Space Cybersecurity Market 2033: The Future of Spaceports and Launch Facilities

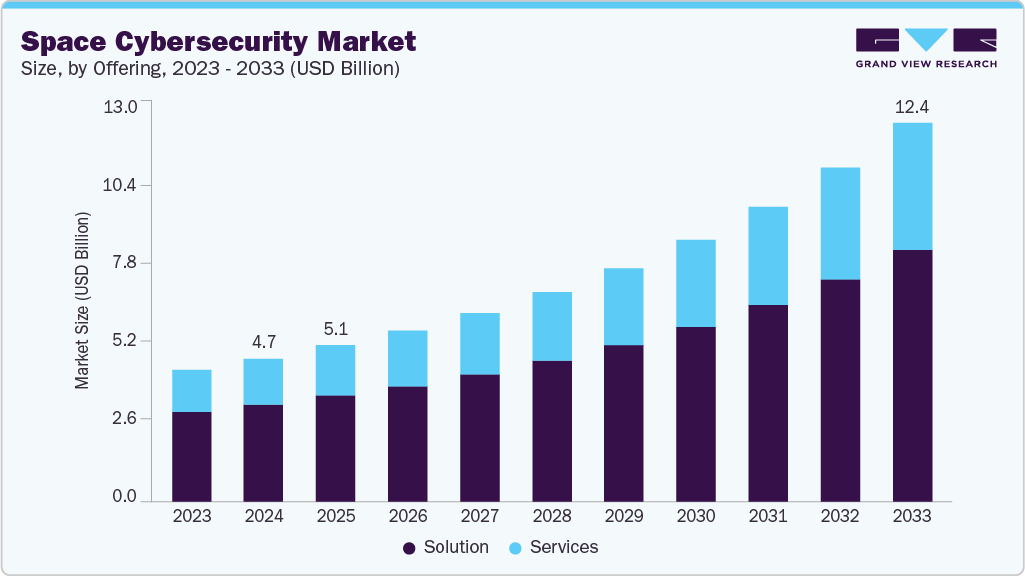

The global space cybersecurity market was valued at USD 4.68 billion in 2024 and is projected to grow to USD 12.37 billion by 2033.

Global Space Cybersecurity Market Overview

The global space cybersecurity market was valued at USD 4.68 billion in 2024 and is projected to grow to USD 12.37 billion by 2033, expanding at a CAGR of 11.7% from 2025 to 2033. This growth is largely driven by the ongoing digital transformation of the space industry.

As satellite constellations, space assets, and ground-based control systems become increasingly interconnected and data-intensive, cybersecurity is becoming a critical operational requirement. Government bodies, defense contractors, and private aerospace companies are investing significantly in cybersecurity infrastructures to protect vital space systems against evolving threats such as nation-state cyberattacks, ransomware, and signal interference.

The expanding use of small satellites (smallsats), low Earth orbit (LEO) networks, and autonomous spacecraft has significantly increased the potential points of vulnerability to cyber intrusions. At the same time, the adoption of cloud-based ground segment operations and AI-driven space mission planning necessitates scalable cybersecurity solutions capable of securing data transfers between terrestrial and orbital systems.

Moreover, as commercial activity in space grows and space-based assets become integrated into national security frameworks, the need for resilient and AI-enabled cybersecurity solutions becomes more pressing. New technologies such as satellite-to-satellite communications, space-based edge computing, and space situational awareness (SSA) platforms are accelerating demand for adaptive cybersecurity frameworks that can secure infrastructure both in orbit and on the ground in real time.

Order a free sample PDF of the Space Cybersecurity Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America held the largest market share in 2024, accounting for 35.7% of global revenue. The region leads in space cybersecurity investment, with support from major government agencies such as NASA and the Department of Defense, as well as from key private players like SpaceX and Blue Origin. Persistent threats like GPS spoofing, jamming, and sophisticated cyberattacks on satellites and ground systems are driving demand for robust cybersecurity defenses.

- By offering, the solution segment accounted for 68.1% of revenue in 2024. The increasing complexity of threats against interconnected satellite systems has expanded the attack surface, making advanced cybersecurity solutions indispensable for space infrastructure protection.

- By platform, the satellite segment dominated in 2024, reflecting the rising dependency on satellites for communication, navigation, Earth observation, and defense. As satellite constellations grow, their complexity and exposure to cyber threats also increase, raising the importance of comprehensive cybersecurity measures.

- By end use, the government & defense segment led the market in 2024. This is attributed to the strategic value of space-based systems in military and intelligence operations, including surveillance, communication, navigation, and missile defense.

Market Size & Forecast

- 2024 Market Size: USD 4.68 Billion

- 2033 Projected Market Size: USD 12.37 Billion

- CAGR (2025-2033): 11.7%

- North America: Largest regional market in 2024

- Asia Pacific: Fastest-growing regional market

Key Companies & Market Share Insights

- Lockheed Martin Corporation is a major player in space cybersecurity, leveraging AI and machine learning to secure satellites and ground systems. The company provides real-time threat detection and supports secure satellite networks, integrating technologies like 5G and autonomous systems to enhance mission assurance in contested environments.

- Northrop Grumman specializes in both software and hardware cybersecurity solutions, including the Space End Crypto Unit (ECU). These technologies are crucial for protecting interconnected satellite networks and supporting U.S. military initiatives like Joint All Domain Command and Control (JADC2).

- Thales also plays a significant role, offering advanced encryption and network security solutions tailored to the space sector.

Emerging Participants:

- Pan Galactic, a UK-based startup, has developed GalacticOS, a quantum-safe operating system that uses post-quantum encryption and blockchain technology to secure communications in space environments. The OS is designed to be lightweight and hardware-agnostic, offering robust protection from boot-up through operation.

- InspeCity, based in India, focuses on sustainable space operations with technologies for satellite life extension, in-orbit servicing, and debris mitigation. Founded in 2022, the company has developed innovative propulsion and robotics systems and established partnerships in Japan and Taiwan while earning recognition in defense innovation competitions.

Key Players

- Lockheed Martin Corporation

- Northrop Grumman

- Thales

- Airbus

- Booz Allen Hamilton

- BAE Systems

- CHI Group

- Checkpoint Software Technologies

- SpiderOak Mission Systems

- Xage Security, Inc.

- Anduril Industries, Inc.

- Cisco

- CrowdStrike

- Fortinet

- Sophos

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global space cybersecurity market is entering a phase of rapid expansion, fueled by increasing satellite deployments, commercialization of space, and growing cyber threats to orbital and terrestrial infrastructure. The combination of geopolitical tensions, technological innovation, and the rise of private space ventures underscores the urgent need for advanced, AI-driven, and quantum-resistant cybersecurity solutions. North America remains the largest market, while Asia Pacific is emerging as a key growth region. As both established defense contractors and innovative startups continue to shape the landscape, investment in space cybersecurity will remain a top priority for ensuring the resilience and safety of space operations.