North America Beer Market 2030: From Taproom to Table—The Experience Economy

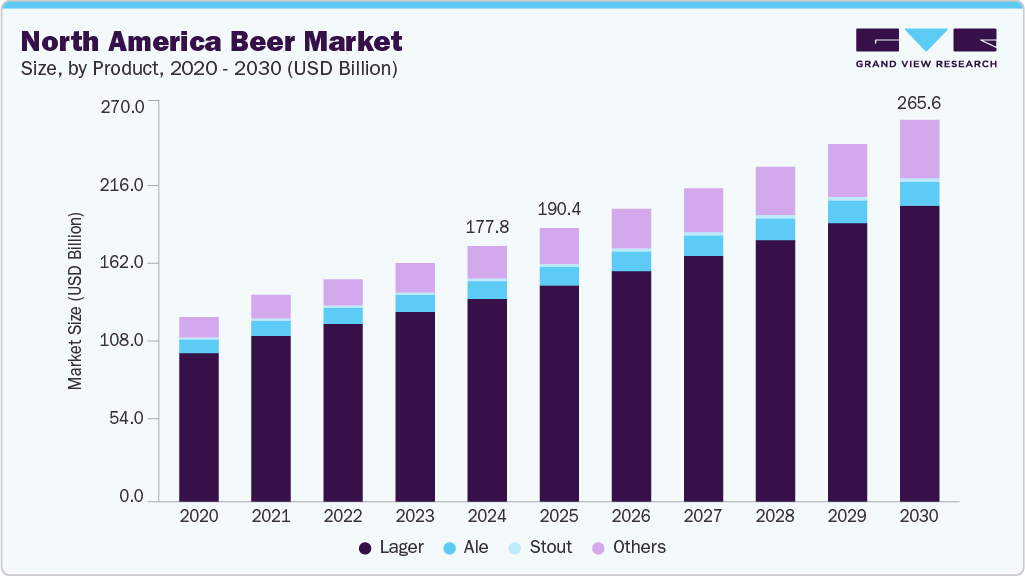

The North America beer market size is anticipated to reach USD 265.64 billion by 2030 and is expected to expand at a CAGR of 6.9% during the forecast period.

The North America beer market size is anticipated to reach USD 265.64 billion by 2030 and is expected to expand at a CAGR of 6.9% during the forecast period, according to a new report by Grand View Research, Inc. Consumers across the U.S., Canada, and Mexico are increasingly seeking unique flavor profiles, artisanal quality, and locally sourced ingredients, which has led to a surge in microbreweries and independent craft producers. This trend reflects a broader cultural movement favoring authenticity and experiential consumption, especially among younger demographics willing to pay a premium for differentiated products.

In addition, to the craft beer boom, the market is benefiting from the rising popularity of low-alcohol and non-alcoholic beer options. Health-conscious consumers gravitate toward beverages that align with wellness trends, prompting breweries to innovate with low-calorie, organic, and functional beer varieties. This diversification expands the consumer base and creates new growth avenues for regional producers.

Adopting direct-to-consumer sales models and expanding online retail channels are also reshaping the market landscape. Breweries are leveraging digital platforms to reach consumers more efficiently, bypassing traditional distribution bottlenecks and offering personalized experiences. This shift is particularly advantageous for smaller producers, enabling them to scale their operations and build brand loyalty in a competitive environment.

Furthermore, the region’s strong brewing heritage and robust infrastructure support market growth. The U.S. remains the dominant force, accounting for most beer volume sales, while Canada and Mexico are emerging as vibrant markets with increasing consumption and production capacity. Government support, favorable trade policies, and the rise of beer tourism reinforce the sector’s resilience and long-term potential.

Order a free sample PDF of the North America Beer Market Intelligence Study, published by Grand View Research.

Further key findings from the report suggest:- By product, lager beer accounted for a revenue share of 79.3% in 2024.

- By packaging, canned beer accounted for a share of 66.0% of the North America revenue in 2024.

- By production, macro brewery accounted for a revenue share of 61.9% in 2024.

- By distribution channel, sales of beer through on-trade channels accounted for a revenue share of 51.9% in 2024.

- In January 2025, Anheuser-Busch launched Michelob ULTRA Zero, an alcohol-free beer. Targeting health-conscious and active consumers, this new brew offers just 29 calories-about half that of many leading non-alcoholic beers-while maintaining the refreshing taste associated with the Michelob ULTRA brand.

List of Key Players in the North America Beer Market

- AB InBev

- Heineken N.V.

- Carlsberg Breweries A/S

- Molson Coors Beverage Company

- Asahi Group Holdings, Ltd.

- Diageo

- China Resources North America Beer (Holdings) Company Limited

- Boston North America Beer Co.

- Kirin Holdings Company, Limited.

- Beijing Yanjing North America Beer Group Corporation

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.