How to Use Surveys for Pricing Strategy in Competitive B2C Markets

Learn how to use surveys for pricing strategy in competitive B2C markets. Explore proven methods like Gabor-Granger, Van Westendorp, and Conjoint analysis, and discover how MindProbe’s AI-powered platform transforms raw feedback into actionable pricing insights.

1. Introduction

In the highly competitive B2C market, pricing can make or break a product’s success. While branding, product quality, and marketing campaigns all influence consumer behavior, the price often stands out as a decisive factor that nudges consumers either toward a purchase or away from it. Yet, determining the ideal price point is far from straightforward. Set it too high, and you risk alienating cost-conscious buyers; set it too low, and you may undermine your brand’s perceived value or compromise your profit margins.

So how can B2C companies pinpoint that sweet spot where value and profitability converge? The answer lies in data-driven methods, especially well-designed pricing surveys. By tapping into the voice of the customer, these surveys reveal how your target audience perceives your product’s value, how much they’re willing to pay, and what trade-offs they might accept. When analyzed properly, survey data can inform strategic decisions on pricing tiers, discount structures, subscription models, and more.

This article aims to show you how to use surveys for pricing strategy in competitive B2C markets. We’ll explore best practices for designing these surveys, discuss how to analyze the results usingMindProbe an AI-powered market research platform that features 7-day trial access and no free subscriptions and offer practical tips for avoiding common pitfalls. Whether you’re a seasoned product manager or a marketer new to survey methodology, you’ll learn techniques to build a resilient pricing strategy that resonates with your audience.

2. Why Pricing Is Critical in B2C Markets

Pricing, by its very nature, is often the first and last point of consideration for consumers particularly in a saturated market. The sheer range of choices means potential customers will quickly compare prices across brands, sometimes within minutes. If your pricing isn’t competitive, you could lose a sale; but if it’s too low, you risk undermining profitability and brand perception.

1. Influence on Brand Perception

- In many B2C markets, price is a signaling mechanism. A higher price can imply quality or exclusivity, while a lower price can position a product as a budget-friendly option. Determining the best approach depends on your brand identity and target customer segments.

2. Direct Impact on Profit Margins

- Your price point heavily influences your margins. Even a small increase in price can lead to a significant uptick in profit if it doesn’t deter a substantial portion of your consumer base. Conversely, a small decrease might capture more volume but may erode profitability if not balanced carefully.

3. Competitive Edge

- In a crowded marketplace, savvy competitors often adjust their prices quickly in response to market trends, promotions, or macroeconomic changes. By monitoring these shifts and using surveys to predict consumer reactions, you can fine-tune your price to stay ahead.

4. Retention and Loyalty

- Pricing also plays a crucial role in customer retention. If a competitor slashes prices, you might see churn unless you understand exactly where your core customers draw the line on what they’re willing to pay. By actively surveying current customers, you’ll have the data to justify your price or make strategic adjustments.

Given these high stakes, it’s clear that crafting a robust pricing strategy is essential. That’s where survey methodology comes into play giving you direct insights from the buyers you aim to serve.

3. The Role of Surveys in Pricing Strategy

Surveys function like a customer echo chamber, reflecting back precisely how the market perceives your offerings and their corresponding price points. But they also do something more: they help you validate hypotheses around elasticity, demand, and brand value.

- Direct Voice of the Customer

Instead of second-guessing consumer sentiment, surveys provide a platform for direct responses. This approach helps differentiate between what you think customers want and what they actually want.

- Contextualizing Competitors

By including questions related to competitor products or asking respondents to compare price-value ratios, you can glean how your pricing fits into the broader marketplace.

- Segment-Specific Insights

Different segments within your overall target market might respond to pricing changes differently. For example, a premium segment might prefer bundle deals or exclusivity, whereas more cost-conscious customers might be open to paying a lower price for fewer premium features. Surveys let you slice data to reveal these nuances.

