Military Wearables Market 2030: How Data Analytics is Shaping Warfare

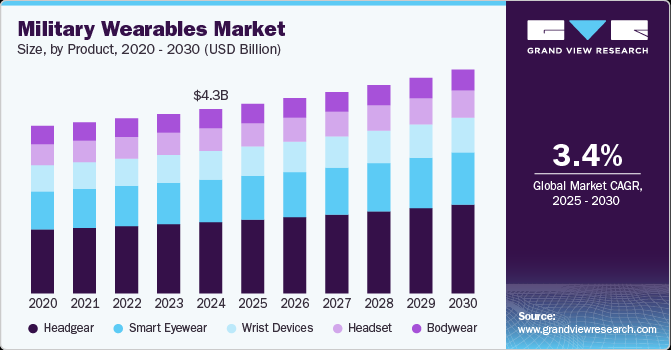

The global military wearables market, estimated at USD 4,358.3 million in 2024 and poised for a steady march forward, projected to grow at a CAGR of 3.4% from 2025 to 2030.

Imagine the modern soldier, no longer just clad in uniform, but augmented by a network of intelligent threads woven into their very gear. This is the unfolding story of the global military wearables market, estimated at USD 4,358.3 million in 2024 and poised for a steady march forward, projected to grow at a CAGR of 3.4% from 2025 to 2030. This isn't just about equipping troops; it's about supercharging their capabilities through a new generation of sophisticated technology.

Think of smart helmets whispering vital information, exoskeletons lending superhuman strength, body armor embedded with perceptive sensors, and communication systems weaving a seamless web across the battlefield. These advanced wearables are no longer a futuristic fantasy; they are becoming integral to modern military strategies, enhancing situational awareness, enabling real-time communication, and vigilantly monitoring the health and well-being of personnel in the heat of mission.

The winds of innovation are further propelling this market, with trends like the increasing integration of artificial intelligence (AI) and machine learning (ML) promising predictive health insights for soldiers. Augmented reality (AR) is poised to paint a richer picture of the battlefield, while smart textiles with embedded sensors will track every nuance of a soldier's performance. Moreover, the focus on wearable exoskeletons and sensor-enabled body armor is sharpening, all aimed at boosting soldier resilience and maximizing operational effectiveness. With global defense budgets on the rise, particularly in the technological powerhouses of North America, Europe, and Asia-Pacific, the demand for these force-multiplying military wearables is set to grow steadily, creating a fertile ground for tech pioneers and manufacturers

Get a preview of the latest developments in the Military Wearables Market; Download your FREE sample PDF copy today and explore key data and trends

Giants of the defense industry, the likes of Lockheed Martin, Boeing, Raytheon Technologies, and Thales Group, are leading this charge, pouring significant resources into research and development to unleash groundbreaking wearable solutions for defense applications. Their focus? Crafting advanced systems that elevate soldier capabilities, streamline communication, enhance health monitoring, and ultimately ensure mission success. Recognizing the sensitive nature of defense data, cybersecurity integration is also climbing the priority list for these military wearables.

Looking ahead, the military wearables landscape is projected to witness significant evolution, fueled by continuous advancements in AI, sensor technologies, and robust data protection. As defense forces increasingly recognize the transformative potential of these technologies in enhancing soldier performance, mitigating operational risks, and sharpening decision-making, the demand for wearable solutions is set to surge. With mission preparedness and the delivery of real-time intelligence taking center stage, military wearables are poised to become an indispensable component of future defense efforts, shaping the very fabric of warfare well into the next decade.

Detailed Segmentation

Product Insights

The Headgear segment accounted for the largest market share of over 37% in 2024. The tactical helmet segment is experiencing the fastest growth, driven by the increasing adoption of advanced technologies to enhance soldier safety and environmental awareness. Modern tactical helmets now incorporate augmented reality (AR) displays, built-in communication systems, and health sensors, enabling soldiers to access real-time battlefield data, maintain seamless communication, and remain operational in high-stress conditions. The growing emphasis on soldier protection, along with technological advancements in lightweight and durable materials, is fueling the widespread adoption of tactical helmets, making them an essential piece of equipment for military units worldwide. As technology continues to evolve, next-generation helmets will feature even more sophisticated capabilities, further reinforcing their importance in modern warfare.

