Germany Legal Cannabis Market Grows With Strategic Partnerships

The Germany legal cannabis market is witnessing strong momentum, supported by favorable regulatory developments, increasing medical applications, and a growing consumer shift toward cannabis-based products.

The Germany legal cannabis market, valued at USD 37.15 million in 2024, is on a significant upward trajectory, projected to reach USD 85.64 million by 2030, exhibiting a robust Compound Annual Growth Rate (CAGR) of 14.09% from 2025 to 2030. This impressive growth is driven by several key factors: the increasing adoption of cannabis for treating chronic diseases, progressive legal advancements within the country, expanding research into its therapeutic applications, and the growing availability and introduction of CBD-infused cosmetic products. For instance, in September 2023, Cronos Group Inc. launched its medical brand PEACE NATURALS in Germany, following a distribution agreement signed in July with Cansativa Group, a prominent distributor of medical cannabis in the country.

Furthermore, the rising prevalence of chronic conditions such as diabetes, cancer, and various neurological disorders, coupled with increasing research activities and clinical trials in Germany, are propelling market expansion. A notable example is Avextra, a biopharmaceutical company, which in October 2023, progressed with a double-blind Phase 2 clinical trial for its medicine, Belcanto, aimed at cancer patients in palliative care. This medicine received approval from the German Federal Institute for Drugs and Medical Devices (BfArM) and relevant ethics committees, with the first patient dosed in December 2023. The clinical trial, named "Improvement of Quality of Life by Cannabinoids in Oncologic Patients (BELCANTO)", officially started recruiting in April 2024 and is expected to complete by June 2026.

The German healthcare system, particularly its insurance framework, plays a crucial role in market growth. German citizens have the option of public insurance (GKV) or private insurance (PKV). Since January 2017, public health insurers have been mandated to cover cannabis medication up to 5 ounces, exceeding the recreational legal limit of 3.5 ounces or 100 grams per month (as of April 1, 2024, with new regulations). This comprehensive coverage, which extends to all cannabis treatments without specifying particular medical conditions, positions Germany as a potentially lucrative market in Europe and significantly boosts the country's market growth.

Key Market Insights:

- By source, the hemp segment dominated the market with the highest revenue share of 84.50% in 2024. Hemp's versatility allows it to be incorporated into a wide range of products, including supplements, nutritional powders, beverages, protein and nutrition bars, animal feed, and pet food.

- By derivatives, the CBD segment held the largest revenue share of 63.61% in 2024. CBD, a non-psychoactive compound found in the cannabis plant, is gaining increasing adoption due to its wide array of perceived health benefits.

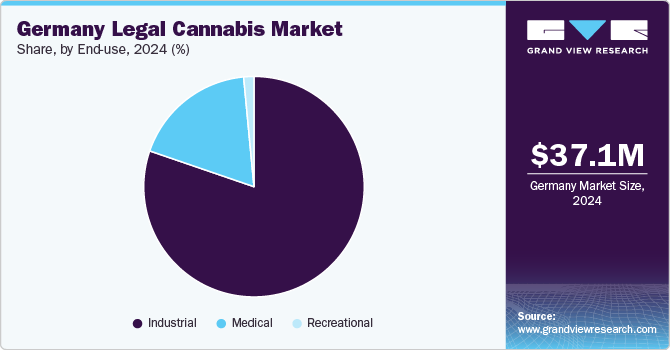

- By end-use, the industrial use segment dominated the market with a revenue share of 80.26% in 2024. In Germany, hemp is utilized across various commercial sectors for products such as animal feed, food, textiles, clothing, paper, paint, insulation, and biodegradable plastics.

Order a free sample PDF of the Germany Legal Cannabis Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 37.15 Million

- 2033 Projected Market Size: USD 85.64 Million

- CAGR (2025-2030): 14.09%

Key Companies & Market Share Insights

Key market participants in the Germany legal cannabis market are intensely focused on implementing innovative business growth strategies. These strategies primarily revolve around expanding product portfolios, forging strategic partnerships and collaborations, engaging in mergers and acquisitions (M&A), and extending their overall business footprint. These initiatives are crucial for gaining new market avenues and strengthening their competitive edge within this rapidly evolving industry.

Key Players

- The Cronos Group

- Organigram Holding, Inc

- Tilray Brands

- Canopy Growth Corporation

- Aurora Cannabis

- SynBiotic

- Cansativa GmbH

- DEMECAN

- Four 20 Pharma

- Avextra Pharma GmbH

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The Germany legal cannabis market is witnessing strong momentum, supported by favorable regulatory developments, increasing medical applications, and a growing consumer shift toward cannabis-based products. Advancements in clinical research and the integration of cannabis into the national healthcare system further reinforce its growth potential. Companies are actively expanding their presence through strategic collaborations, product launches, and clinical innovations. With rising public acceptance and insurance coverage for cannabis treatments, Germany is positioned as a leading market in Europe. As demand broadens across medical, industrial, and wellness sectors, the market outlook remains highly optimistic.