- Dynamic Adjustments

Market conditions change. Consumer preferences shift. Surveys allow you to update your understanding and adapt in near-real time, rather than relying on outdated assumptions.

When combined with data from MindProbe which offers AI-driven sentiment analysis and auto-tagging of open-ended responses you gain a richer, more actionable perspective on how price influences buying behavior.

4. Designing Effective Pricing Surveys

A pricing survey is only as good as its design. Here’s how to create a survey that yields reliable, insightful results.

4.1 Clarify Your Objective

Before drafting any questions, ask yourself:

- What do I need to learn?

Are you testing a new pricing model? Checking willingness-to-pay for product upgrades? Gauging the elasticity of demand in a new segment?

- Who is my target audience?

Existing customers will have a different perspective from prospective ones. Similarly, a price point question directed at a cost-sensitive demographic might yield different results than the same question posed to a premium segment.

- How will I use the data?

If your objective is to set a single price, your survey design may differ from one aimed at exploring multiple tiers or bundles.

4.2 Choose the Right Question Types

Pricing surveys often blend quantitative and qualitative elements:

- Multiple-Choice Questions

e.g. “Which price range are you most comfortable paying for this product?”

These yield clear, numeric data for easy analysis, especially when cross-tabbed with demographics or psychographics.

- Rating Scales

e.g. “Rate your willingness to pay for [Product] at £X on a scale of 1–5.”

Great for measuring elasticity especially if you vary the price point across segments of your respondent pool.

- Open-Ended Questions

e.g. “What factors influence your perception of fair pricing for this product?”

This is where MindProbe really shines, using AI-powered sentiment analysis to auto-tag words like “expensive,” “worth it,” or “unreasonable,” providing deeper insights into consumer sentiment.

4.3 Timing and Distribution

- Timing: Depending on your objective, you might deploy these surveys before launching a new product (to set an initial price) or after a purchase (to evaluate if the customer felt the price was fair).

- Channels: Email, social media ads, in-app prompts, or website pop-ups. Meeting your audience where they naturally engage can boost response rates.

- Incentives: Offering a small reward (like a discount code or entry into a giveaway) can encourage participation, but ensure it doesn’t bias the results. Sometimes, the promise of improvement or brand involvement is incentive enough.

