Military Drone Market Forecast: Charting the Path to 2030

The global military drone market was valued at USD 40.53 billion in 2024 and is anticipated to reach USD 87.63 billion by 2030.

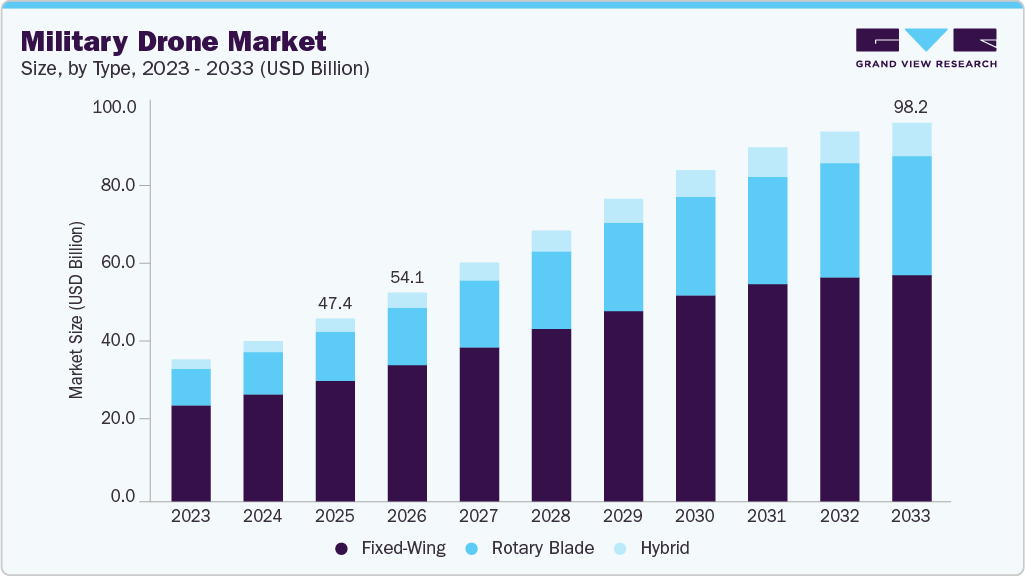

The global military drone market was valued at USD 40.53 billion in 2024 and is anticipated to reach USD 87.63 billion by 2030, growing at a CAGR of 13.9% from 2025 to 2030. This growth is largely fueled by increasing defense budgets, the rising use of unmanned aerial vehicles (UAVs) in surveillance and combat missions, rapid technological advancements, and growing demand for intelligence, surveillance, and reconnaissance (ISR) across military operations.

Adoption of military drones is being significantly boosted by innovations that improve operational performance. These include advanced sensor technologies, high-resolution imaging systems, state-of-the-art avionics, and real-time connectivity via next-generation networks like 5G. Such technological progress enables drones to execute critical missions—ranging from ISR and target acquisition to precision strikes—with greater accuracy and efficiency, further accelerating the market’s expansion.

Moreover, the strategic role of drones in modern warfare, especially their capabilities in multi-domain operations and swarm tactics, is prompting defense agencies to invest heavily in drone procurement and modernization programs. Drones are increasingly viewed as cost-effective alternatives to manned aircraft, driving governments to expand their UAV fleets. In particular, the Asia-Pacific region—led by countries like India and China—is seeing significant growth, driven by ongoing military modernization efforts and rising regional security challenges, positioning it as one of the fastest-growing markets in the coming years.

Order a free sample PDF of the Military Drone Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: North America held the largest market share in 2024, accounting for over 39% of global revenue. This dominance is attributed to the increasing use of drones for rapid delivery of supplies and equipment in complex military operations, including to remote or hostile areas where traditional logistics face limitations.

- By Type: The fixed-wing drone segment led the market with a 64%+ revenue share in 2024. Key drivers include integration of AI-enabled avionics, extended surveillance endurance, and autonomous ISR capabilities, especially amid escalating geopolitical tensions and defense modernization initiatives.

- By Operation Mode: The remotely piloted segment was the market leader in 2024. Rising demand for real-time situational awareness, precision targeting, and pilot risk reduction through remote operations are critical factors behind its dominance.

- By Range: The beyond visual line of sight (BVLOS) segment is projected to grow at the highest CAGR of over 17% in 2024. Growth in this area is driven by increased use in long-range reconnaissance, deep-penetration surveillance, and precision strike missions conducted beyond the operator's direct view.

- By Application: Intelligence, surveillance, and reconnaissance (ISR) remained the dominant application area in 2024. Investments in real-time battlefield intelligence, miniaturized sensors, and AI-powered data analytics are enhancing mission capabilities and decision-making speed.

- By Maximum Take-Off Weight (MTOW): The 150–1000 kg category led the market in 2024. These drones are particularly suited for advanced ISR missions, integration of precision-guided weapons, and use in maritime and border security operations.

- By End-Use: The air force segment held the largest share in 2024, supported by growing investment in remotely piloted aircraft, AI-driven autonomous systems, and collaborative combat technologies aimed at enhancing manned-unmanned teaming in network-centric warfare.

Market Size & Forecast

- 2024 Market Size: USD 40.53 Billion

- 2030 Projected Market Size: USD 87.63 Billion

- CAGR (2025-2030): 13.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

Key Companies & Market Share Insights

Prominent players in the global military drone market include:

- Northrop Grumman Corporation – A leading provider of advanced aerospace and defense technologies, offering unmanned systems, autonomous technologies, C4ISR, missile defense, and space systems. Its product suite supports military aircraft, weapon systems, and modernization services globally.

- Lockheed Martin Corporation – A major defense contractor with expertise in aeronautics, missiles, fire control, rotary and mission systems, and space technologies. Its diverse portfolio includes UAVs, advanced sensors, and networked combat systems.

Emerging companies include:

- Shield AI Inc. – Specializes in AI-powered autonomous flight systems for military drones. Known for its product Nova, capable of operating in GPS-denied environments, Shield AI supports reconnaissance and tactical operations with minimal human input.

- SZ DJI Technologies Co., Ltd. – Although widely known for its consumer and commercial drone products, DJI also develops UAV solutions for emergency services, infrastructure inspection, and security applications, potentially crossing over into military and dual-use domains.

Key Players

- Northrop Grumman Corporation

- RXT Corporation

- Israel Aerospace Industries Ltd.

- General Atomics Aeronautical Systems Inc.

- Teledyne FLIR LLC

- Lockheed Martin Corporation

- Boeing

- BAE Systems plc

- Elbit Systems Ltd.

- Thales Group

- Textron Inc

- AeroVironment Inc

- Leonardo S.p.A.

- Turkish Aerospace Industries

- Insitu Inc

- Shield AI Inc.

- Baykar

- SZ DJI Technologies Co. Ltd

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The military drone market is experiencing robust and sustained growth, underpinned by rising geopolitical tensions, rapid technological evolution, and a global shift towards unmanned and autonomous warfare capabilities. With a projected CAGR of 13.9% through 2030, the industry is poised for continued expansion, especially in regions investing heavily in defense modernization such as Asia-Pacific.

North America will likely retain its leadership position in the near term, while emerging players and evolving technologies—such as AI, 5G, and BVLOS capabilities—will shape the competitive landscape. The expanding scope of drone applications in ISR, combat, logistics, and surveillance is expected to keep demand high, making military drones an essential component of future defense strategies worldwide.