments:

- August 2023: CSR Launches "Better White Clear White Sugar"

Sugar Refinery Sdn Bhd (CSR) unveiled its "Better White Clear White Sugar" in August 2023. This launch is a strategic move to solidify CSR's standing as Malaysia's foremost sugar specialist. The new product builds upon the success of CSR's "Better Brown" variant, introduced in 2018, which aimed to encourage healthier sugar consumption and has since captured an impressive 78% share of Malaysia's brown sugar market. "Better White" is designed to cater to evolving consumer demands for premium sugar products offered at competitive prices.

- September 2023: British Sugar and Sidel Partner for End-of-Line Solution

British Sugar, a subsidiary of Associated British Foods plc and a significant sugar producer in the Irish and British food and beverage markets, announced a pioneering partnership with Sidel in September 2023. This collaboration focuses on implementing an innovative end-of-line solution, marking a significant upgrade to British Sugar's operations. Committed to meeting market demands and exceeding retailer expectations, British Sugar processes approximately 8 million tonnes of sugar beet annually, yielding up to 1.2 million tonnes of sugar. The objective of this initiative is to replace British Sugar's outdated 38-year-old end-of-line system with a modern solution capable of handling high levels of complexity and automation, thereby ensuring efficient management of multiple stock-keeping units (SKUs).

- August 2023: UPL SAS and NSL Sugars Collaborate on Sustainable Sugarcane

In August 2023, UPL Sustainable Agriculture Solutions (UPL SAS), based in Mumbai, and Hyderabad's NSL Sugars signed a Memorandum of Understanding (MoU). This partnership aims to promote sustainable practices in sugarcane production. UPL SAS seeks to enhance its market penetration, while NSL Sugars anticipates benefiting from the adoption of sustainable cultivation methods. A key target of this collaboration is to achieve a 15% increase in sugarcane yield per acre, equivalent to an additional 5 metric tonnes.

Key Players

- Südzucker AG

- Tereos

- Cosan

- Mitr Phol Group

- Associated British Foods plc

- Nordzucker

- Texon International Group

- Biosev (Louis Dreyfus)

- Wilmar International Ltd

- Thai Roong Ruang Sugar Group

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global sugar market is undergoing steady growth, driven by rising population, evolving consumer preferences, and expanding food and beverage industries. Increasing demand for processed and sweetened products continues to support market expansion. Additionally, sugar’s application in biofuel production and the influence of government policies add further momentum. However, the rising awareness around health and wellness and the push for reduced sugar consumption pose challenges. Despite this, innovations, sustainability initiatives, and strategic collaborations by key players are expected to shape the future landscape of the sugar industry.