India Pet Food Market Advances with Tech-Driven Processing

The Indian pet food market is undergoing a notable transformation, driven by evolving consumer preferences, increasing urban pet adoption, and a rising emphasis on pet health and wellness.

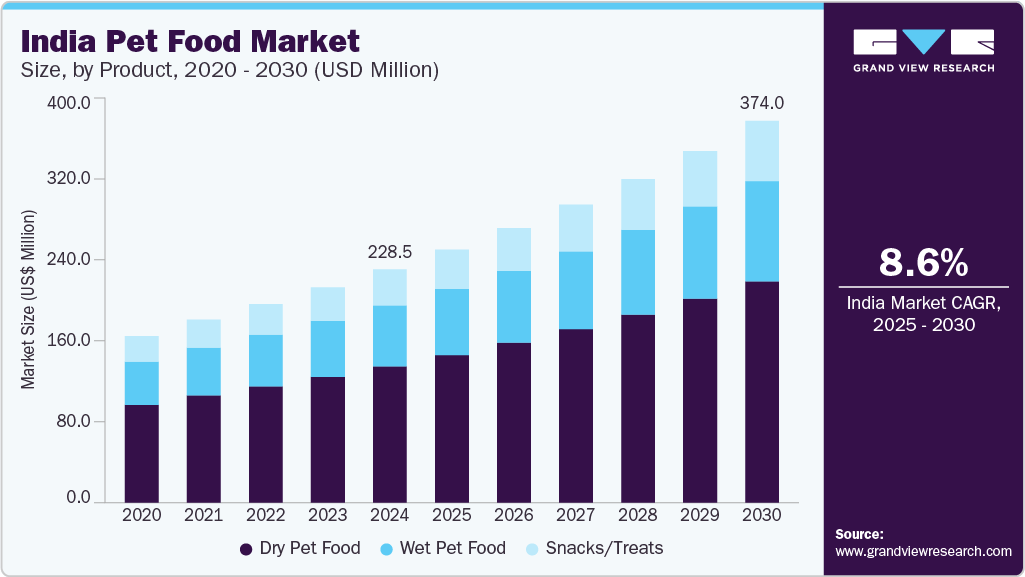

The Indian pet food market, valued at an estimated USD 228.53 million in 2024, is on a significant growth trajectory, projected to reach USD 373.98 million by 2030, at a Compound Annual Growth Rate (CAGR) of 8.6% from 2025 to 2030. This rapid expansion is primarily fueled by increasing pet ownership, rising disposable incomes, and a notable shift in societal attitudes towards pet care and nutrition. Urbanization and changing lifestyles, particularly in major metropolitan areas such as Delhi, Mumbai, Bengaluru, and Hyderabad, have led to a surge in pet adoption among families and young professionals. As pets are increasingly regarded as integral family members, there's a growing demand for high-quality, convenient, and nutritionally balanced pet food that actively supports their overall health and well-being.

Indian pet owners are becoming more knowledgeable and selective, showing a clear preference for branded, scientifically formulated pet food over traditional home-cooked meals. They are increasingly prioritizing specific nutritional factors such as digestive health, coat care, breed-specific formulations, life-stage-appropriate diets, and immunity-boosting ingredients. Functional foods, including grain-free, hypoallergenic, and protein-rich diets, are gaining considerable popularity, especially among owners of pedigreed dogs and cats with specialized dietary requirements. Interestingly, in contrast to Western markets where meat-heavy diets are dominant, many Indian pet owners, particularly those from vegetarian households, prefer or actively seek out plant-based or egg-based pet food options, even for carnivorous pets like dogs.

Key Market Insights:

- Dry Pet Food Dominance: In 2024, dry pet food commanded a revenue share of 58.4%. The increasing demand for dry pet food is driven by its inherent convenience, longer shelf life, and cost-effectiveness when compared to wet or fresh alternatives.

- Dog Food Leads by Pet Type: Pet food specifically formulated for dogs accounted for a significant 59.8% revenue share in 2024. The rapid growth in dog pet food sales across India is attributed to the surging rate of dog ownership nationwide and the deepening emotional bond where dogs are increasingly treated as family members.

- Traditional Pet Food's Large Share: Traditional pet food represented an 86.4% revenue share in 2024. Its continued growth in India is underpinned by its widespread affordability, extensive availability, and familiarity among long-time pet owners.

- Pet Specialty Stores as a Key Channel: Sales of pet food through pet specialty stores accounted for a 30.8% revenue share of the Indian pet food market in 2024. These stores are favored as they offer a curated selection of high-quality, niche, and premium pet food products that cater to specific dietary needs and health concerns, aligning perfectly with the burgeoning trends of pet humanization and premiumization.

Order a free sample PDF of the India Pet Food Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 228.53 Million

- 2030 Projected Market Size: USD 373.98 Million

- CAGR (2025-2030): 8.6%

Key Companies & Market Share Insights

Pet food manufacturers in India are increasingly adopting advanced food processing technologies to enhance product quality, flavor, and nutritional content. Techniques such as vacuum coating, air frying, and freeze-drying are being utilized to preserve the natural qualities and nutrients of ingredients while minimizing oil content. This focus on advanced processing ensures superior digestibility and taste, crucial for discerning pet owners.

In addition, manufacturers are incorporating innovative packaging solutions to boost convenience and sustainability. This includes the widespread use of resealable bags and the development of biodegradable options, aligning with growing consumer awareness about environmental impact. Furthermore, customization is gaining significant momentum in the Indian pet food market. Brands are offering diverse seasoning blends, organic choices, and personalized snack/treat packs to cater to the varied and specific preferences of pet owners, reflecting the increasing humanization of pets in the region.

Key Players

- The J.M. Smucker Company

- Nestlé Purina

- Mars, Incorporated

- LUPUS Alimento

- Total Alimentos

- Hill’s Pet Nutrition, Inc.

- General Mills Inc.

- WellPet LLC

- The Hartz Mountain Corporation

- Diamond Pet Foods

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The Indian pet food market is undergoing a notable transformation, driven by evolving consumer preferences, increasing urban pet adoption, and a rising emphasis on pet health and wellness. As pet owners grow more informed, the demand for scientifically formulated, functional, and even plant-based pet food continues to rise. Dry food and dog food segments remain dominant, while pet specialty stores emerge as trusted purchase channels. Manufacturers are innovating through advanced processing techniques and sustainable packaging to meet changing expectations. With continued investments in product quality and customization, the market is well-positioned for sustained growth in the coming years.