Philippines Dairy Market Size, Share, Trends, Growth, Analysis and Forecast from 2025 to 2033

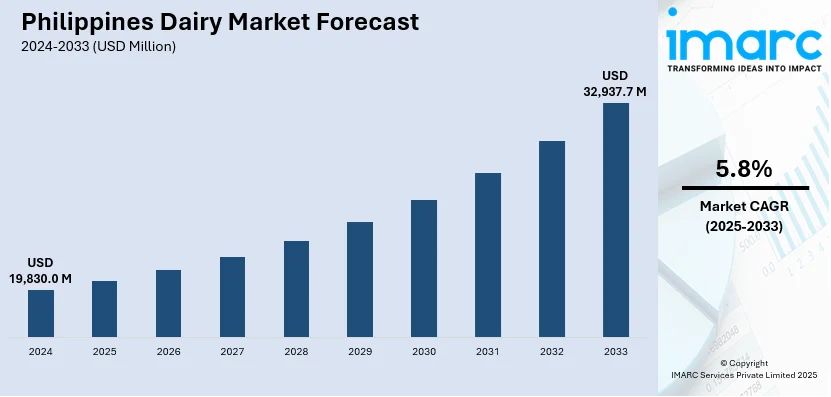

The Philippines dairy market size reached USD 19,830.0 Million in 2024 and is projected to grow to USD 32,937.7 Million by 2033, exhibiting a CAGR of 5.8% during 2025-2033.

The latest report by IMARC Group, “Philippines Dairy Market Report by Product Type (Liquid Milk, Flavored Milk, Cream, Butter, Cheese, Yoghurt, Ice Cream, Anhydrous Milk Fat (AMF), Skimmed Milk Powder (SMP), Whole Milk Powder (WMP), Whey Protein, Lactose Powder, Curd, and Others), and Region 2025-2033,” provides an in-depth analysis of the Philippines dairy market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines dairy market size reached USD 19,830.0 Million in 2024 and is projected to grow to USD 32,937.7 Million by 2033, exhibiting a CAGR of 5.8% during 2025-2033.

Report Attributes and Key Statistics:

| Report Attribute | Key Statistics |

|---|---|

| Base Year | 2024 |

| Forecast Years | 2025-2033 |

| Historical Years | 2019-2024 |

| Market Size in 2024 | USD 19,830.0 Million |

| Market Forecast in 2033 | USD 32,937.7 Million |

| Market Growth Rate 2025-2033 | 5.8% |

****

Philippines Dairy Market Overview:

The Philippines dairy market is growing as producers and retailers expand their offerings to meet the rising demand for nutritious and diverse dairy products. Companies are investing in modern retail infrastructure and developing innovative products. Government initiatives support local dairy production and food self-sufficiency. Key factors like rapid urbanization, rising disposable incomes, and growing health awareness are influencing market dynamics. Stakeholders focus on improving supply chain efficiency and working with international partners to boost local production and lessen import reliance.

Request For Sample Report: https://www.imarcgroup.com/philippines-dairy-market/requestsample

Philippines Dairy Market Trends and Drivers:

Manufacturers are launching fortified and value-added dairy products, including probiotic yogurts and functional beverages, to meet changing consumer preferences. The market is seeing more use of modern processing technologies and cold chain logistics, which ensure product quality and shelf life. Strategic partnerships with international dairy businesses are aiding technology transfer and knowledge sharing. The growth of modern retail channels and e-commerce is speeding up market penetration, while regulatory support for food safety and labeling builds consumer trust.

Key drivers include the growing demand for protein-rich and convenient foods, government investments in dairy infrastructure, and the development of urban retail networks. The market also benefits from increasing health awareness, the popularity of Western diets, and ongoing efforts to tackle malnutrition. Supportive policies for local milk production, along with growing collaborations between public and private sectors, are driving industry growth. The sector also gains from increased consumer education about the nutritional benefits of dairy products.

Market Opportunities and Challenges:

The Philippines dairy market presents a mix of significant opportunities and notable challenges. On the opportunity side, rising health consciousness among consumers is driving demand for nutrient-rich dairy products like milk, yogurt, and cheese. Urbanization and changing lifestyles are also contributing to the growth of ready-to-consume and value-added dairy items. Additionally, the expanding foodservice and hospitality sectors are fueling B2B demand, while improvements in cold chain infrastructure are enhancing product shelf life and distribution efficiency. The country’s high reliance on imported dairy opens up potential for local production and processing to reduce import dependency. Furthermore, growing interest in lactose-free, organic, and fortified dairy products is creating avenues for innovation and market diversification.

However, the market faces several challenges. The Philippines remains heavily dependent on imported dairy—particularly milk powder—making it vulnerable to global price fluctuations and supply chain disruptions. Domestic dairy production is limited due to low yields, inadequate feed supply, and underinvestment in local farming. Weak cold chain and logistics infrastructure in rural regions also hampers effective distribution. Price sensitivity among a large portion of the population restricts the growth of premium segments, while regulatory inconsistencies can pose compliance risks for both local and imported products. Additionally, the rise of plant-based alternatives may gradually impact traditional dairy consumption, especially among health-conscious and lactose-intolerant consumers.

Philippines Dairy Key Growth Drivers:

- Rising need for nutritious and protein-rich foods

- Rapid urbanization and changing lifestyles

- Government support for local dairy production

- Expansion of modern retail and e-commerce channels

- Increasing health consciousness among consumers

Key Highlights of the Report:

- Comprehensive market size and forecast for 2024-2033

- Detailed segmentation by product type and region

- Analysis of key growth trends, technological advancements, and government initiatives

- Competitive landscape with profiles of leading players and their strategies

- Insights into consumer behavior and retail channel evolution

- Evaluation of challenges and opportunities for local producers

Philippines Dairy Market Segmentation:

- Product Type Insights:

- Liquid Milk

- Flavored Milk

- Cream

- Butter

- Cheese

- Yoghurt

- Ice Cream

- Anhydrous Milk Fat (AMF)

- Skimmed Milk Powder (SMP)

- Whole Milk Powder (WMP)

- Whey Protein

- Lactose Powder

- Curd

- Others

- Regional Insights:

- Luzon

- Visayas

- Mindanao

Competitive Landscape:

- Detailed profiles of all major companies

- Market structure and key player positioning

- Top winning strategies and competitive dashboard

- Company evaluation quadrant

Philippines Dairy Market News:

- May 2024: Department of Trade and Industry (DTI) discusses major investment with Baladna for a fully integrated dairy facility, aligning with national food self-sufficiency goals.

- March 2024: Qatar’s Baladna seeks business partners for large-scale dairy ventures in the Philippines, including innovation hubs and agro-industrial parks.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=23612&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group 134 N 4th St. Brooklyn, NY 11249, USA Email: Sales@imarcgroup.com Tel. No.: (D) +91 120 433 0800 Americas: +1 631 791 1145