Plastic Packaging Market Sees Surge Due to Single-Serve and On-the-Go Products

The global plastic packaging market is undergoing a steady transformation, fueled by strong demand across key end-use industries such as food & beverages, pharmaceuticals, and personal care.

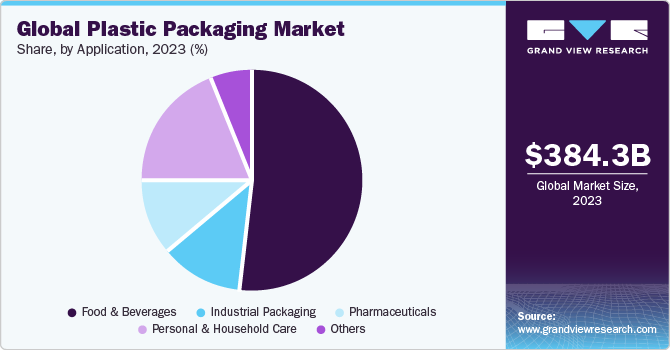

The global plastic packaging market reached an estimated size of USD 384.35 billion in 2023. Projections indicate continued growth, with the market expected to reach USD 492.29 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 3.5% from 2024 to 2030. This expansion is primarily driven by the increasing scale of key application industries, including personal and household care, pharmaceuticals, and food & beverages, along with the rising global penetration of e-retail.

Plastic is a preferred packaging material due to its versatility, offering both rigid and flexible forms, its lightweight nature, and transparency. These attributes make it a preferred substitute over alternatives like glass or metal in major industries such as food and beverage, household & personal care, and industrial applications. Furthermore, engineered plastics possess the ability to withstand extreme environmental conditions without degrading in high or low temperatures, thereby preserving the integrity of products like cosmetics and food & beverages. The cost-effectiveness and excellent printability associated with plastic further enhance its appeal as a packaging solution.

The extrusion technology segment is anticipated to experience robust growth in the U.S. market from 2024 to 2030. Extrusion-based plastic packaging products, including wraps & films, pouches, and plastic packaging bags, are widely utilized across most consumer and industrial applications in the country. This widespread adoption is attributed to their performance benefits and increasing focus on sustainability. The high penetration of organized retail across the U.S. has also significantly contributed to the substantial demand for plastic packaging in the nation.

Key Market Insights:

- Asia Pacific's Leadership: Asia Pacific dominated the plastic packaging market in 2023, accounting for over 43.0% of the global revenue share.

- China's Pivotal Role: China held a leading position within the Asia Pacific market in 2023, both in terms of production and demand.

- Food and Beverage Dominance: Based on application, the food and beverage segment led the industry in 2023, accounting for over 51.0% of the revenue share.

- Extrusion Technology Leads: Within the technology segment, extrusion technology held the largest share in 2023, representing over 39.0% of the market.

- Rigid Packaging's Largest Share: By product type, the rigid segment dominated the plastic packaging market, securing the largest revenue share of over 60.0% in 2023.

Order a free sample PDF of the Plastic Packaging Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2023 Market Size: USD 384.35 Billion

- 2030 Projected Market Size: USD 492.29 Billion

- CAGR (2024-2030): 3.5%

- Asia Pacific: Largest market in 2023

Key Companies & Market Share Insights

The plastic packaging market is characterized by intense competition and fragmentation, encompassing a wide array of medium, small, and large-sized players operating both domestically and internationally. The industry is currently navigating a significant transformation, driven by increasingly stringent regulations on plastic usage and a heightened consumer awareness of sustainability. This shift is compelling the market to steadily adopt more sustainable packaging materials and practices.

Leading companies in the global plastic packaging market are primarily employing acquisition strategies to expand their geographic footprint and enhance manufacturing capabilities.

- Greif Inc., a U.S. industrial packaging manufacturer, acquired PACKCHEM Group SAS (France), a producer of small plastic containers and jerrycans, in October 2023 for $538 million. This acquisition significantly enhanced Greif's product portfolio through horizontal expansion.

- In March 2023, SK Chemicals acquired the chemically recycled BHET and PET business division of Shuye, a Chinese green materials company, for approximately $100 million. This move positioned SK Chemicals to address the growing demand for recycled plastic and secure a lead in the chemically recycled PET market.

Key players in the market include:

- Amcor plc: Operates through two primary business segments: Flexible and Rigid Packaging. Its offerings encompass plastic, paper, and aluminum-based packaging solutions.

- Constantia Flexibles: Focuses its operations across two business segments: Consumers and Pharma, providing flexible packaging solutions for various end-use applications.

Emerging participants contributing to the market's dynamic landscape include:

- Coveris: Offers an extensive range of plastic packaging products, including films, pouches, bags, trays, and barrier films. It serves diverse industries such as food & beverage, household & personal care, healthcare, agriculture, chemical, and pet care.

- Alpha Packaging Ltd: Specializes in complete packaging solutions, including air/sea worthy packaging, heavy-duty corrugated boxes, and lashing services, with a strong focus on quality and customized services.

Key Players

- Novolex

- Printpack Inc.

- Reynolds Consumer Products Inc.

- Quadpack Industries SA

- Tetra Pak International SA (Tetra Laval Group)

- Toppan Inc.

- Plastic Packaging Technologies (PPT)

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global plastic packaging market is undergoing a steady transformation, fueled by strong demand across key end-use industries such as food & beverages, pharmaceuticals, and personal care. Plastic’s versatility, lightweight nature, and durability continue to make it a preferred packaging solution, especially in emerging economies and organized retail environments. Technological advancements like extrusion and growing interest in sustainable materials are reshaping the competitive landscape. While regulatory pressures on plastic usage rise, market leaders are adapting through acquisitions and investments in recycled materials. Overall, the sector remains dynamic, balancing performance needs with environmental responsibilities.