Intrusion Detection & Prevention Systems Market: Balancing Safety and Compliance

The global intrusion detection and prevention systems (IDPS) market was valued at USD 6.25 billion in 2024 and is expected to reach USD 12.14 billion by 2030.

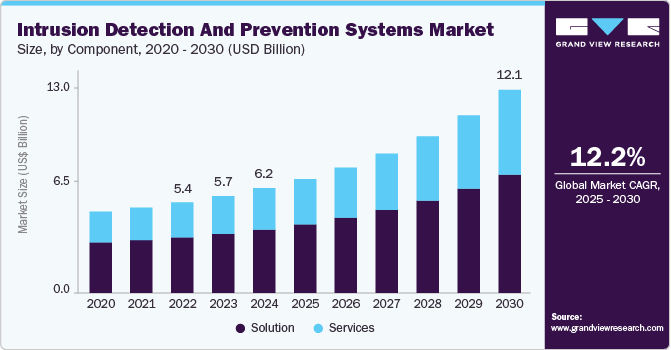

The global intrusion detection and prevention systems (IDPS) market was valued at USD 6.25 billion in 2024 and is expected to reach USD 12.14 billion by 2030, registering a CAGR of 12.2% from 2025 to 2030. Market growth is primarily driven by the increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies, which enable real-time threat detection, faster response, and more proactive cybersecurity strategies.

A major factor supporting market expansion is the rising frequency and sophistication of cyberattacks, including data breaches, ransomware, and Distributed Denial of Service (DDoS) attacks. As organizations continue their digital transformation journeys, protecting networks, endpoints, and sensitive data has become a critical challenge. In addition, regulatory standards such as GDPR, HIPAA, and PCI-DSS are enforcing stricter cybersecurity requirements, encouraging organizations to deploy real-time intrusion detection and prevention solutions to ensure compliance and reduce risk.

The growing adoption of cloud computing is another significant trend shaping the IDPS market. As enterprises migrate applications and workloads to cloud environments, new security vulnerabilities emerge, requiring IDPS solutions that can effectively protect cloud-based and hybrid infrastructures. Scalable solutions capable of operating across hybrid and multi-cloud environments are increasingly in demand. Moreover, the rapid expansion of Internet of Things (IoT) devices has increased network complexity and expanded the attack surface, further intensifying the need for advanced intrusion detection and prevention mechanisms.

The increasing reliance on managed security services is also accelerating market growth. Managed services allow organizations—particularly small and medium-sized enterprises (SMEs)—to access comprehensive IDPS capabilities through subscription-based models without large upfront investments in infrastructure or specialized personnel. These services provide benefits such as continuous monitoring, scalability, and expert incident response. At the same time, advancements in AI and ML are enhancing IDPS performance by improving real-time threat identification, minimizing false positives, and adapting to evolving attack techniques. The adoption of Zero Trust Architecture further emphasizes the importance of IDPS, as these systems function as continuous enforcement layers that monitor and validate traffic, users, devices, and workloads across the network.

Order a free sample PDF of the Intrusion Detection And Prevention Systems Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: North America accounted for over 35% of the global IDPS market share in 2024. The region has experienced a surge in ransomware and Advanced Persistent Threat (APT) attacks targeting sectors such as critical infrastructure, finance, and healthcare. The increasing use of double extortion tactics has accelerated demand for automated intrusion prevention solutions. Initiatives led by the U.S. Cybersecurity & Infrastructure Security Agency (CISA), including real-time threat intelligence sharing, are strengthening national cybersecurity defenses. As a result, organizations are increasingly transitioning from signature-based detection methods to behavior-driven IDPS solutions to improve accuracy and response times.

- Component Insights: The solution segment dominated the market, accounting for over 60% of revenue in 2024. AI-enabled IDPS solutions are gaining widespread adoption due to their ability to analyze network behavior in real time and identify advanced threats that bypass traditional security tools. Rising incidents of ransomware and APTs are driving demand for solutions that offer automated threat response. Additionally, cloud-based IDPS solutions are gaining momentum due to their scalability and compatibility with hybrid IT environments. Regulatory compliance requirements such as GDPR and CCPA continue to support demand for advanced intrusion prevention solutions.

- Type Insights: The network-based segment held the largest revenue share in 2024. The expansion of hybrid and multi-cloud infrastructures is increasing demand for network-based IDS/IPS solutions capable of monitoring complex environments. With the rise of remote work, organizations are securing VPN and SD-WAN connections using network-based intrusion prevention technologies. AI-powered behavioral analytics are further enhancing anomaly detection and proactive threat identification.

- Technology Insights: The hybrid IDS segment is expected to grow at a significant rate during the forecast period. Organizations are adopting hybrid IDS solutions to address security challenges across hybrid cloud environments. These systems provide real-time behavioral analysis across multiple attack vectors and can scale dynamically in response to fluctuating network traffic. Integration with Security Orchestration, Automation, and Response (SOAR) platforms is also improving automated threat remediation.

- Deployment Insights: The on-premises segment accounted for the largest market share in 2024. Despite increasing cloud adoption, many organizations—particularly those handling sensitive data such as government agencies and financial institutions—continue to prefer on-premises IDPS solutions for enhanced control and data sovereignty. The incorporation of AI and ML into on-premises systems is improving threat detection accuracy and reducing false positives while maintaining low latency.

- Organization Size Insights: Large enterprises dominated the market in 2024, driven by their need to combat complex and sophisticated cyber threats. These organizations are increasingly integrating IDS/IPS with extended detection and response (XDR) platforms to enhance visibility across enterprise environments. Compliance with international cybersecurity frameworks such as ISO 27001 and NIST further supports adoption among large enterprises.

- Vertical Insights: The BFSI sector accounted for over 25% of total market revenue in 2024. Financial institutions are deploying AI-driven IDPS solutions to address increasing cyber fraud, phishing attacks, and insider threats. Regulatory mandates such as PCI DSS and GDPR are reinforcing the need for advanced intrusion detection capabilities. The growth of digital banking services is also driving demand for cloud-based IDPS solutions to secure online financial transactions.

Market Size & Forecast

- 2024 Market Size: USD 6.25 Billion

- 2030 Projected Market Size: USD 12.14 Billion

- CAGR (2025-2030): 12.2%

- North America: Largest market in 2024

Key Companies & Market Share Insights

Leading companies in the intrusion detection and prevention systems market are implementing strategies such as partnerships, geographic expansion, and product innovation to strengthen their market presence. These initiatives aim to broaden product portfolios, enhance technological capabilities, and address evolving cybersecurity challenges across industries.

Key Players

- Allegion plc

- ASSA ABLOY

- BAE System

- Cisco System, Inc.

- Fortinet, Inc

- IBM Corporation

- Palo Alto Networks

- Robert Bosch GmbH

- Secureworks, Inc.

- Sophos Ltd

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The intrusion detection and prevention systems market is poised for strong growth, supported by rising cyber threats, regulatory pressures, and the increasing adoption of cloud, IoT, and Zero Trust security models. With the market projected to reach USD 12.14 billion by 2030 at a CAGR of 12.2%, IDPS solutions are becoming an essential component of modern cybersecurity frameworks. Continued advancements in AI, machine learning, and managed security services will further enhance detection accuracy, automation, and scalability, positioning IDPS as a critical defense layer for organizations across all major industries.