Philippines Logistics Market to Reach USD 40.0 Billion by 2033 – IMARC Group

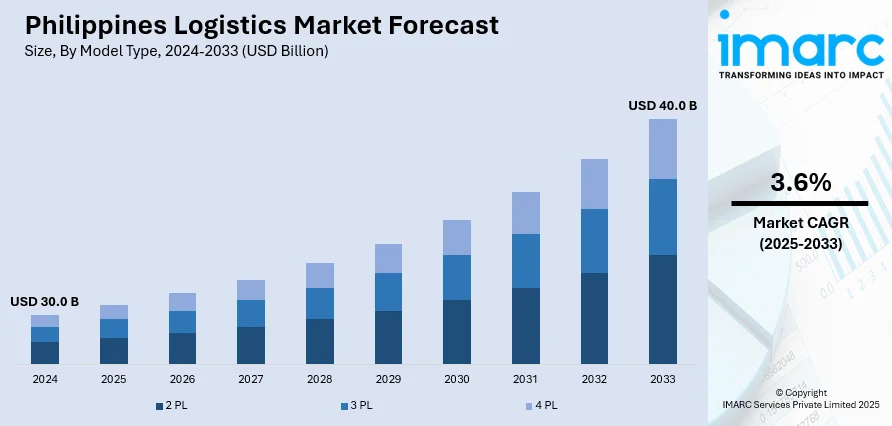

The market size reached USD 30.0 billion in 2024 and is projected to grow to USD 40.0 billion by 2033, exhibiting a CAGR of 3.6% during the forecast period.

The latest report by IMARC Group, “Philippines Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2025–2033,” offers an in-depth analysis of the logistics sector in the Philippines. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The market size reached USD 30.0 billion in 2024 and is projected to grow to USD 40.0 billion by 2033, exhibiting a CAGR of 3.6% during the forecast period.

Report Attributes and Key Statistics:

- Base Year: 2024

- Forecast Years: 2025–2033

- Historical Years: 2019–2024

- Market Size in 2024: USD 30.0 Billion

- Market Forecast in 2033: USD 40.0 Billion

- Market Growth Rate (2025–2033): 3.6%

Philippines Logistics Market Overview:

The logistics industry in the Philippines is experiencing steady growth, driven by the rise of e-commerce, improvements in transportation infrastructure, and strong government initiatives aimed at enhancing trade efficiency. The increasing demand for effective supply chain solutions, along with the country's strategic position in Southeast Asia, positions the Philippines as a potential logistics hub in the region. Investments in port modernization, road and rail systems, and the digitalization of logistics processes support ongoing progress. Additionally, rising consumer expectations for faster delivery services encourage logistics providers to adopt innovative solutions and streamline their operations.

Request for Sample Report: https://www.imarcgroup.com/philippines-logistics-market/requestsample

Philippines Logistics Market Trends and Drivers:

The logistics market in the Philippines is undergoing significant changes, largely due to the surge in e-commerce activities. According to the Comprehensive Trade Organization, e-commerce revenue in the Philippines reached $17 billion in 2021, with projections estimating growth to $24 billion by 2025. This increase is linked to a growing number of online shoppers, creating a need for efficient logistics operations, especially in last-mile deliveries and warehousing. Logistics companies are investing in smart transport hubs and expanding distribution networks to meet this demand. Moreover, there is a growing emphasis on sustainable logistics practices, with companies adopting eco-friendly solutions to reduce their carbon footprint and comply with global environmental standards.

Several factors are driving changes in logistics operations in the Philippines. The rapid growth of the e-commerce sector is creating a higher demand for efficient logistics solutions. Government programs, such as the "Build, Build, Build" initiative, are improving transportation systems and facilitating smoother movement of goods. The country's strategic geographic location provides a competitive edge, making it an attractive center for regional logistics activities. Additionally, the increasing adoption of advanced technologies in logistics operations is streamlining processes, reducing costs, and improving profit margins, thus contributing to ongoing development.

