Potash Market Trends: Adoption of Sustainable Agriculture Practices

The potash market remains integral to global agriculture, with demand firmly supported by population growth, food security needs, and advances in farming practices.

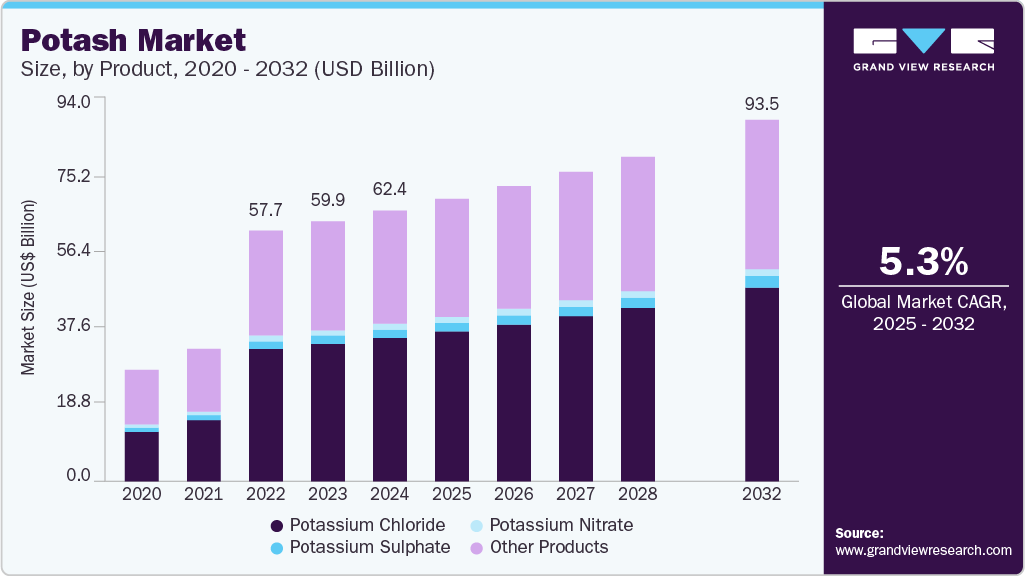

The global potash market size was estimated at USD 62,374.0 million in 2024 and is projected to reach USD 93,501.2 million by 2032, growing at a CAGR of 5.3% from 2025 to 2032. The increasing global population continues to drive food and agricultural demand, directly influencing the growth of the potash industry.

As food demand rises, farmers rely on fertilizers to enhance productivity and ensure higher crop yields. Potash plays a critical role in improving root development, nutrient uptake, and overall plant health. In the U.S., where agriculture remains one of the strongest economic sectors, the demand for potash is consistently high. This demand is supported by large-scale crop cultivation, soil fertility management, precision farming practices, specialty crop adoption, technological innovation, and favorable government initiatives. These factors collectively ensure stable and sustained market growth in the country.

Globally, potash remains a vital input in agriculture as it is the primary source of potassium, a key nutrient for plant growth. Potassium chloride (KCl) dominates the market as the most widely consumed form. Increasing demand for food security, higher crop productivity, and soil health management continue to be the main growth drivers. Potash not only improves yields but also enhances resistance to drought and diseases, thereby improving both the quality and quantity of agricultural output.

Asia Pacific, particularly China and India, along with Latin America and North America, represent the largest consumer bases due to extensive commercial farming. On the supply side, Canada, Russia, Belarus, and China are the leading producers, with Canada’s Saskatchewan region holding the world’s largest reserves. Market dynamics are significantly influenced by production capacity, long-term contracts, trade policies, and geopolitical developments. For example, sanctions on Belarusian exports and disruptions caused by the Russia-Ukraine conflict have tightened global supply in recent years.

Additionally, the rising focus on sustainable agriculture and premium crop cultivation has created opportunities for low-chloride potash variants, such as potassium sulfate (SOP) and potassium nitrate. These products are increasingly adopted in fruits, vegetables, and horticulture segments, further expanding market opportunities.

Key Market Insights:

- Asia Pacific dominated the market with a revenue share of more than 38.4% in 2024.

- The China potash market is expected to witness robust growth during the forecast period.

- By product, the potassium chloride segment held the largest share at 53.0% in 2024.

- By end-use, the agriculture segment accounted for 93.1% of the market in 2024.

Order a free sample PDF of the Potash Market Intelligence Study, published by Grand View Research.

Market Size & Forecast:

- 2024 Market Size: USD 62,374.0 Million

- 2032 Projected Market Size: USD 93,501.2 Million

- CAGR (2025–2032): 5.3%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights:

Key companies in the market focus on strengthening production capacity, expanding geographic reach, and developing specialty fertilizer offerings. For example, K+S Aktiengesellschaft operates across multiple regions with two major business segments—Potash and Magnesium Products, and Salt. Its extensive portfolio of potassium chloride, magnesium sulfate, and specialty fertilizers serves industries ranging from agriculture and pharmaceuticals to water treatment, making it a vital player in the global fertilizer market.

Key Players:

- JSC Belaruskali

- Compass Minerals Intl. Ltd.

- Mosaic Company

- Uralkali

- Rio Tinto Ltd.

- BHP Billiton Ltd.

- Eurochem

- Red Metal Ltd.

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion:

The potash market remains integral to global agriculture, with demand firmly supported by population growth, food security needs, and advances in farming practices. While geopolitical challenges and supply constraints create volatility, ongoing investments in sustainable agriculture and specialty potash products are expected to open new growth avenues. With Asia Pacific leading consumption and Canada dominating supply, the market is well-positioned for steady expansion through 2032.