Portugal Accident Insurance Market: Future Outlook and Predictions

The Portugal accident insurance market is on a strong growth path, supported by rising accident cases, higher healthcare costs, and greater consumer awareness.

The Portugal accident insurance market size, measured in terms of Gross Written Premium (GWP), was valued at USD 1.42 billion in 2024 and is projected to reach USD 2.43 billion by 2033, growing at a CAGR of 6.14% from 2025 to 2033. In terms of New Business Premium (NBP), the market was valued at USD 0.37 billion in 2024 and is expected to expand at a CAGR of 7.14% from 2025 to 2033.

Industry growth is being fueled by rising road accidents, escalating healthcare costs, and increasing awareness of the importance of financial protection through accident insurance. According to Portugal News (December 2024), nearly 135,000 road accidents were reported, leading to 453 fatalities and 2,550 serious injuries. While fatalities decreased compared to 2023, the overall number of accidents rose. These statistics were published by the National Road Safety Authority (ANSR) during the launch of the “Safe Parties” campaign for the 2024–2025 festive season.

Private accident insurance is gaining traction as consumers seek coverage beyond what public systems provide. This trend is supported by rising disposable incomes, enabling individuals to opt for more comprehensive policies. Additionally, the surge in road accidents and growing awareness around mental health have prompted employers to strengthen employee benefits with accident coverage. Technological advancements in claims processing and customer engagement have further simplified access, making policies easier to purchase, manage, and settle. Collectively, these factors are fostering growth across both public and private insurance segments in Portugal.

Key Market Insights

- By policy type: The corporate policy segment led the market in 2024, holding a 76.52% revenue share. Its growth is driven by stricter regulatory standards, increased workplace safety initiatives, and rising employee benefit costs.

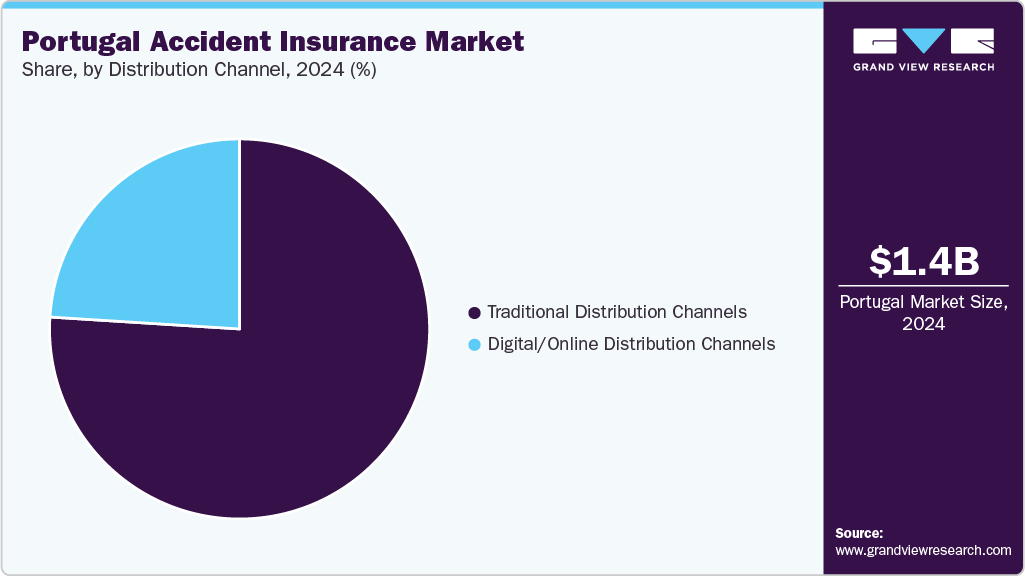

- By distribution channel: Traditional channels—including insurance agents, brokers, and bancassurance—dominated the market in 2024, supported by cultural preferences, regulatory structures, and established consumer trust.

- By insurance type: The private insurance segment accounted for the largest revenue share of 91.15% in 2024, reflecting growing consumer demand for financial protection against accidents.

Order a free sample PDF of the Portugal Accident Insurance Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 1.42 Billion

- 2033 Projected Market Size: USD 2.43 Billion

- CAGR (2025–2033): 6.14%****

Key Companies & Market Share Insights

The private accident insurance sector in Portugal is highly fragmented, with several multinational and domestic insurers competing for market share.

- Allianz, Assicurazioni Generali S.p.A., and Zurich are among the largest global players, offering broad accident insurance portfolios tailored to multiple customer groups.

- Lonpac is a leading player with a significant share, particularly among civil servants and high-income individuals.

Key Players

- Tranquilidade (Grupo Generali)

- Mapfre Seguros Portugal

- Allianz

- Zurich

- Ageas

- Fidelidade

- Banco ActivoBank

- Famasegur

- Ibex Insurance Services Ltd.

- Mutualista Montepio

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The Portugal accident insurance market is on a strong growth path, supported by rising accident cases, higher healthcare costs, and greater consumer awareness. With technological innovation and increased participation from private insurers, the sector is expected to expand steadily through 2033.