Market Challenges and Opportunities:

However, the logistics sector in the Philippines faces several structural challenges. Customs clearance remains slow, with delays extending to weeks due to outdated procedures and port congestion, leading to higher operational costs and unpredictability. Logistics companies often rely on manual processes, which increases error rates and limits scalability. The country's island geography results in high transport costs and poor connectivity for remote areas. Traffic congestion in urban centers like Manila slows down delivery times and raises fuel and labor expenses. Frequent natural disasters, such as typhoons and floods, further disrupt logistics operations, highlighting systemic weaknesses and the need for resilient infrastructure.

Despite these challenges, the Philippine logistics market offers a wealth of opportunities. The rapid growth in e-commerce and the demand for quicker delivery services are driving expansion in last-mile delivery, warehousing, and value-added services like reverse logistics and cash on delivery. Digital transformation through technologies like AI-based route optimization, real-time GPS tracking, and automated warehousing can greatly boost efficiency and customer satisfaction. Government investments in infrastructure under the "Build, Build, Build" initiative, including upgraded ports and roads, are expected to improve internal connectivity and reduce transit times. The growing need for cold-chain logistics—especially in pharmaceuticals, food, and healthcare—provides further opportunities for growth. Eco-friendly logistics and public-private partnerships enhance long-term prospects.

Key Growth Drivers

- Booming e‑commerce demand boosts need for fast, reliable delivery networks across urban and rural regions

- Government infrastructure programs improving roads, ports, and transport corridors

- Adoption of digital logistics tools like AI, IoT, and warehouse automation

- Rising demand for 3PL/4PL services as businesses outsource logistics operations

- Expansion of cold‑chain logistics for pharma, food, and healthcare sectors

- Urbanisation and growing middle class fueling domestic trade and FMCG demand

- Regulatory reforms and trade liberalization are attracting foreign logistics investment

Philippines Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, deployment type, user type, and industry vertical.

By Model Type:

- 2PL (Second-Party Logistics)

- 3PL (Third-Party Logistics)

- 4PL (Fourth-Party Logistics)

By Transportation Mode:

- Roadways

- Seaways

- Railways

- Airways

By End Use:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

By Region:

- Luzon

- Visayas

- Mindanao

Competitive Landscape:

The logistics market in the Philippines features a mix of established local firms, international players, and innovative startups:

· 2GO Group Inc.

· LBC Express Holdings Inc.

· Airfreight 2100 Inc. (Air21)

· J&T Express Philippines

· XDE Logistics Philippines Inc.

· AAI Group of Companies

· F2 Logistics Philippines, Inc.

· Ninja Van

· Entrego

· Lalamove

· GrabExpress

· Black Arrow Express

· Angkas

· Pickabar

· FedEx

· DHL

· C.H. Robinson

· Maersk

Philippines Logistics Market News:

· Philippine Airlines rebrands its logistics division to PAL Cargo in June 2025, emphasizing a digital-first, full-service cargo platform for individuals, freight forwarders, and corporations.

· FAST Logistics launches the Revv-Evodine Venture Studio in April 2025 — the country’s first logistics-focused startup incubator aimed at solving interoperability challenges across the supply chain.

· Maersk opened its largest Philippine distribution center (10-hectare Maersk Optimus) in Calamba, Laguna in November 2024, enhancing its contract logistics capabilities.

· C.H. Robinson inaugurated its Philippine office in June 2024 to deliver custom logistics solutions in support of growing demand.

· PHLPost upgraded its fleet with 22 new trucks (April 2024) to modernize last-mile delivery infrastructure.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for a customized sample: https://www.imarcgroup.com/request?type=report&id=31189&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group 134 N 4th St. Brooklyn, NY 11249, USA Email: Sales@imarcgroup.com Tel No.: (D) +91 120 433 0800 Americas: +1 631 791 1145