Over-The-Counter Hearing Aids Market Adoption Accelerates in Aging Populations

The OTC hearing aids market is on a robust growth trajectory, fueled by rising hearing loss prevalence, aging demographics, and the affordability gap between prescription and OTC products.

The global over-the-counter (OTC) hearing aids market size was valued at USD 1.06 billion in 2022 and is projected to reach USD 1.74 billion by 2030, growing at a CAGR of 6.6% from 2023 to 2030.

One of the primary growth drivers is the significantly lower cost of OTC hearing aids compared to prescription devices. The average cost of prescription hearing aids is approximately USD 4,600, whereas OTC hearing aids cost around USD 1,600. Additionally, Medicare and most insurance providers do not cover hearing aids, which further accelerates the demand for more affordable OTC options.

Market Drivers

- Rising prevalence of hearing loss: According to the World Health Organization (WHO), more than 1.5 billion people currently live with some level of hearing loss, and this number is expected to rise to 2.5 billion by 2050. Furthermore, over 460 million people experience disabling hearing loss today, a figure projected to surpass 700 million (1 in 10 people) by 2050.

- Aging population & noise exposure: Increasing life expectancy and higher levels of urban noise pollution contribute significantly to the growing incidence of hearing impairments.

- Product innovation: Manufacturers are investing in discreet, technologically advanced devices such as Behind-the-Ear (BTE), Invisible-in-Canal (IIC), and receiver-in-canal designs. These smaller devices fit closer to the eardrum, require less power, and deliver clearer, more natural sound.

For example, in October 2022, Lexie (hearX IP (Pty) Ltd.) launched the Lexie B2 receiver-in-canal OTC hearing aid in the U.S., strengthening the availability of discreet and affordable solutions.

Key Market Trends & Insights

- Regional Insights: North America dominated the market in 2022, holding 35.2% of the global share.

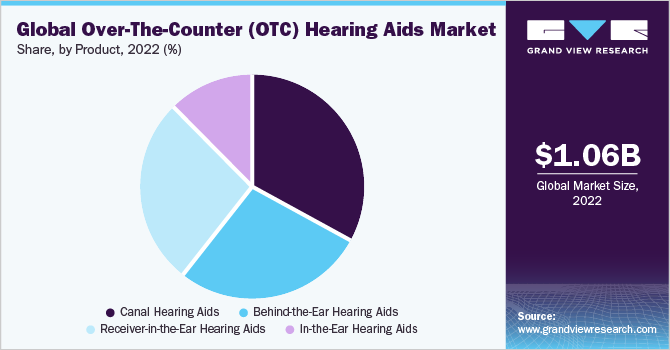

- Product Trends: The canal hearing aids segment accounted for the largest share at 32.9% in 2022.

- Technology Trends: Digital hearing aids represented a significant 93.3% revenue share in 2022, highlighting the transition from analog to digital technology.

- Distribution Channels: Retail stores held the largest share at 39.7%, though online channels are witnessing rapid growth.

Download a free sample PDF of the Over-the-Counter Hearing Aids Market Intelligence Study, published by Grand View Research.

Market Performance

- 2022 Market Size: USD 1.06 Billion

- 2030 Projected Market Size: USD 1.74 Billion

- CAGR (2023–2030): 6.6%

- North America: Largest market in 2022

Competitive Landscape

The OTC hearing aids market is highly competitive, with multinational and local players focusing on new product launches, regional expansion, and strategic collaborations.

- Eargo Inc. – Known for direct-to-consumer hearing solutions.

- Jabra (GN Store Nord A/S): In October 2022, launched Jabra Enhance Plus, an in-ear device that not only improves hearing but also supports music playback and call handling.

- MDHearing – Offers affordable, accessible OTC devices.

- Audicus – Focused on direct sales with competitive pricing.

- Sony Corporation – Expanding into OTC hearing aids with advanced sound technologies.

- Start Hearing – Provides accessible solutions with a wide product range.

- Lexie (hearX IP (Pty) Ltd.): Innovating in discreet, affordable designs like Lexie B2.

Key Companies

- Eargo Inc.

- Jabra (GN Store Nord A/S)

- MDHearing

- Audicus

- Sony Corporation

- Start Hearing

- Lexie (hearX IP (Pty) Ltd.)

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The OTC hearing aids market is on a robust growth trajectory, fueled by rising hearing loss prevalence, aging demographics, and the affordability gap between prescription and OTC products. As more companies introduce discreet, technologically advanced, and affordable solutions, OTC devices are expected to play a pivotal role in addressing the global hearing health challenge.