Space Debris Monitoring And Removal Market: The Role of AI in Collision Avoidance

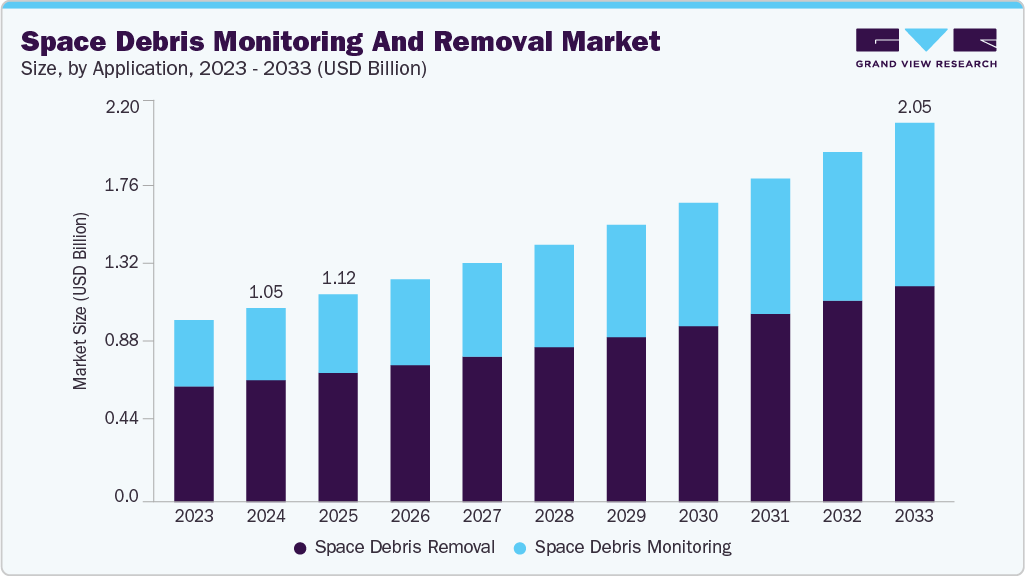

The global space debris monitoring and removal market was valued at USD 1.05 billion in 2024 and is projected to reach USD 2.05 billion by 2033.

The global space debris monitoring and removal market was valued at USD 1.05 billion in 2024 and is projected to reach USD 2.05 billion by 2033, growing at a CAGR of 7.8% from 2025 to 2033. This growth is primarily driven by the increasing emphasis on space sustainability and the protection of satellites. With the number of satellite launches rapidly increasing, particularly in Low Earth Orbit (LEO), there is a heightened need for advanced debris mitigation technologies.

The escalating demand for orbital safety is accelerating the development and adoption of space debris monitoring and removal solutions. Traditional passive systems are no longer adequate, prompting governments and private sector players to invest in technologies capable of actively tracking, predicting, and removing space debris. The risk of orbital collisions and pressure from regulatory bodies are further fueling this shift. Consequently, organizations are turning to innovative solutions such as AI-enabled tracking systems and active debris removal (ADR) missions to secure long-term space operations and protect high-value assets.

Another factor driving the market is the growing importance of satellite insurance. Insurers are increasingly focusing on collision avoidance and risk mitigation protocols as conditions for coverage. This trend is encouraging satellite operators to implement more sophisticated debris tracking and alert systems. Thus, space debris mitigation is evolving from a regulatory obligation into a strategic necessity that impacts both operational security and insurance viability.

Order a free sample PDF of the Space Debris Monitoring And Removal Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America accounted for the largest revenue share (39.0%) in 2024, driven by a high number of commercial satellite launches and significant government investments in space situational awareness. The presence of key players and space programs led by NASA and private entities reinforces North America's leading position in the market.

- By application, the space debris removal segment led the market, representing 62.9% of total revenue in 2024. The segment is experiencing rapid growth as operators prioritize active solutions like robotic arms, harpoons, nets, and propulsion-based deorbiting technologies to reduce the threat of collisions.

- Based on debris size, objects larger than 10 cm dominated the market in 2024. These larger fragments pose the highest risk of catastrophic collisions and are easily trackable with existing radar and optical systems, prompting focused monitoring and removal efforts.

- By end use, the commercial segment held the leading market share of 56.5% in 2024. This is fueled by the expansion of private satellite constellations used for communication, navigation, and Earth observation. Commercial operators are investing in advanced tracking and collision avoidance systems to ensure mission safety and continuity.

- The LEO (Low Earth Orbit) segment is projected to grow at the fastest CAGR of 8.9% from 2025 to 2033. LEO’s growing congestion due to frequent satellite launches by both private and government entities is intensifying the demand for targeted debris mitigation technologies.

Market Size & Forecast

- 2024 Market Size: USD 1.05 Billion

- 2033 Projected Market Size: USD 2.05 Billion

- CAGR (2025-2033): 7.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

- Northrop Grumman: A major U.S. defense contractor, Northrop Grumman has a prominent presence in orbital servicing and debris mitigation technologies. Its Mission Extension Vehicle (MEV) program extends satellite life, indirectly curbing debris generation. The company is working with both government and commercial partners to develop autonomous debris removal systems, specializing in satellite refueling, secure mission extension, and in-orbit servicing.

- Astroscale: Astroscale is a global leader solely focused on space debris removal and in-orbit servicing. Its flagship mission, ELSA-d, demonstrates capabilities in magnet-based capture and controlled deorbiting of defunct satellites. The company partners with space agencies and commercial operators, offering scalable, operational ADR services.

- ClearSpace: A rising player headquartered in Switzerland, ClearSpace was selected by the European Space Agency (ESA) to conduct ClearSpace-1, the world’s first active debris removal mission. This mission involves capturing and deorbiting a defunct satellite using robotic arms. The company specializes in modular, robotic ADR systems aimed at long-term orbital sustainability.

- Rocket Lab: While primarily known for small satellite launches, Rocket Lab is expanding into orbital sustainability through in-orbit servicing. The company is exploring deorbiting solutions integrated into its Photon platform and has acquired capabilities to support satellite repositioning and life-extension. It is building expertise in end-of-life management and integrated servicing.

Key Players

- Astroscale

- ClearSpace

- LeoLabs

- Northrop Grumman

- Lockheed Martin

- Airbus

- SpaceX

- Rocket Lab

- Surrey Satellite Technology

- Momentus

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global space debris monitoring and removal market is poised for significant growth, driven by the urgent need for orbital sustainability, rising satellite deployment rates, and growing regulatory and insurance pressures. North America leads the market, while Asia Pacific shows the fastest growth potential. As passive monitoring proves inadequate, the industry is rapidly moving toward active, technology-driven solutions. Major players like Northrop Grumman, Astroscale, ClearSpace, and Rocket Lab are leading the charge in developing scalable and innovative debris mitigation systems. With a projected market size of USD 2.05 billion by 2033, space debris management is becoming a critical component of the evolving global space ecosystem.