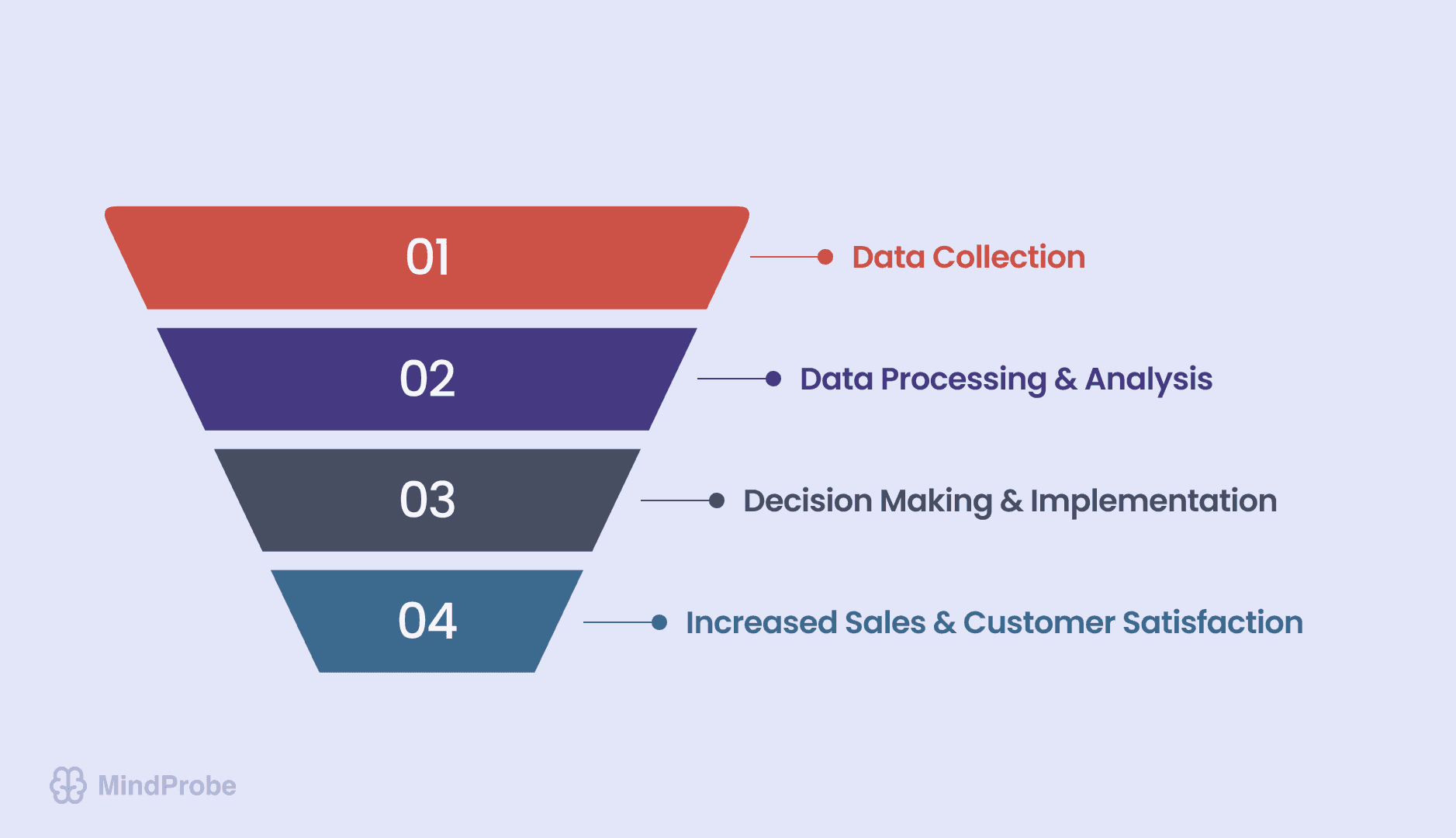

5. Analyzing Data with MindProbe

MindProbe is an AI-driven market research platform designed to help you get the most out of your pricing surveys without wrestling with complicated spreadsheets or third-party analytics tools. Here’s how it works:

5.1 Setting Up Your Survey in MindProbe

1. Create a New Project Log into MindProbe and create a project dedicated to your pricing strategy.

2. Choose a Template MindProbe offers pre-built survey templates you can adapt for pricing questions or start from scratch to fully customize your approach.

3. Add Question Logic Incorporate branching logic (e.g., if a respondent says they’re only willing to spend under £20, you can skip the high-price questions). This approach keeps the survey concise and relevant.

5.2 Leveraging AI-Powered Sentiment Analysis and Auto-Tagging

- Sentiment Analysis MindProbe automatically categorizes open-ended responses as positive, negative, or neutral. Instead of manually reading hundreds or thousands of comments, you’ll see at a glance how respondents feel about your pricing.

- Auto-Tagging The platform identifies recurring keywords or phrases like “too expensive,” “excellent value,” or “just right” so you can spot patterns and prioritize your action items accordingly.

5.3 Real-Time Dashboard and Advanced Segmentation

MindProbe’s dashboard updates as responses roll in, letting you see how different segments (e.g., new vs. returning customers, high-income vs. mid-income, etc.) perceive your price points. This is invaluable when fine-tuning your strategy on the fly or if you need to pivot before a product launch.

Pro Tip: MindProbe offers a 7-day trial with no free subscriptions thereafter. This trial grants you full access to advanced features like sentiment analysis so you can run a robust pricing survey project, interpret the data, and decide if it’s the right solution for your ongoing needs.

