Insurtech Market Booms as AI and Automation Reshape the Insurance Landscape

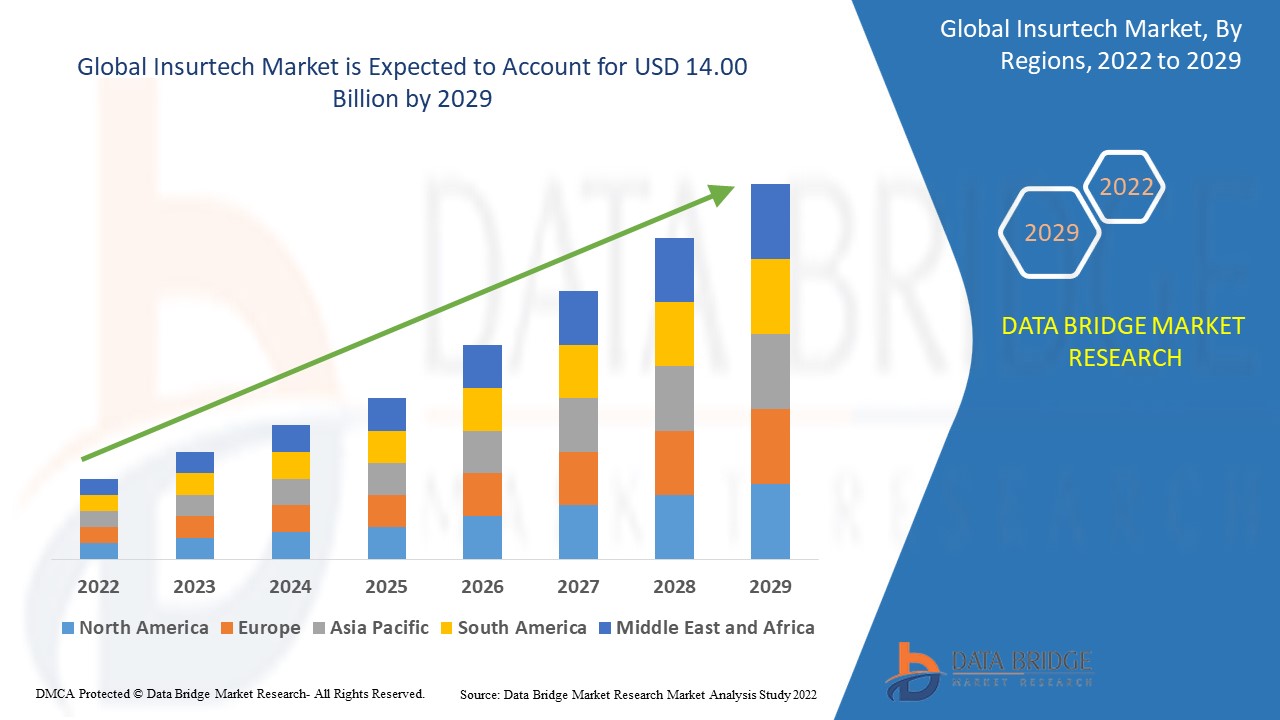

Global Insurtech market size was valued at USD 5.16 billion in 2023 and is projected to reach USD 19.53 billion by 2031, with a CAGR of 18.10% during the forecast period of 2024 to 2031

"Executive Summary Insurtech Market :

Global Insurtech market size was valued at USD 5.16 billion in 2023 and is projected to reach USD 19.53 billion by 2031, with a CAGR of 18.10% during the forecast period of 2024 to 2031

Analysis and interpretation of market research data is used to build this Insurtech Market industry report which contains information and knowledge that can be used to predict future events, future products, marketing strategy, actions or behaviours. This market analysis and information given in it provides the insights which bring marketplace clearly into focus and thus help organizations make better decisions. In this era of globalization, many businesses insist for International market research to support decision making and Insurtech Market report does the same. It includes systematic gathering and analysis of information about individuals or organisations which is conducted through social and opinion research.

