Internet Data Center Market 2030: Insights into Global Growth

The global internet data center (IDC) market was valued at USD 48.70 billion in 2022 and is expected to reach USD 107.26 billion by 2030.

The global internet data center (IDC) market was valued at USD 48.70 billion in 2022 and is expected to reach USD 107.26 billion by 2030, expanding at a CAGR of 10.6% between 2023 and 2030. The rapid increase in data generation and processing is driven by the widespread adoption of connected devices, the Internet of Things (IoT), and enterprise-level digital transformation initiatives.

Internet data centers continuously monitor critical parameters such as insulation resistance, leakage current, and partial discharge activity. By detecting early indicators of insulation degradation, insulation monitoring devices (IMDs) support proactive maintenance and preventive actions, thereby reducing the risk of equipment damage, power interruptions, and fire-related hazards.

Demand for IDC services from cloud service providers (CSPs) continues to rise as organizations increasingly migrate their IT workloads to cloud environments. This shift has significantly accelerated investments in data center infrastructure. Geographic distribution has also become a crucial factor in IDC market growth. The expansion of edge computing—where data processing is performed closer to the data source—has gained momentum to minimize latency and support real-time applications. Additionally, strict data protection regulations, disaster recovery requirements, and business continuity planning have compelled enterprises to invest in high-quality IDC facilities. These centers provide robust security, redundancy, and reliable power and cooling systems, enabling uninterrupted operation of critical IT workloads.

As real-time and latency-sensitive data processing requirements increase, organizations are increasingly deploying edge computing solutions that position data centers nearer to data generation points. Edge data centers operated by IDCs enhance response times and support advanced applications such as IoT, autonomous vehicles, and augmented reality. This shift toward edge computing has introduced new growth opportunities and operational demands within the IDC market. Nonetheless, the continued expansion of cloud services remains the primary driver of IDC market growth, with CSPs consistently scaling their data center capacities to meet growing demand for cloud-based solutions.

Order a free sample PDF of the Internet Data Center Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: North America accounted for approximately 39% of the global market share in 2022. The region’s strong economic environment and favorable business ecosystem contribute to market growth. IDC services are widely adopted across industries such as e-commerce, entertainment, finance, and healthcare. North America’s role as a global financial hub further strengthens IDC demand, as financial institutions require secure, compliant, and reliable data storage solutions. The rising adoption of FinTech platforms and online banking services continues to support market expansion.

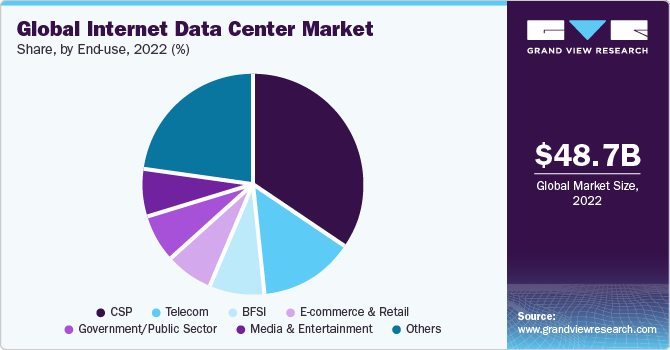

- End-Use Insights: The CSP segment generated the largest revenue share, accounting for around 35% in 2022. CSPs play a central role in advancing cloud computing by offering Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). These offerings provide scalable, on-demand, and cost-efficient solutions that rely heavily on IDC infrastructure. The globalization of digital services has prompted CSPs to establish data centers worldwide, enabling efficient service delivery to a broad customer base.

- Service Insights: Colocation services held the largest share of approximately 45% of the IDC market in 2022. Their growing adoption is largely attributed to cost efficiency. Building and maintaining private data centers requires high capital investment and ongoing operational expenses. Colocation allows enterprises to share infrastructure resources, significantly reducing costs while benefiting from a flexible pay-as-you-use model.

- Deployment Insights: Public deployment accounted for over 52% of total revenue in 2022. The growing need for scalable and economical cloud solutions has driven this segment’s growth. Leading cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud continue to expand their global data center footprints. Public cloud deployments allow organizations to avoid large upfront infrastructure investments and adjust capacity based on demand.

- Enterprise Size Insights: Large enterprises represented 83% of total revenue in 2022. These organizations operate data-intensive applications that require advanced computing power, networking, and storage capabilities. IDCs provide the scalability and performance needed to support data analytics, artificial intelligence, and machine learning initiatives. The increasing adoption of big data technologies continues to drive IDC demand among large enterprises.

Market Size & Forecast

- 2022 Market Size: USD 48.70 Billion

- 2030 Projected Market Size: USD 107.26 Billion

- CAGR (2023-2030): 10.6%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

The IDC market is highly competitive, with leading players focusing on innovation and energy efficiency. Companies are investing heavily in research and development to design sustainable and energy-efficient data center solutions while expanding their customer base. For example, in September 2023, Google, Microsoft, Schneider Electric, and Danfoss, in collaboration with the Danish Data Center Industry, launched the Net Zero Innovation Hub for Data Centers in Fredericia, Denmark. This initiative aims to accelerate the transition toward environmentally sustainable data center infrastructure across Europe.

Key Players

- Alibaba Cloud

- Amazon Web Services, Inc.

- AT&T Intellectual Property

- Lumen Technologies (CenturyLink)

- China Telecom Americas, Inc.

- CoreSite

- CyrusOne

- Digital Realty

- Equinix, Inc.

- Google Cloud

- IBM

- Microsoft

- NTT Communications Corporation

- Oracle

- Tencent Cloud

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global internet data center market is experiencing strong and sustained growth, driven by the expansion of cloud computing, rising data volumes, and increasing adoption of edge computing solutions. With a projected market value of USD 107.26 billion by 2030 and a CAGR of 10.6%, IDCs are becoming essential enablers of digital transformation across industries. Regional expansion, technological advancements, and sustainability-focused initiatives are further shaping market dynamics. As enterprises continue to prioritize scalability, security, and efficiency, internet data centers will remain a critical component of the global digital ecosystem.