Real-time Bidding Market Advertising Efficiency for Luxury Marketers

The real-time bidding market is set for rapid growth, supported by targeted advertising, mobile and video adoption, and advancements in AI-driven programmatic technologies.

The global real-time bidding market was valued at USD 14.37 billion in 2023 and is projected to reach USD 39.61 billion by 2030, growing at a CAGR of 16.0% from 2024 to 2030. The growing need for targeted advertising remains a key driver of market growth.

Advertisers are increasingly aiming to connect with specific audiences through personalized messaging, and RTB enables precise targeting by leveraging user data. This enhances ad relevance, boosts engagement rates, and maximizes return on investment (ROI).

The rising consumption of digital media is further fueling market expansion. As consumers spend more time online across devices, advertisers continue to shift budgets from traditional to digital channels. RTB supports this transition by providing scalability, efficiency, and real-time campaign optimization based on performance data.

Technological advancements in programmatic advertising are also propelling the market. AI and machine learning (ML) algorithms are transforming bidding strategies, optimizing ad placements, and enhancing campaign outcomes. These technologies allow advertisers to process and analyze massive datasets instantly, leading to informed decision-making and stronger results.

The rise of mobile advertising is another major trend, driven by the rapid adoption of smartphones and apps. Mobile has become the primary medium for digital content consumption, prompting advertisers to prioritize mobile RTB strategies. Similarly, video advertising is reshaping the landscape. With higher engagement and storytelling power, video ads are in demand, and programmatic video RTB enables delivery of targeted video content across multiple platforms.

At the same time, data privacy and compliance regulations, such as GDPR and CCPA, are reshaping RTB practices. Advertisers are adopting privacy-compliant strategies and focusing on user consent to ensure regulatory adherence and maintain consumer trust.

The market also presents emerging opportunities in channels such as connected TV (CTV) and digital out-of-home (DOOH) advertising, which offer high-quality inventory and broader reach. Growing adoption of smart TVs and digital billboards is expected to accelerate RTB adoption in these channels. Furthermore, the integration of advanced analytics and AI-driven insights into RTB platforms will allow advertisers to predict user behavior and deliver more tailored ad experiences.

In addition, emerging markets such as Asia Pacific and Latin America are experiencing rapid digital transformation, rising internet penetration, and increasing ad spending. These regions represent high-potential growth avenues for RTB adoption.

Key Market Trends & Insights

- North America led the market in 2023, supported by high adoption of digital advertising technologies and the presence of major players.

- By auction: The open auction segment dominated in 2023 with a revenue share of over 34%.

- By advertisement: The display ads segment accounted for the largest share in 2023.

- By device: The mobile devices segment dominated the market in 2023.

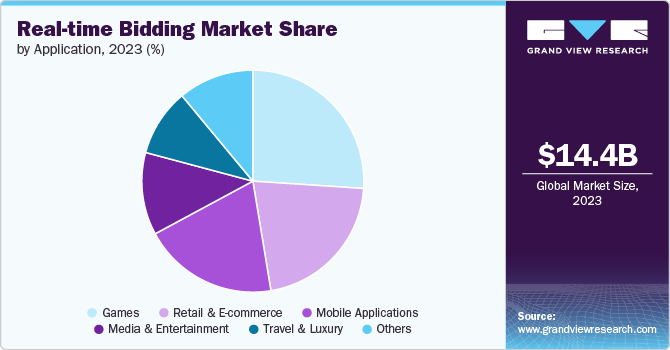

- By application: The gaming segment held the largest market share in 2023.

Download a free sample PDF of the Real-time Bidding Market Intelligence Study, published by Grand View Research.

Market Performance

- 2023 Market Size: USD 14.37 Billion

- 2030 Projected Market Size: USD 39.61 Billion

- CAGR (2024–2030): 16.0%

- North America: Largest market in 2023

- Asia Pacific: Fastest-growing market

Prominent Companies & Market Dynamics

Leading players are pursuing new product launches, collaborations, and partnerships to expand market share and strengthen competitiveness.

- April 2024: SpotX upgraded its server-to-server bidding product, enabling media owners to combine yield management strategies with third-party header bidders. The updated ad-serving suite now supports both server-side and client-side header bidding.

- September 2019: Following its acquisition by AT&T, AppNexus rebranded its exchange as Xandr Monetize and introduced new features designed to build a comprehensive programmatic stack for video publishers.

Key Companies

- The Trade Desk

- AppNexus

- MediaMath

- Rubicon Project

- Criteo

- PubMatic

- OpenX

- Adobe Inc.

- SpotX

- Amazon Advertising

- Meta

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The real-time bidding market is set for rapid growth, supported by targeted advertising, mobile and video adoption, and advancements in AI-driven programmatic technologies. While privacy regulations shape industry practices, opportunities in CTV, DOOH, and emerging markets will continue to expand the RTB landscape globally.