Procurement Analytics Market: Identifying Value Leakage with AI

The global procurement analytics market is poised for rapid expansion through 2030, driven by the growing strategic importance of procurement, rising adoption of advanced analytics, and increasing demand for operational efficiency.

The global procurement analytics market was valued at USD 2.88 billion in 2021 and is expected to reach USD 18.18 billion by 2030, expanding at a CAGR of 23.6% from 2022 to 2030. Market growth is being driven by the increasing need for operational efficiency, cost optimization, and data-driven decision-making, as organizations across industries continue to prioritize efficiency-led transformation initiatives.

Procurement functions generate vast volumes of structured and unstructured data, including transaction histories, spend patterns, supplier performance metrics, and contract information. The adoption of advanced analytics enables organizations to extract actionable insights from this data, supporting improved negotiations, performance management, vendor segmentation, risk mitigation, and annual purchasing planning.

With the integration of intelligent analytics capabilities, procurement teams can enhance strategic sourcing, reduce maverick spending, and improve compliance, ultimately leading to better business outcomes. As enterprises increasingly recognize procurement as a strategic value driver rather than a cost center, demand for procurement analytics solutions continues to accelerate.

Key Market Trends & Insights

- North America accounted for the largest revenue share of over 40% in 2021, supported by early adoption of analytics and digital procurement solutions.

- Asia Pacific is expected to witness the highest CAGR over the forecast period, driven by rapid digital transformation and expanding enterprise adoption.

- By component, the solution segment dominated the market, capturing over 70% of total revenue in 2021.

- By deployment, the on-premise segment held the largest share of over 53% in 2021, reflecting enterprise preferences for data control and security.

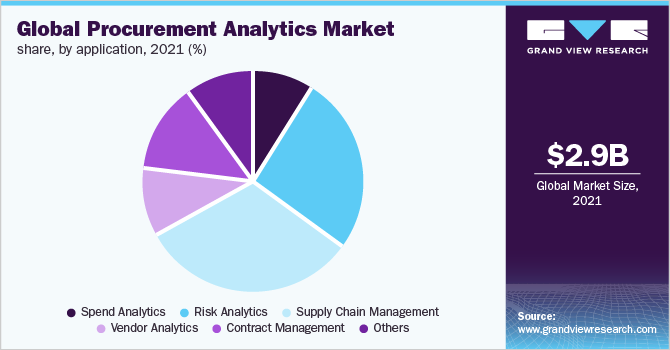

- By application, supply chain management accounted for over 30% of revenue in 2021, highlighting the role of analytics in improving procurement and logistics visibility.

Download a free sample PDF of the Procurement Analytics Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2021 Market Size: USD 2.88 Billion

- 2030 Projected Market Size: USD 18.18 Billion

- CAGR (2022–2030): 23.6%

- Largest Market (2021): North America

- Fastest-Growing Market: Asia Pacific

Competitive Landscape

The procurement analytics market is highly competitive, with major players focusing on continuous innovation, platform enhancements, and portfolio expansion to gain a competitive edge. Vendors are increasingly integrating analytics with cloud procurement, ERP, and supply chain platforms to deliver end-to-end visibility.

For example, in August 2021, Oracle Corporation launched an updated version of Oracle Cloud Procurement, strengthening its analytics capabilities within Oracle Fusion Cloud ERP and Oracle Fusion Cloud Supply Chain & Manufacturing solutions. These platforms help organizations mitigate risks, reduce costs, and simplify procurement and supply chain processes.

Strategic acquisitions and backward integration are also common as companies seek to expand capabilities and improve operational efficiency. In July 2021, Bain Capital acquired PartsSource, a U.S.-based B2B marketplace and healthcare services provider. PartsSource connects approximately 19,000 clinics and hospitals with over 6,000 OEM manufacturers, offering precision procurement analytics solutions that help healthcare organizations reduce waste, minimize risk, and enhance supply chain visibility.

Prominent players operating in the global procurement analytics market include:

- SAP

- Oracle

- SAS Institute

- Coupa Software

- Genpact

- Rosslyn Data Technologies

- Microsoft

- IBM

- Cisco

- GEP

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The global procurement analytics market is poised for rapid expansion through 2030, driven by the growing strategic importance of procurement, rising adoption of advanced analytics, and increasing demand for operational efficiency. While North America continues to lead the market, Asia Pacific is expected to emerge as the fastest-growing region. Ongoing technological advancements, cloud integration, and strategic acquisitions will remain key factors shaping competition and innovation in the procurement analytics landscape.