Refinancing Market Forecast: Increasing Investments in Fintech Solutions

The refinancing market is poised for steady growth, supported by technology integration, government-backed initiatives, and innovative financial products designed to improve accessibility and affordability.

The global refinancing market size was valued at USD 18.09 billion in 2021 and is projected to reach USD 34.04 billion by 2030, expanding at a CAGR of 7.5% from 2022 to 2030. Growth is primarily fueled by increasing investments from banks and financial institutions in advanced technologies to deliver improved refinancing services, enhancing overall customer experience.

Financial institutions are offering diverse refinancing options, including fixed-rate mortgages and loans at lower interest rates, which are key drivers of market expansion. To address barriers such as lower income levels that limit refinancing eligibility, several players are launching innovative solutions. For example, in July 2021, Ally Home, the lending arm of Ally Bank, introduced RefiNow, a refinancing solution designed to support customers who face challenges in qualifying due to income constraints or other limitations.

Technology adoption is also playing a pivotal role. Lenders are increasingly leveraging artificial intelligence (AI) and machine learning (ML) to automate mortgage processing and streamline approvals. Digital tools, such as mortgage calculators, provide borrowers with valuable insights into interest rates, loan terms, and potential savings, helping them make more informed refinancing decisions.

Government programs have further boosted refinancing adoption, particularly among low-income groups. In the U.S., initiatives such as FHA refinance loans, VA refinance loans, and USDA refinance loans have been instrumental in making refinancing accessible to a wider demographic. However, the relatively high costs associated with refinancing remain a challenge that could restrain growth during the forecast period.

Key Market Insights:

- North America accounted for the largest revenue share of over 30.0% in 2021.

- By type, the fixed-rate mortgage refinancing segment held the largest share at over 40.0% in 2021.

- By deployment, the on-premises segment dominated with a share of over 68.0% in 2021.

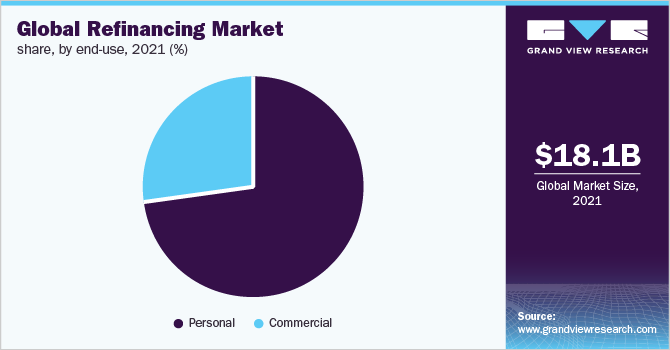

- By end-use, the personal segment led the market in 2021, capturing more than 72.0% of the global revenue.

Order a free sample PDF of the Refinancing Market Intelligence Study, published by Grand View Research.

Market Size & Forecast:

- 2021 Market Size: USD 18.09 Billion

- 2030 Projected Market Size: USD 34.04 Billion

- CAGR (2022–2030): 7.5%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights:

The refinancing market is fragmented, with players pursuing partnerships, collaborations, and product launches to strengthen their portfolios. Companies are adopting digital innovations like AI and ML to streamline services and improve customer engagement. New product offerings are designed to provide borrowers with greater flexibility, particularly in managing financial obligations during challenging times such as the pandemic.

In addition, regional expansion strategies have enabled firms to extend their refinancing services into new geographies, increasing customer reach and revenue growth. These combined efforts underscore the market’s competitive nature and its emphasis on enhancing customer accessibility and experience.

Key Players:

- WELLS FARGO & COMPANY

- Bank of America

- ALLY FINANCIAL INC

- JPMorgan Chase & Co.

- Rocket Companies, Inc.

- Citigroup Inc.

- RefiJet

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion:

The refinancing market is poised for steady growth, supported by technology integration, government-backed initiatives, and innovative financial products designed to improve accessibility and affordability. While high refinancing costs remain a challenge, ongoing advancements in digital solutions and increasing demand for flexible loan options are expected to sustain market expansion through 2030.