While preparing this Insurtech Market report, individuality of respondents is kept secret and no promotional approach is made to them. And even though individuals provide information, market research team skilfully and valuably handles it. Not to mention, precise and exact information is provided to drive your business in the right direction with this report and that to at the best price. The basic steps have been employed to conduct market research analysis in this Insurtech Market report which includes survey, focus groups, personal interviews, observations and field trials.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Insurtech Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-insurtech-market

Insurtech Market Overview

Segments

-

Insurance Software: The insurance software segment is dominating the insurtech market as advancements in technology have enabled insurance companies to streamline their operations, enhance customer experience, and improve risk management. Insurance software solutions such as policy administration systems, claims management software, and underwriting platforms are in high demand.

-

Services: The services segment of the insurtech market includes consulting services, implementation services, and support & maintenance services. With the increasing adoption of insurtech solutions, there is a growing need for specialized services to help insurance companies integrate these technologies effectively.

-

Insurance Type: The insurtech market is segmented based on insurance types such as life insurance, health insurance, property & casualty insurance, and others. Each of these insurance segments has unique requirements and challenges that can be addressed through insurtech solutions.

Market Players

-

Lemonade Inc.: Lemonade is a well-known insurtech company that leverages artificial intelligence and behavioral economics to offer homeowners and renters insurance. The company has gained popularity for its fast and easy online insurance platform.

-

ZhongAn: ZhongAn is a leading Chinese insurtech company that focuses on using technology to disrupt the traditional insurance market. The company offers a wide range of insurance products and services, including healthcare, travel, and consumer finance insurance.

-

PolicyBazaar: PolicyBazaar is one of the largest online insurance marketplaces in India that has revolutionized the way insurance is bought and sold in the country. The platform offers a wide range of insurance products from leading insurance companies.

-

Metromile: Metromile is a U.S.-based insurtech company that specializes in pay-per-mile car insurance. The company uses telematics technology to track drivers' mileage and offer customized insurance plans based on actual usage.

In conclusion, the global insurtech market is experiencing rapid growth driven by advancements in technology, changing consumer preferences, and the need for more efficient insurance solutions. Companies like Lemonade Inc., ZhongAn, PolicyBazaar, and Metromile are at the forefront of this market, offering innovative products and services that cater to the evolving needs of the insurance industry.

The insurtech market continues to evolve with the advancement of technology and the changing landscape of the insurance industry. One of the key trends shaping the market is the increasing focus on personalized insurance solutions. Insurtech companies are utilizing data analytics, artificial intelligence, and machine learning to tailor insurance products to individual customer needs. This shift towards personalized offerings not only enhances customer experience but also helps in better risk assessment and pricing, leading to improved profitability for insurance companies.

Another significant trend in the insurtech market is the rise of usage-based insurance models. Companies like Metromile are pioneering the use of telematics technology to track drivers' behavior and offer insurance plans based on actual vehicle usage. This shift towards pay-per-mile or pay-as-you-drive insurance models is gaining popularity among consumers looking for more flexible and cost-effective insurance options. As technology continues to advance, we can expect to see more innovative usage-based insurance solutions entering the market.

Moreover, the insurtech market is witnessing increased collaborations between traditional insurance companies and insurtech startups. These partnerships allow traditional insurers to leverage the technological expertise of insurtech companies to modernize their operations, improve customer engagement, and stay competitive in the evolving market landscape. By combining the industry knowledge of traditional insurers with the innovation of insurtech startups, these collaborations are driving digital transformation within the insurance sector.

Furthermore, regulatory changes and compliance requirements are also playing a significant role in shaping the insurtech market. As the regulatory landscape evolves to address emerging risks and challenges in the digital age, insurtech companies are required to adapt their offerings to comply with new regulations. This can present both opportunities and challenges for companies operating in the insurtech space, as regulatory compliance becomes a key consideration in developing and launching new insurance products and services.