6. Common Pricing Survey Methods

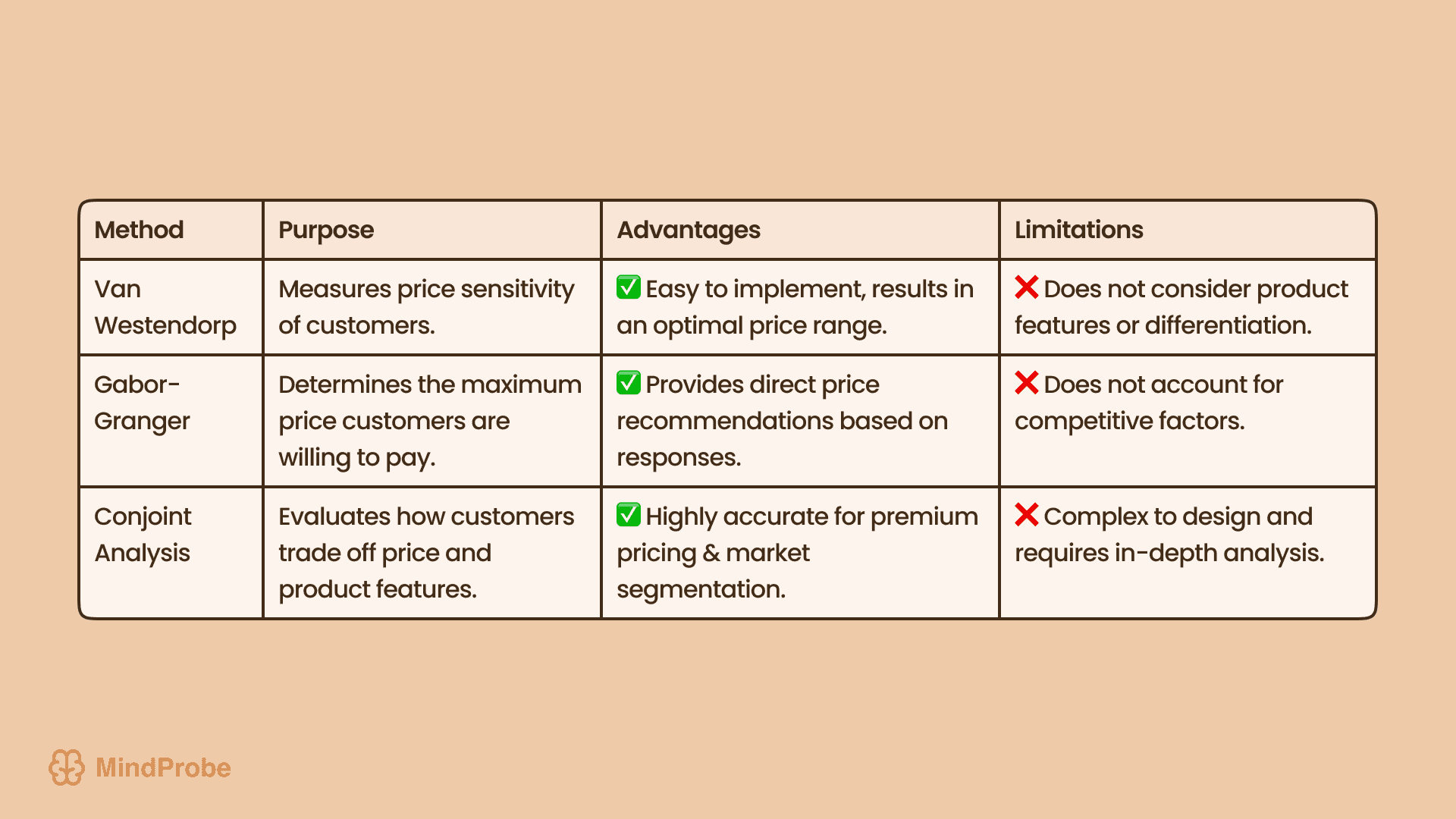

Although a simple multiple-choice question might suffice in some cases, advanced pricing research often relies on specific methodologies to capture consumer willingness-to-pay data more accurately.

