Green Steel Market 2030: Trends That Will Shape the Industry

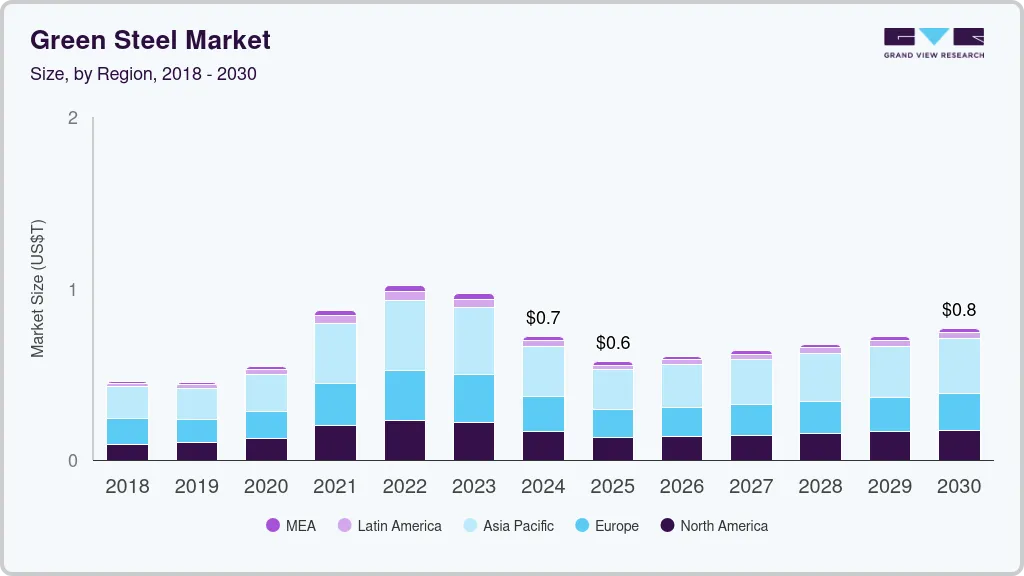

The global green steel market was valued at USD 718.30 billion in 2024 and is expected to reach USD 766.76 billion by 2030.

The global green steel market was valued at USD 718.30 billion in 2024 and is expected to reach USD 766.76 billion by 2030, growing at a CAGR of 6.0% from 2025 to 2030. This growth is primarily driven by rising demand for sustainable manufacturing practices and the steel industry’s efforts to reduce carbon emissions.

The market has experienced significant price fluctuations, influenced by raw material availability, technology adoption rates, and global supply chain dynamics. In 2022, green steel prices surged due to high demand from environmentally conscious manufacturers and disruptions caused by geopolitical tensions. By 2023, prices began stabilizing as technological advancements improved production efficiency and government policies incentivized green steel adoption. In 2024, prices declined further, reflecting overall commodity market stabilization and increased production capacity.

Order a free sample PDF of the Green Steel Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Growth: The Asia Pacific market is expanding rapidly, driven by investments in sustainable manufacturing and increasing environmental awareness. China, Japan, and South Korea lead in green steel production, with growing demand from the automotive, construction, and electronics sectors. Government initiatives promoting carbon neutrality and the adoption of advanced production technologies, such as electric arc furnace (EAF) and hydrogen-based steelmaking, are key drivers for regional market growth.

- Production Technology: Electric Arc Furnace (EAF) technology dominates the market due to its efficiency and lower carbon emissions compared to traditional blast furnaces. EAF is widely used in construction and building applications, and its reliance on scrap steel enhances environmental benefits. This makes EAF a preferred choice for manufacturers aiming to meet sustainability standards.

- End-Use Sector: The building and construction segment is emerging as a major end-use sector for green steel. Growth is supported by the increasing demand for sustainable materials in urban infrastructure projects. As cities worldwide focus on reducing carbon footprints, green steel is becoming essential in frameworks for buildings, bridges, and high-rise structures.

Market Size & Forecast

- 2024 Market Size: USD 718.30 Billion

- 2030 Projected Market Size: USD 766.76 Billion

- CAGR (2025-2030): 6.0%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Leading players in the green steel market include ArcelorMittal, SSAB, and ThyssenKrupp AG:

- ArcelorMittal (Luxembourg) leads in green steel production with its ‘XCarb’ program, aimed at reducing carbon emissions. The company continues to expand through strategic partnerships and investments.

- SSAB (Sweden) produces fossil-free steel via its HYBRIT initiative, utilizing hydrogen instead of coal to transform steelmaking processes.

- ThyssenKrupp AG (Germany) emphasizes sustainable practices and technological innovation through its ‘Steel for the Future’ program, focusing on green steel production.

Key Players

- ArcelorMittal

- China BaoWu Steel Group Corporation Limited

- Emirates Steel Arkan

- Nippon Steel Corporation

- Nucor Corporation

- Outokumpu

- Salzgitter AG

- SSAB

- Tata Steel

- thyssenkrupp AG

- voestalpine AG

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global green steel market is positioned for steady growth, driven by rising demand for sustainable production methods and carbon reduction in the steel industry. Asia Pacific leads the market due to strong investments and supportive government policies, while technologies like EAF and hydrogen-based steelmaking are driving the shift toward low-emission production. With the building and construction sector increasingly adopting sustainable materials, key players such as ArcelorMittal, SSAB, and ThyssenKrupp AG are expected to expand their influence, shaping the future of environmentally responsible steel manufacturing.