In conclusion, the insurtech market is poised for continued growth and innovation as technology continues to reshape the insurance industry. Companies that can adapt to changing consumer demands, leverage advanced technologies, and navigate regulatory complexities will be well-positioned to thrive in this dynamic market. As insurtech solutions continue to gain traction globally, we can expect to see further disruption and transformation within the insurance sector in the coming years.The insurtech market is a dynamic and evolving landscape characterized by innovation, technological advancements, and shifting consumer demands. One key trend that is shaping the market is the increasing focus on digital customer experience. Insurtech companies are leveraging technology to enhance customer interactions, streamline processes, and provide personalized solutions. With the rise of digital platforms and mobile applications, insurers are now able to engage with customers in real-time, offer self-service options, and deliver seamless and convenient insurance experiences.

Another notable trend in the insurtech market is the emergence of ecosystem partnerships. Insurtech companies are collaborating with various stakeholders such as technology firms, data analytics providers, and other industry players to create integrated ecosystems that offer end-to-end insurance solutions. These partnerships enable insurtech companies to expand their product offerings, access new market segments, and drive innovation through shared expertise and resources.

Moreover, sustainability and ESG (Environmental, Social, and Governance) considerations are increasingly becoming important factors in the insurtech market. Insurers are recognizing the need to address climate change, social responsibility, and ethical governance practices in their business operations. As a result, there is a growing demand for sustainable insurance products, green solutions, and ESG-focused investment strategies within the insurtech sector.

Additionally, the rapid evolution of regulatory frameworks and data privacy regulations are shaping the insurtech market. Insurtech companies must stay abreast of changing regulatory requirements, data protection laws, and cybersecurity standards to ensure compliance and maintain customer trust. As data becomes the lifeblood of the insurance industry, ensuring the security and privacy of customer information is paramount for insurtech firms to build credibility and safeguard against potential cyber threats.

In conclusion, the insurtech market continues to be a hotbed of innovation and transformation driven by technological advancements, changing consumer preferences, and regulatory dynamics. Insurtech companies that can adapt to these trends, embrace digitalization, foster strategic partnerships, and integrate sustainability practices will be well-positioned to thrive in this competitive landscape. The future of insurtech holds immense potential for disruptive solutions, customer-centric experiences, and sustainable growth strategies that will redefine the insurance industry in the years to come.

The Insurtech Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-insurtech-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Benefits of the Report:

- This study presents the analytical depiction of the global Insurtech Market Industry along with the current trends and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and opportunities along with detailed analysis of the global Insurtech Market

- The current market is quantitatively analyzed to highlight the Insurtech Market growth scenario.

- Porter's five forces analysis illustrates the potency of buyers & suppliers in the market.

- The report provides a detailed global Insurtech Market analysis based on competitive intensity and how the competition will take shape in coming years.

Browse More Reports:

Europe Smart Hospital Market Middle East And Africa Non-Small Cell Lung Cancer Diagnostics Market Global Multicystic Dysplastic Kidney Market Global Industrial Plastic Valve Market Global Intracranial Stents Market Europe Ultra Low Freezers Market Global Healthcare Analytical Testing Services Market Europe Stevia Market Global Fischer-Tropsch Wax Market Global Reye Syndrome Treatment Market Global Autonomous Farm Equipment Market Global Online Clothing Rental Market Global Data Lake Market Global Procurement Analytics Market Ireland Radiology Services Market Global Medium Molecular Weight Polyisobutylene Market U.S. Hemp Oil Market Asia-Pacific Computer Vision Market Global Polyurethane (PU) Elastomer Market Global Next-Gen Robotic Surgical Systems Market Middle East and Africa Surgical Robots Market Global Epitope Tags Market Global Fully Wireless Fire Detection System Market Global Chronic Kidney Disease (CKD) Market Global Electronic Support Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us: Data Bridge Market Research US: +1 614 591 3140 UK: +44 845 154 9652 APAC : +653 1251 975 Email:- corporatesales@databridgemarketresearch.com"