Technology Insights

The communication segment accounted for the largest market share in the military wearables market, driven by the critical need for secure and efficient communication in defense operations. As military forces become increasingly dependent on real-time information sharing, integrated communication systems within wearables-such as tactical helmets and wrist devices-have become indispensable. These systems ensure uninterrupted connectivity in harsh environments, where traditional communication methods may be ineffective. Additionally, the adoption of 5G technology, enhanced encryption techniques, and satellite communication is further fueling the demand for advanced military communication solutions. The ability to securely transmit large volumes of data in real-time remains a top priority, solidifying this segment's leading position in the market.

End-user Insights

The Land Forces segment is expected to grow at the fastest CAGR between 2025 and 2030, primarily driven by the rising adoption of wearable technology to enhance soldier performance, safety, and combat communication. Advanced wearables such as tactical helmets, intelligent vision equipment, and sensor-integrated body armor are significantly improving operational capabilities, real-time information delivery, and situational awareness. As warfare tactics evolve, land-based troops are at the forefront of integrating next-generation wearable technologies to gain tactical superiority, enhance mobility, and safeguard troop health in various combat environments. This segment is also benefiting from increased defense technology investments and continuous upgrades of troop equipment to meet modern battlefield requirements.

Regional Insights

North America military wearables market dominates the global industry, accounting for over 41% of total market revenue. The United States, the world’s largest defense spender, is the primary driver of this growth due to continuous investments in military technology. The U.S. military is rapidly adopting wearables to enhance soldier efficiency, enable real-time communication, and improve health monitoring. Additionally, the integration of Artificial Intelligence (AI), machine learning (ML), and cybersecurity features into military wearables is further accelerating market expansion. With ongoing modernization efforts and a strong focus on technological advancement, North America is expected to maintain its market dominance from 2025 to 2030.

Key Military Wearables Companies:

The following are the leading companies in the military wearables market. These companies collectively hold the largest market share and dictate industry trends.

- BAE Systems

- Elbit Systems

- Rheinmetall

- Saab

- Rheinmetall

- Aselsan

- General Dynamics

- Garmin

- Lockheed Martin

- Honeywell International Inc.

- L3harris Technologies Inc.

- Leonardo S.p.A.

Military Wearables Market Segmentation

Grand View Research has segmented the global military wearables market report based on product, technology, end-user, and region:

- Product Outlook (Revenue, USD Million, 2018 - 2030)

- Headgear

- Smart Eyewear

- Wrist Devices

- Headset

- Bodywear

- Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Communication

- Network and Connectivity

- Imaging & Surveillance

- Navigation

- Intelligent Fabric

- Other

- End-user Outlook (Revenue, USD Million, 2018 - 2030)

- Land Forces

- Naval Forces

- Air Forces

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- North America

Curious about the Military Wearables Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In December 2024, BAE Systems has signed a £133 million contract with the Eurofighter Typhoon consortium (Germany, Italy, Spain, and the UK) to continue developing its Striker II Helmet Mounted-Display (HMD). The helmet brings together cutting-edge technologies, such as digital night vision and a color display, to deliver mission-critical information to the pilot in real-time on their visor. The deal will concentrate on developing the capabilities of the helmet through flying trials and solidifying its leadership position in military wearables for flight.

- In July 2024, Viasat launched the Secure Wireless Hub (SWH), a wearable tactical communications system for dismounted troops. Co-developed with U.S. Special Operations Command (USSOCOM), the system provides a light, single-unit tactical gateway that improves network connectivity and situational awareness for ground troops. Weighing less than one kilogram, the SWH minimizes size, weight, and power (SWaP), easily integrating with body armor. It gives interoperability between a range of devices and supplies secure VPN capability, allowing dependable connectivity and data sharing in near real-time while in combat mode

- Thales Group partnered with the French Ministry of Armed Forces in February 2024 to provide next-generation integrated combat systems for wearable devices. This includes the creation of connected helmets, body-worn sensors, and intelligent communication systems for soldiers. These wearables are intended to enhance soldier survivability, health monitoring, and data transmission on the battlefield. The objective of the partnership is to keep the French military in the lead of wearable defense technology.