6.1 Van Westendorp Price Sensitivity Meter

Van Westendorp is a popular technique for measuring price sensitivity. Respondents answer four key questions:

-

At what price would you consider this product to be so inexpensive that you’d question its quality?

-

At what price would you consider the product inexpensive or a great bargain?

-

At what price would you consider the product a bit expensive, but still worth buying?

-

At what price would you consider the product so expensive that you’d no longer be willing to pay?

Plotting these responses creates a price sensitivity curve, revealing:

- The optimal price point where you’re likely to maximize sales.

- The range in which most consumers feel comfortable.

- Points where your brand might risk perceived low quality or excessive expensiveness.

6.2 Gabor-Granger Technique

The Gabor-Granger method tests multiple price points in a structured format. Respondents are asked: “Would you buy this product at £X?” If they answer yes, you ask about a higher price; if no, you ask about a lower price. You keep adjusting until you find the highest price each respondent is willing to accept.

- Pros: Offers a direct measure of maximum willingness-to-pay.

- Cons: Might not account for real-world complexity like competitor pricing, brand loyalty, or promotions.

6.3 Conjoint Analysis

Conjoint analysis examines how people value various attributes (price, features, brand, etc.) in combination, rather than in isolation. Respondents might choose between Product A (feature set 1, priced at £10) and Product B (feature set 2, priced at £15). By varying these attributes across multiple scenarios, you can pinpoint which features or aspects drive willingness to pay more.

- Pros: Better simulates real-world trade-offs.

- Cons: More complex to design and analyze, though MindProbe can streamline much of the interpretation process thanks to its AI-driven insights.

7. Real-World Applications and Examples

Let’s see how these methods and principles come to life in different B2C contexts.

7.1 E-Commerce and Online Retail

Scenario: You’re an online retailer selling fashion accessories. You notice cart abandonment spikes during checkout, and suspect price might be an issue.

- Approach: You run a Gabor-Granger survey via email to customers who abandoned their cart, offering them a small discount code for participation.

- Result: Data reveals that once prices exceed £30 for certain accessories, interest drops sharply. You adjust your mid-range product line to stay under that threshold, increasing conversions by 15% in the next quarter.

7.2 Subscription Services

Scenario: You offer a monthly meal kit subscription. Competitors have recently lowered their prices, and you’re unsure if you need to follow suit.

- Approach: You implement a Van Westendorp survey to find the range in which your existing subscribers see your service as “inexpensive,” “expensive,” or “too expensive.”

- Result: Analysis shows that your price is on the higher side of acceptable, but customers perceive your quality to be superior. You maintain your current price, but enhance packaging and recipe variety to justify that premium. Churn remains stable despite competitor discounts.

7.3 Physical Retail and Direct-to-Consumer Brands

Scenario: You run a brick-and-mortar coffee chain launching a new, high-end espresso maker to complement your direct-to-consumer business model.

- Approach: Using a conjoint analysis survey, you measure how much customers value built-in Wi-Fi, self-cleaning features, or a premium aesthetic, as well as how these attributes affect willingness to pay.

- Result: The data reveals that while customers appreciate advanced features, many aren’t willing to pay significantly more for them. Instead, they value durability and brand heritage. You pivot, removing less-desired bells and whistles, and set a more affordable price that aligns with consumer expectations.

8. Overcoming Challenges in Pricing Surveys

While surveys offer unparalleled insights into consumer perception, they’re not without hurdles.

8.1 Bias and Leading Questions

- Problem: If your question wording suggests a “correct” or “desirable” response, you might end up with skewed data.

