Generative AI in Financial Services Market: Transforming Investment Strategies

The global generative AI in financial services market was valued at USD 1,673.1 million in 2023 and is projected to reach USD 16,018.1 million by 2030.

The global generative AI in financial services market was valued at USD 1,673.1 million in 2023 and is projected to reach USD 16,018.1 million by 2030, growing at a CAGR of 39.1% from 2024 to 2030. Generative AI is transforming customer engagement in the financial services sector by enabling highly personalized interactions. Through advanced data analytics, AI tailors financial advice, investment strategies, and customer service experiences to individual preferences, significantly enhancing customer satisfaction.

AI-powered chatbots and virtual assistants are becoming increasingly capable of handling complex queries, streamlining transactions, and providing real-time financial guidance. This shift toward AI-driven customer experiences not only boosts customer loyalty but also drives operational efficiency for financial institutions. Generative AI is also automating financial processes, improving operational efficiency, and reducing costs. AI-powered robo-advisors now offer automated investment management services, providing personalized advice with minimal human intervention. In the lending sector, AI is revolutionizing the underwriting process by quickly assessing the creditworthiness of borrowers through advanced data analysis. This automation accelerates financial processes and enhances accuracy, benefiting both financial institutions and customers.

Generative AI is also enhancing risk management and fraud detection capabilities within financial institutions. By analyzing vast datasets in real time, AI models can detect unusual transaction patterns and anomalies, significantly reducing the risk of fraud. Predictive analytics powered by AI allows financial institutions to anticipate and mitigate various risks, such as credit, market, and operational risks. This proactive approach to risk management not only strengthens security but also ensures compliance with regulatory requirements, safeguarding both institutions and their clients.

Order a free sample PDF of the Generative AI In Financial Services Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America led the global market in 2023, holding a dominant revenue share of 39.7%. In this region, a prominent trend is the automation of compliance and reporting processes through generative AI. Financial institutions are leveraging AI systems to monitor regulatory changes and assess their impact on business operations, greatly reducing the time and effort required for manual compliance tasks.

- Risk Management was the leading application segment in 2023, accounting for 28.6% of global revenue. The integration of generative AI into compliance processes is streamlining regulatory adherence for financial institutions, significantly improving operational efficiency. By automating routine monitoring and reporting tasks, generative AI allows compliance teams to focus on more strategic initiatives, reducing human error and enabling swift adaptation to evolving regulatory requirements.

- Cloud-Based Solutions dominated the distribution channel segment, capturing the largest revenue share in 2023. The increasing demand for secure, compliant cloud-based solutions is driving cloud providers to invest in advanced security measures, making generative AI applications more robust. These enhanced security protocols enable financial institutions to protect sensitive data while adhering to industry regulations such as GDPR and PCI DSS.

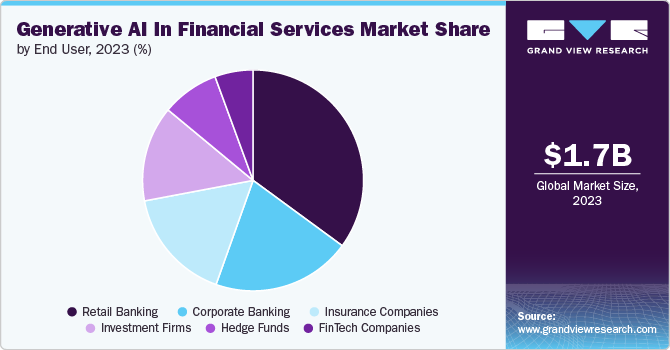

- Retail Banking was the largest end-user segment in 2023. The growing demand for faster and more efficient loan processing is fueling the adoption of generative AI in retail banking. AI models are streamlining underwriting and approval processes by automating key aspects of loan assessments. By analyzing a variety of data points, including traditional credit scores and alternative data sources like social media activity, AI can quickly evaluate creditworthiness and make informed lending decisions.

Market Size & Forecast

- 2023 Market Size: USD 1,673.1 Million

- 2030 Projected Market Size: USD 16,018.1 Million

- CAGR (2024-2030): 39.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

The generative AI in financial services market is highly competitive, with a few key players dominating the landscape. Major companies such as AWS, EY, Google, HCL Technologies, IBM, and Intel are at the forefront, leveraging various strategies like mergers, acquisitions, collaborations, partnerships, and new product launches to expand their customer base and maintain their market position. For example, a 2024 EY report revealed that 61% of respondents in the financial services sector believe generative AI will significantly enhance the entire value chain, improving efficiency and responsiveness to market changes. The report estimates that generative AI could contribute between USD 66 billion and USD 80 billion to the sector's Gross Value Added (GVA) by 2030. This potential economic impact highlights the transformative role of generative AI in driving innovation and operational improvements within financial institutions.

Key Players

- Alpha Sense

- Amazon Web Services, Inc.

- EY (Ernst & Young)

- Google LLC

- HCL Technologies

- IBM Corporation

- Intel Corporation

- Mastercard

- Microsoft

- Narrative Science

- OpenAI

- Salesforce, Inc.

- SAP

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The generative AI market in financial services is poised for rapid growth, with an estimated CAGR of 39.1% from 2024 to 2030. The increasing adoption of AI in customer engagement, financial process automation, risk management, and fraud detection is revolutionizing the sector. North America currently leads the market, with Asia-Pacific emerging as the fastest-growing region. The widespread use of AI-powered tools, such as robo-advisors, virtual assistants, and AI-driven compliance automation, is streamlining operations and enhancing the customer experience. As AI continues to evolve and gain traction, financial institutions will increasingly rely on generative AI to drive efficiency, improve decision-making, and stay competitive in a rapidly changing market. The sector's future is marked by further innovation, regulatory adaptation, and the growing economic contribution of AI technologies to the financial services industry.