India Accident Insurance Market Senior Executives’ Growth Agendas

The India accident insurance market is expanding steadily, supported by government initiatives, workplace safety reforms, and digital innovations.

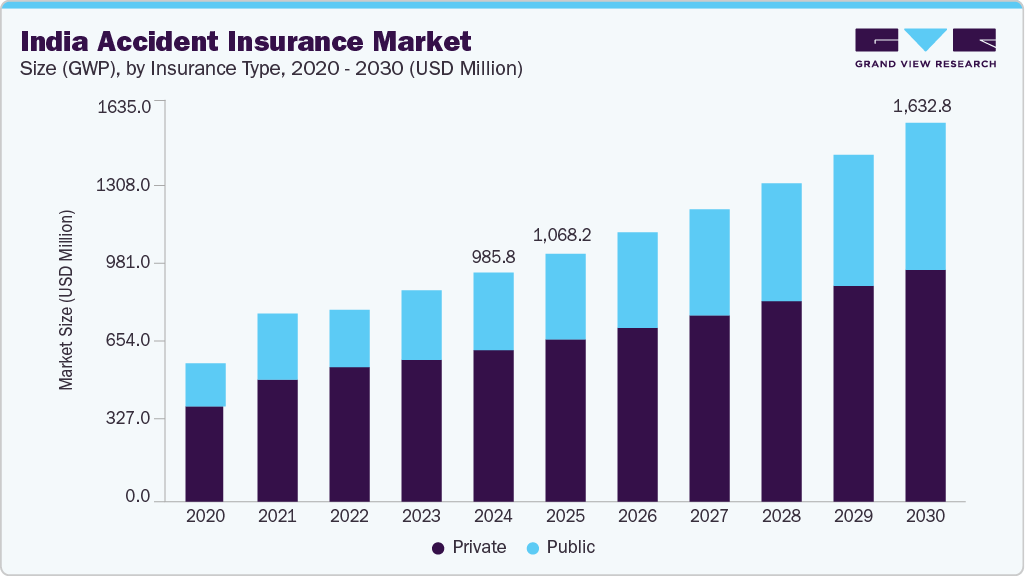

The India accident insurance market size, measured in terms of Gross Written Premium (GWP), was valued at USD 985.84 million in 2024 and is projected to reach USD 1,147.61 million by 2030, expanding at a CAGR of 8.86% from 2025 to 2030. In terms of New Business Premium (NBP), the market was valued at USD 680.01 million in 2024 and is anticipated to grow at a CAGR of 9.21% during 2025–2030.

The industry’s growth is supported by rising awareness about financial protection against unforeseen accidents. Public insurance, typically delivered through social security systems, ensures coverage for work-related injuries and disabilities. Government-backed initiatives on accident insurance and workplace safety are further accelerating adoption. For instance, in May 2025, the Government of India introduced the Cashless Treatment Scheme for Road Casualty Victims, providing up to USD 17,555.5 in cashless medical care for road accident victims, regardless of insurance status. This program highlights the government’s focus on strengthening public health and worker safety frameworks.

The initiative complements existing schemes under the Employees' State Insurance Corporation (ESIC) and the Workers' Compensation Act, which safeguard formal sector employees. It also aligns with India’s emphasis on occupational safety, reinforced by updates to compliance standards under the Occupational Safety, Health and Working Conditions Code, 2020.

Technological advancements such as telematics and digital platforms are reshaping the accident insurance landscape. Insurers now provide personalized coverage based on individual risk profiles, improving customer experience and policy relevance. Technology has also streamlined claims settlement and strengthened fraud detection. For example, in July 2024, Bajaj Allianz General Insurance successfully processed its first claim through the National Health Claim Exchange (NHCX), a milestone that promises faster settlements, greater transparency, and improved policyholder convenience. The Insurance Regulatory and Development Authority of India (IRDAI) has also mandated all insurers to onboard the NHCX platform, highlighting its importance for the sector.

Key Market Insights

- By insurance type: The private segment led the market in 2024, accounting for 66.33% revenue share, supported by rising awareness, rapid urbanization, and a growing middle-class population with higher disposable incomes.

- By policy type: Retail policies dominated in 2024, holding a 57.68% revenue share, driven by the increasing adoption of digital platforms.

Order a free sample PDF of the India Accident Insurance Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 985.84 Million

- 2030 Projected Market Size: USD 1,147.61 Million

- CAGR (2025–2030): 8.86%

Key Companies & Market Share Insights

The private accident insurance market in India remains highly fragmented.

- Star Health & Allied Insurance Co. Ltd. is a major global player offering a wide range of accident insurance products.

- ICICI Lombard General Insurance Co. Ltd., a market leader, holds a strong position particularly among civil servants and affluent segments.

- Other prominent players such as Bajaj Allianz General Insurance Co. Ltd. and Care Health Insurance Ltd. are competing by offering customized coverage options and superior customer service.

Recent Developments:

- July 2024 – India Post Payments Bank (IPPB) introduced a new accidental insurance policy targeted at financially weaker groups. It covers accidental death, disability, limb damage, paralysis, hospital expenses, OPD costs, and more. Variants include Health Plus and Xpress Health Plus.

- June 2024 – IPPB launched another affordable accident insurance plan designed for individuals unable to afford higher premiums. The plan offers additional benefits such as annual health check-ups, unlimited tele-counselling, and accident-related medical expense coverage.

Key Players

- ICICI Lombard General Insurance Co. Ltd.

- Bajaj Allianz General Insurance Co. Ltd.

- HDFC ERGO General Insurance Co. Ltd.

- Star Health & Allied Insurance Co. Ltd.

- Care Health Insurance Ltd.

- Future Generali India Insurance Company Ltd.

- Aditya Birla Capital Ltd.

- Niva Bupa Health Insurance Company Ltd.

- New India Assurance Co. Ltd.

- Bharti AXA Life Insurance Company Limited

- United India Insurance Co. Ltd.

- National Insurance Company Ltd.

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The India accident insurance market is expanding steadily, supported by government initiatives, workplace safety reforms, and digital innovations. With both public and private players driving accessibility and efficiency, the industry is poised for sustainable growth through 2030.