- Solution: Use neutral phrasing and run a pilot test. MindProbe can also flag frequently biased terms.

8.2 Survey Fatigue

- Problem: Overly long or complex surveys turn off respondents, leading to drop-offs.

- Solution: Keep your survey focused. If you’re employing advanced methods like conjoint analysis, consider breaking it into parts or using branching logic so respondents only see relevant questions.

8.3 Low Response Rates

- Problem: You can’t rely on data from just a handful of people. A minimal sample size undermines confidence in your results.

- Solution: Promote your survey effectively through email campaigns, social media, or even physical receipts. Offering a small incentive, such as a discount code, can also help boost participation without overly biasing your results.

8.4 Data Interpretation Pitfalls

- Problem: Even clean data can be misread if you’re not careful for instance, focusing on averages while ignoring segment-specific variations.

- Solution: Perform subgroup analysis. Slice and dice data by demographics (e.g., age, location, income) or usage behavior. Use MindProbe’s advanced analytics to see which segments are more or less price-sensitive.

9. Best Practices for Sustainable Pricing Strategies

Even the most precise data won’t help if your pricing approach remains static. Here’s how to keep your strategy agile and resilient in a constantly shifting market.

9.1 Continuous Feedback Loop

Markets evolve, and so do customer expectations. Pricing surveys shouldn’t be a one-off exercise.

- Regular Check-Ins: Run periodic mini-surveys especially if you anticipate economic changes or seasonal shifts in demand.

- Close the Loop: After each price adjustment, track metrics like sales volume, churn rate, or net promoter scores to validate your decision.

9.2 Combining Survey Data with Market Insights

Surveys are invaluable for capturing the voice of the customer, but they’re most powerful when coupled with market data:

- Competitor Tracking: Keep an eye on how rivals are pricing similar products.

- Sales Analytics: Link your survey responses to purchase history or user engagement data to see how stated willingness-to-pay translates into real behavior.

- Macro Trends: Factor in economic indicators like inflation, unemployment rates, or disposable income levels in your key markets.

9.3 Testing Price Changes Incrementally

A radical shift in price can spook customers. Instead:

1. A/B Testing Launch small pilot tests, offering slightly different price points to different customer cohorts. Track results (conversion, churn, etc.) in real time.

2. Phased Rollouts If data suggests a price increase, roll it out gradually or in select regions. Gather feedback via surveys throughout the transition.

3. Communication Strategy Justifying a price change is often about messaging. If costs have risen due to improved quality or shipping enhancements, let your customers know. Surveys can also test the resonance of different narratives around price changes.

10. Conclusion

Incompetitive B2C markets, getting your pricing strategy right is both an art and a science. Surveys offer a direct line to your consumers, enabling you to glean insights into willingness-to-pay, perceived value, and brand loyalty all crucial components in setting the right price. Whether you opt for simpler methods like multiple-choice questions or more advanced techniques such as Van Westendorp, Gabor-Granger, or conjoint analysis, the core principle remains the same:listen to your customers.

Yet surveys alone won’t guarantee success if the data isn’t handled properly. This is where MindProbe comes in, providing an integrated platform for survey design, distribution, and analysis. WithAI-powered sentiment analysis, auto-tagging, and a real-time dashboard, you can transform raw feedback into actionable pricing insights perfect for fine-tuning everything from monthly subscription fees to premium product lines. Plus, with a 7-day trial and no free subscriptions, you get to experience the platform’s robust features before committing long-term.

Remember: Pricing is never static. Markets change, new competitors emerge, and consumer preferences evolve. By making ongoing, data-backed adjustments and regularly surveying your audience, you’ll maintain a resilient pricing strategy that not only captures market share but also maximizes profitability. Ultimately, the real power of pricing surveys lies in their ability to merge consumer intelligence with strategic foresight, ensuring your brand remains competitive in a rapidly shifting world.