Indonesia Palm Oil Market 2030: Market Dynamics Unveiled

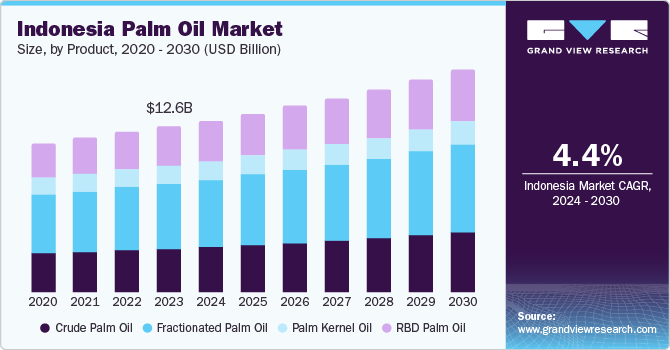

The Indonesia palm oil market was valued at USD 12.58 billion in 2023 and is projected to reach USD 16.93 billion by 2030.

The Indonesia palm oil market was valued at USD 12.58 billion in 2023 and is projected to reach USD 16.93 billion by 2030, growing at a CAGR of 4.4% between 2024 and 2030. The increasing demand for palm oil across food, cosmetics, and biofuel industries is a major driver of this growth. According to the International Labour Organization, Indonesia’s economy has significantly benefited from the expansion of its palm oil sector, which plays a vital role in economic development, job creation, and export revenues. As the world’s largest palm oil producer, Indonesia’s industry supports over 17 million jobs.

The palm oil market is a key contributor to Indonesia’s economy through both agricultural output and export earnings. Production growth has been supported by plantation expansion and technological advancements. Around 40% of the country’s palm oil cultivation area is managed by small-scale farmers, while the remaining portion is operated by large plantations owned by domestic and international companies. For example, in 2022, the Indonesian Palm Oil Association (GAPKI) reported that the industry contributed a record USD 39.07 billion to the national economy.

Palm oil production continues to rise in response to population growth and government policies encouraging the use of biofuels. The Indonesian government actively promotes sustainable production and works closely with businesses to minimize environmental impacts. In February 2023, the government introduced a high blend biodiesel called B35, which contains 35% palm oil. This biodiesel blend is expected to have positive effects on both the environment and economy by increasing renewable fuel use, reducing carbon emissions, and supporting global climate change mitigation efforts.

Order a free sample PDF of the Indonesia Palm Oil Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Product: The fractionated palm oil segment held the largest revenue share at 39.3% in 2023 and is anticipated to grow the fastest during the forecast period. Its market leadership stems from its versatility and growing demand across various sectors such as food processing, cosmetics, and pharmaceuticals, along with its economic advantages and alignment with sustainability trends.

- By Nature: The conventional palm oil segment led the market in revenue share in 2023. Conventional palm oil remains prevalent in Indonesia due to its lower production costs and higher yields compared to organic options, making it popular among many producers, particularly smallholders. Its longer shelf life, natural preservative qualities, and stability at high temperatures make it ideal for cooking and food applications.

- By Application: The food and beverages segment dominated with the highest revenue share in 2023. Palm oil is widely used in cooking oils, margarine, snacks, baked goods, and processed foods in Indonesia due to its cost-effectiveness and versatility. Its stability under high temperatures makes it especially suitable for frying applications, maintaining strong demand in the sector.

Market Size & Forecast

- 2023 Market Size: USD 12.58 Billion

- 2030 Projected Market Size: USD 16.93 Billion

- CAGR (2024-2030): 4.4%

Key Companies & Market Share Insights

Prominent players in the Indonesian palm oil market include Wilmar International, Provident Agro, Golden Agri-Resources, Astra Agro Lestari, and Asian Agri.

- Wilmar International is a major agribusiness group active in Indonesia’s palm oil sector, with extensive plantations and processing facilities. The company covers the entire supply chain from cultivation and harvesting to processing and distribution, holding a strong position in the market.

- Golden Agri-Resources (GAR) is one of Indonesia’s largest palm oil producers, operating vast plantations across the country. GAR emphasizes sustainable production and is engaged in initiatives promoting environmental conservation and social responsibility within the industry.

Key Players

- Asian Agri

- Astra Agro Lestari

- First Resources Limited

- Golden Agri-Resources Ltd.

- M.P. Evans Group PLC.

- Musim Mas

- Provident agro

- PT Salim Ivomas Pratama Tbk

- PT SMART Tbk.

- Wilmar International

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The Indonesia palm oil market is poised for steady growth, driven by rising demand across food, cosmetics, and biofuel sectors. The industry's significance to Indonesia's economy is underscored by its contribution to employment, export revenues, and rural development. With government support for sustainable practices and biofuel adoption, alongside technological advancements and plantation expansions, the market is expected to grow at a CAGR of 4.4% through 2030. Key players’ commitment to sustainability will play a crucial role in balancing economic growth with environmental responsibility, ensuring the continued prominence of Indonesia as the world’s leading palm oil producer.